Freeport-McMoRan Inc.

FCX

is set to release

fourth-quarter 2021

results before the opening bell on Jan 26.

The mining giant’s earnings beat the Zacks Consensus Estimate in two of the last four quarters, while missed once and were in-line on the other occasion. It has a trailing four-quarter earnings surprise of roughly 4.3%, on average. Freeport’s fourth-quarter results are likely to reflect the benefits of higher copper prices and cost-management actions.

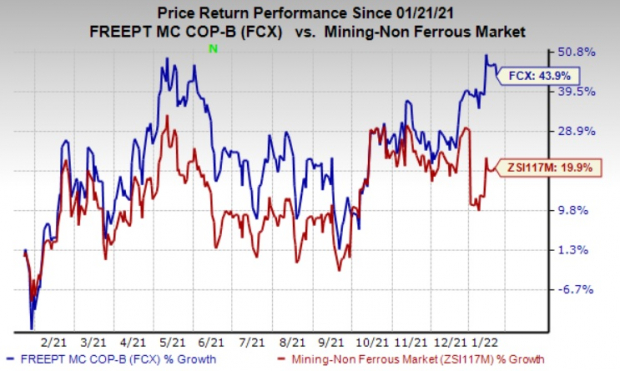

The stock has rallied 43.9% in the past year compared with the

industry

’s 19.9% rise.

Image Source: Zacks Investment Research

Zacks Model

Our proven model predicts an earnings beat for Freeport this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP:

Earnings ESP for Freeport is +2.86%. The Zacks Consensus Estimate for the fourth quarter is currently pegged at 96 cents. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Freeport currently carries a Zacks Rank #1.

What do the Estimates Indicate?

For the fourth quarter, Freeport expects sales volumes to be 1,025 million pounds of copper, 375,000 ounces of gold and 22 million pounds of molybdenum.

The Zacks Consensus Estimate for Freeport’s fourth-quarter consolidated revenues is currently pegged at $6,589 million, which suggests a year-over-year rise of 46.6%.

The Zacks Consensus Estimate for fourth-quarter consolidated net cash costs per pound of copper is currently pegged at $1.23, which calls for 3.9% fall on a year-over-year basis. The same for average realized price for copper stands at $4.31 per pound, reflecting a 26.8% rise year over year.

The consensus mark for consolidated copper sales for the fourth quarter is pegged at 1,026 million pounds, which suggests a year-over-year rise of 18.5%.

A Few Factors to Watch

Freeport is likely to have gained from higher year-over-year copper prices in the fourth quarter. Copper had a stellar run in 2021, thanks to a strong rebound in demand from the pandemic-led downturn and supply constraints. The widely-used industrial metal witnessed a roughly 25% surge in 2021. The rally has been backed by a rebound in industrial demand globally, optimism regarding economic growth, supply chain disruptions associated with the pandemic, and higher demand from top consumer China. Supply from top copper producers Chile and Peru had been under pressure due to the impact of the coronavirus pandemic.

Higher year-over-year average realized prices are expected to have boosted Freeport’s margins in the fourth quarter. The company is also likely to have benefited from its continued focus on maintaining a low-cost position.

The ramp-up of underground mining at PT Freeport Indonesia and efforts to increase operating rates at Cerro Verde and El Abra mines are also likely to have driven the company’s copper sales volumes in the quarter to be reported.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

Olin Corporation

OLN

, scheduled to release earnings on Jan 27, has an Earnings ESP of +1.95% and carries a Zacks Rank #3. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Olin’s fourth-quarter earnings has been revised 4.1% upward over the past 60 days. The consensus estimate for OLN’s earnings for the quarter is currently pegged at $2.53.

CF Industries Holdings, Inc.

CF

, expected to release earnings on Feb 16, has an Earnings ESP of +18.9% and sports a Zacks Rank #3.

The consensus estimate for CF Industries’ fourth-quarter earnings has been revised 31.5% upward over the past 60 days. The Zacks Consensus Estimate for CF’s earnings for the quarter stands at $3.05.

Celanese Corporation

CE

, scheduled to release earnings on Jan 27, has an Earnings ESP of +2.98% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Celanese’s fourth-quarter earnings has been revised 0.6% upward over the past 60 days. The consensus estimate for CE’s earnings for the quarter is currently pegged at $5.05.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report