WestRock Company

WRK

is scheduled to report

second-quarter fiscal 2022

results (ended on Mar 31, 2022) on May 5, before the opening bell.

Q2 Estimates

The Zacks Consensus Estimate for the fiscal second-quarter revenues is pegged at $5.08 billion, suggesting growth of 14.5% from the year-ago quarter’s levels. The same for earnings per share is pegged at $1.01, indicating a year-over-year improvement of 87%. The Zacks Consensus Estimate for the company’s fiscal second-quarter earnings has remained unchanged in the past 30 days.

Q1 Performance

In the last reported quarter, WestRock’s adjusted earnings per share beat the Zacks Consensus Estimate and increased year over year. Revenues missed the consensus mark but increased year on year. The company has a trailing four-quarter positive earnings surprise of 0.31%, on average.

Key Factors to Note

WestRock has been witnessing solid demand for its products and solutions in key end markets while focused on partnering with customers to fulfill their growing demand for sustainable, fiber-based packaging solutions. E-commerce demand remains strong across all channels, primarily during the pandemic. These factors are likely to have aided fiscal second-quarter performance. Solid demand for corrugated packaging, containerboard, food and beverage consumer packaging and industrial packaging are also aiding growth.

Labor shortages and supply chain issues have been disrupting production and impacting shipments to customers. Higher energy, freight and chemicals costs and planned maintenance downtime are anticipated to have hurt margin in the quarter. However, the company might have offset some of this impact with price increases.

WestRock acquired KapStone Paper and Packaging Corp in 2019, with the integration on track. The buyout helped the company cement its presence in the Western United States. The company continues to boost its North American corrugated packaging business margins. These moves are likely to have contributed to its performance in the quarter under review. Productivity, price increase actions, performance-improvement programs across its manufacturing footprint and cost savings are anticipated to have aided the company’s fiscal second-quarter performance.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for WestRock this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

The Earnings ESP for WestRock is -3.48%.

Zacks Rank:

WestRock currently sports a Zacks Rank of 1. You can see

the complete list of today’s Zacks #1 Rank stocks here.

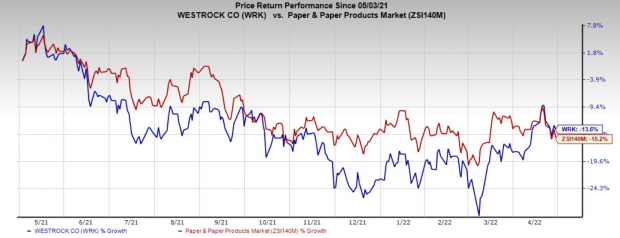

Share Price Performance

WestRock’s shares have lost 13.6% over the past year, compared with the

industry

’s decline of 15.2%.

Image Source: Zacks Investment Research

Stocks Poised to Beat Estimates

Here are some Basic Materials stocks, which you may consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases:

Allegheny Technologies Incorporated

ATI

has an Earnings ESP of +4.55% and carries a Zacks Rank #1.

The Zacks Consensus Estimate for Allegheny’s first-quarter earnings has been revised 4.8% upward over the past 60 days. The Zacks Consensus Estimate for ATI’s earnings for the quarter is currently pegged at 22 cents, highlighting growth of 466.7% from the year-ago quarter’s levels.

Westlake Corporation

WLK

has an Earnings ESP of +17.30% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Westlake’s first-quarter earnings has been revised 22.1% upward over the past 60 days. The consensus estimate for WLK’s earnings for the quarter is currently pegged at $4.70, indicating a year-over-year surge of 151.3%.

Pan American Silver

PAAS

has an Earnings ESP of +9.01% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Pan American Silver’s first-quarter earnings has been revised 17% downward in the past 60 days. The Zacks Consensus Estimate for PAAS’ earnings for the quarter is currently pegged at 20 cents, suggesting year-over-year growth of 11.1%.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report