Click here

to read the previous gold price update.

2021 is now half over, and prospects look positive for gold. Elements such as global COVID-19 relief efforts, low interest rates and inflation concerns are all considered tailwinds.

Despite those factors, the yellow metal enjoyed only a small rise during Q2, leaving many market watchers feeling disappointed and wondering why last summer’s all-time high now seems so far away.

Read on for a look at gold’s performance during the second quarter of 2021, with commentary from experts on its price drivers and future outlook.

Gold price update: Price ends up for the quarter

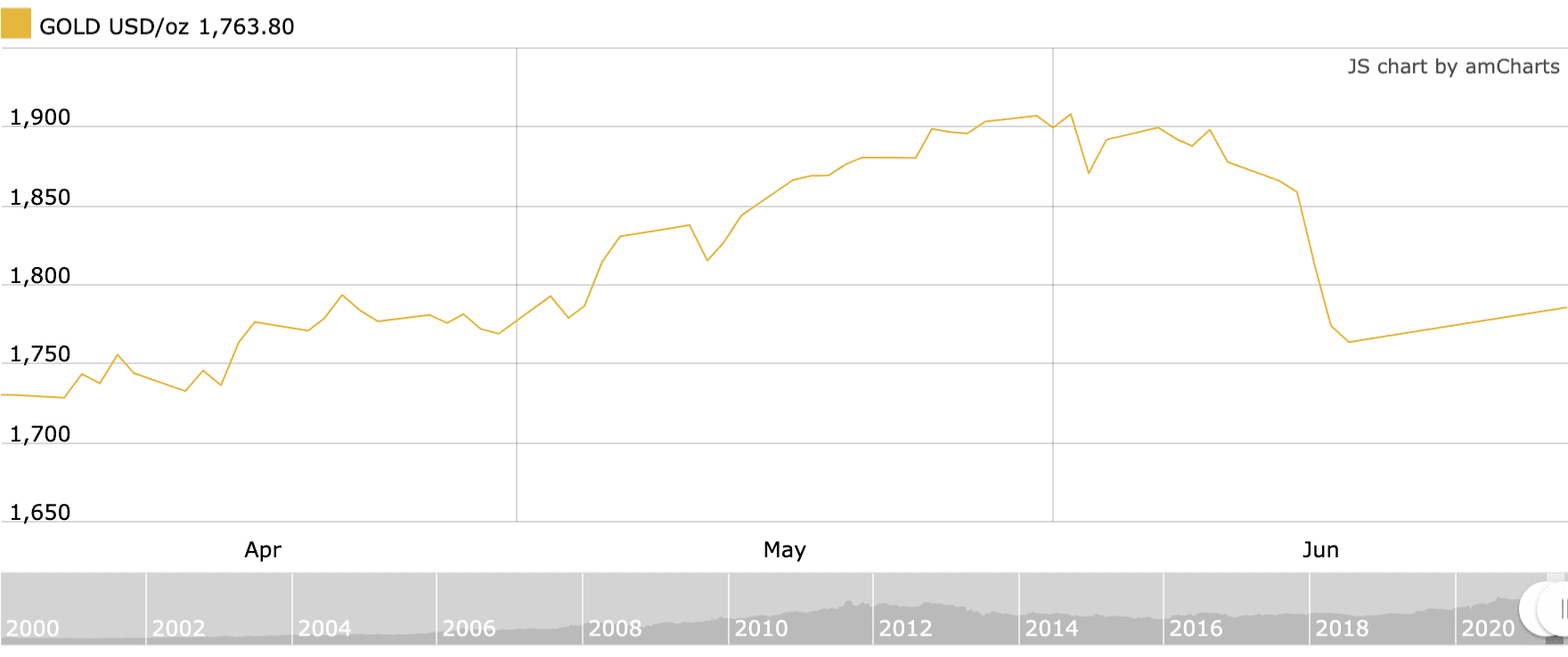

The gold price breached the US$1,900 per ounce mark briefly during the second quarter, but ultimately ended the three month period not far from where it started.

Kicking off April at the US$1,730 level, the yellow metal climbed fairly steadily until the end of May before experiencing its quarterly peak of US$1,908.20 on June 2. It then fell steeply midway through the month before closing June just above US$1,760, placing its quarterly gain at about 1.9 percent.

Gold’s Q2 2021 price performance. Chart via Kitco.

Although gold’s Q2 price movement has been underwhelming for some market participants, it compares favorably to Q1, when gold tumbled from around US$1,900 to under US$1,700.

Even so, the yellow metal remains more than US$200 away from the high point it hit around a year ago, and its failure to take off has surprised gold investors and commentators.

Marc Lichtenfeld, chief income strategist at the Oxford Club, summed up

what many have been thinking

, telling the Investing News Network (INN) in an interview, “It’s so hard to tell what is going on with gold.”

Watch the full interview with Lichtenfeld above.

As mentioned, COVID-19 relief efforts, low interest rates and inflation concerns have all been pointed to as positive gold price drivers. Although many parts of the world are beginning to recover from COVID-19, the pandemic created an unprecedented amount of global money printing, especially in the US.

Meanwhile, interest rates in the US remain near zero, with no indication that the Federal Reserve plans to increase them in the near future. At the same time, the central bank has dismissed inflation as “transitory” — although recently Chair Jerome Powell did concede that it is “

well above target

.”

A strong US dollar, which hampered the

precious metal

‘s performance in Q1, fell off during the second quarter, although it began to gain ground again midway through June. Higher US 10 year Treasury yields also negatively impacted gold in the first quarter of the year, but they remained at fairly elevated levels throughout Q2 as well, perhaps providing some pushback on gold.

Lichtenfeld continued, “If you look back, let’s say 10 years ago, and told a gold investor that over the next 10 years the US government and governments around the world are going to be running their printing presses non-stop, and that oh, by the way, 10 years from now there’s going to be a global pandemic that’s going to kill millions and completely shut down the global economy, and the US government will be literally handing out trillions of dollars for free — you’d probably back up the truck and buy as much gold as possible, because gold should be at record highs and yet it’s not.”

Gold price update: Stocks still relatively cheap

With the gold price below expectations, how are gold-focused companies doing?

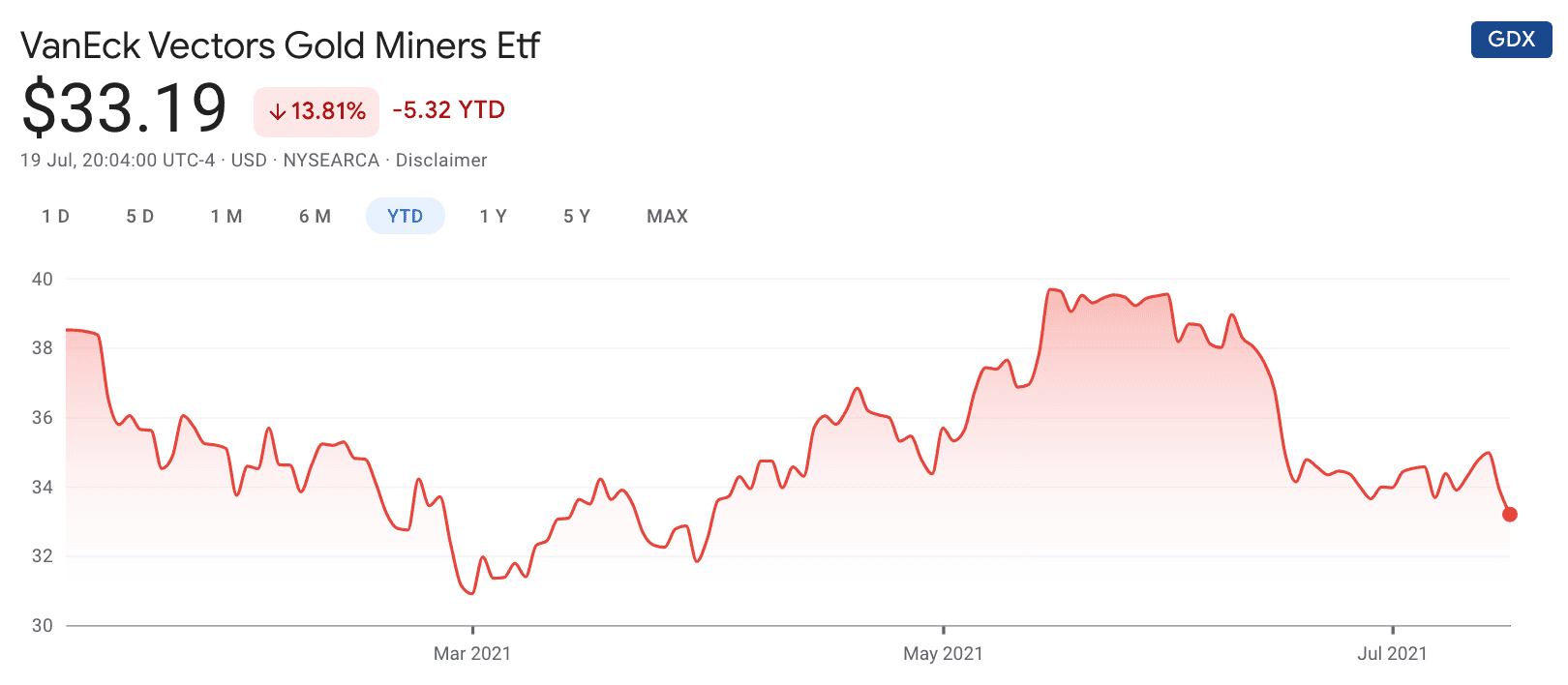

The VanEck Vectors Gold Miners ETF (ARCA:

GDX

) aims to track the performance of gold-mining companies, and although it was on the rise in Q2 it ultimately dropped toward the end of the quarter.

Performance of the VanEck Vectors Gold Miners ETF, January 1, 2021 to July 19, 2021. Chart via

Google Finance

.

The consensus among market watchers seems to be that gold stocks are still inexpensive when compared to the yellow metal’s price. Speaking to INN in early June, Resource Maven’s Gwen Preston

described gold companies

as “historically cheap relative to the price of gold,” and said that as a result she sees significant future upside in this category.

“There’s multiples ahead for gold miners just to catch up to historic ratios for their valuations vs. the price of gold, let alone should the price of gold continue to rise,” she explained in an interview. “So there’s a lot of upside ahead for gold miners, I really believe that.”

Watch the full interview with Preston above.

Lobo Tiggre, founder and CEO of

IndependentSpeculator.com

, is normally focused on smaller-cap opportunities in the gold space, but said at the end of June that he was feeling open to companies on the bigger side too. Like Preston, he described gold stocks as cheap when stacked up against the gold price.

“The opportunities are so broad based that I find myself uncharacteristically looking at the majors as well as the smaller companies … anything that I can see as having a compelling value proposition is of interest to me, and when the stocks are so relatively undervalued compared to the commodity they produce — even the majors can be doubles (or) triples,” he commented.

Watch the full interview with Tiggre above.

Looking more specifically at results this year from precious metals producers, analysts at Raymond James said in a mid-July update for investors that they expect margin compression from the companies they are watching in the second quarter compared to Q1.

As the team explains in its note, “(A)lthough gold and

silver

price averages were up slightly q/q (gold 0.9% and silver 1.7%), we expect a trend of higher unit costs in 2Q on lower q/q production levels related to scheduled maintenance, lower grade sequencing in the quarter, and some mine re-starts.”

The firm is calling for the second quarter to be the year’s weakest operating period for a number of producers — including Agnico Eagle Mines (TSX:

AEM

,NYSE:AEM), B2Gold (TSX:

BTO

,NYSEAMERICAN:BTG), Calibre Mining (TSX:

CXB

,OTCQX:CXBMF) and Barrick Gold (TSX:

ABX

,NYSE:GOLD) — but sees the companies it covers maintaining their annual output guidance.

Gold price update: Will gold hit US$2,000 in 2021?

Looking forward into the second half of 2021, the question of

when the gold price will rise higher

is on many investors’ minds. The thought is especially relevant given gold’s breakout last summer.

Byron King, who writes Whiskey & Gunpowder at St. Paul Research, which is part of Agora Financial, told INN he thinks gold could

repeat last summer’s price jump

. “Last summer we saw gold over US$2,000 an ounce. I expect we’re going to see the same thing again this summer,” he said, noting that his view on the gold price is tied to his outlook for the US dollar, which isn’t favorable.

“When we look ahead, is the US government going to get its spending under control? I don’t think so. Is it going to get its fiscal act together? I don’t think so,” King commented. “Or is the Federal Reserve going to somehow say, ‘No more … Congress, stop spending so much money, we’re not going to print up the wherewithal for you to do it.’ Are you kidding me? No way.”

Watch the full interview with King above.

These ideas have been expressed by many others in the gold space, including industry veterans Ross Beaty and Rob McEwen. Beaty, who is chairman of Equinox Gold (TSX:

EQX

,NYSEAMERICAN:EQX) and recently stepped down from his longtime position as chairman of Pan American Silver (TSX:

PAAS

,NASDAQ:PAAS), has said it’s

difficult for him to think of a negative scenario

for the metal.

“The forces that are driving gold are stronger than I’ve ever seen in my career, and I just don’t see those ending any time soon. We cannot increase interest rates to stem inflation because that’ll crater major markets. Even if we do though, that should be good for gold — even if major markets crater, gold should be a beneficiary,” he explained in a conversation with INN.

“If the US dollar weakens, gold should be a beneficiary. But even if the US dollar strengthens, I think gold will remain strong — I just think in this particular environment gold has a really, really good outlook.”

Watch the full interview with Beaty above.

For his part, McEwen, who is chairman and chief owner of McEwen Mining (TSX:

MUX

,NYSE:MUX),

identified several factors

that he thinks are holding gold back: the belief that inflation is under control, the idea that gold is an “old-school investment” and broad market strength. However, he has a clear idea of how the situation could change — he believes that once inflation is more widely recognized, that will be gold’s cue to move.

“During the last 12 months, the prices of many essential commodities have experienced large price jumps, and it won’t take very long for these increases to be reflected in the prices of finished goods, services, foods — and followed by demand for higher compensation by labor,” he said. “And that’s when that inflation will become evident — clearly evident — and gold will start performing,” said McEwen.

Watch the full interview with McEwen above.

Whether or not gold will have another hot summer remains to be seen, although as of late July the precious metal was breaking out of its late Q2 slump, sitting fairly securely around the US$1,800 level.

Don’t forget to follow us

@INN_Resource

for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure:

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.