When stocks are swingy and volatile, employing a strategy that takes advantage of the market dynamic can not only help us navigate these uncertain times – but thrive and outperform. This is what separates the good investors from the great ones. The top performers are able to adapt their strategies to the current market environment. Similar to an offensive play-caller, these investors successfully adjust to what the other side (the market) is doing by targeting the right industries and executing the proper strategies.

On Tuesday, the U.S. Labor Department released the Consumer Price Index (CPI) data from March which showed prices jumped 8.5% from a year ago, slightly above expectations. Historically viewed as a hedge against inflation and currency devaluation, precious metals can be a great portfolio diversifier – particularly during times when many equities are falling.

Metals have been outperforming over the past year and look set to continue that run as we move further into the second quarter. While the past few months have been treacherous for passive equity investors, gold has made a stealthy move higher and is up over 8% on the year.

There are numerous ways to gain exposure to precious metals. While investing directly in metals can be lucrative, decades of market history have shown us that it is far more profitable to own stocks of companies that produce commodities than the commodities they produce. One of the best ways to target these metals from an investment perspective is to own the stocks of mining companies. These stocks typically outperform the underlying precious metals due to growth in their intrinsic value.

Precious metals do not have the potential for intrinsic value growth as stocks do. The ability of companies to increase their intrinsic value has always enabled stocks to outperform other types of investments. As the intrinsic value of a company grows, the company can increase its production or services which in turn creates more income.

Exchange-traded fund (ETF) performance can also serve as a confirmation indicator that supports our investment thesis. The VanEck Gold Miners ETF

GDX

tracks the performance of companies involved in the gold mining industry. The stock we will discuss below is the top holding of GDX and makes up over 15% of the total GDX holdings. GDX hit a fresh 52-week high today and is up over 27% this year alone. The VanEck Gold Miners ETF is displaying relative strength and looks poised to continue its outperformance.

Image Source: Zacks Investment Research

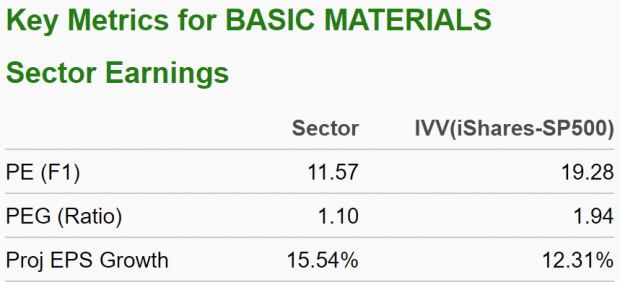

After lagging throughout the latter half of last year, the Basic Materials sector exemplifies the sector rotation that has occurred as it has vastly outperformed the major indices with a 13.54% return year-to-date. This sector is currently ranked in the top 13% out of all 16 Zacks Ranked Sectors. The Basic Materials sector is displaying some favorable characteristics as we can see below:

Image Source: Zacks Investment Research

Digging a bit deeper, the stock we will analyze below is part of the Zacks Mining – Miscellaneous industry group, which ranks in the top 19% of all Zacks Ranked Industries. This industry group is also relatively undervalued (10.0 forward P/E). By targeting stocks in the top industry groups, we can dramatically improve our investing success.

Newmont Corporation (

NEM

)

Newmont Corp. is engaged in the production and exploration of gold. The company operates primarily in North America, South America, Australia, and Africa. NEM also explores for copper, silver, zinc, and lead. Newmont was founded in 1916 and is based in Denver, CO.

NEM has surpassed earnings estimates in two of the past three quarters. The metals mining company most recently reported Q4 EPS back in February of $0.78, a +2.63% surprise over the $0.76 estimate. Shares have advanced 36.5% so far this year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report