Energy Fuels Inc.

UUUU

is anticipated to report a loss when it reports

third-quarter 2021

results later this week.

Q3 Estimates

The Zacks Consensus Estimate for third-quarter revenues is currently pegged at $10.5 million, indicating growth of 2,049% from the prior-year quarter. The consensus mark for earnings stands at a loss of 3 cents per share, compared with a loss of 8 cents per share in the year-ago quarter. The estimates have remained stable over the past 30 days.

Q2 Results

In the last reported quarter, Energy Fuels reported revenues of $0.46 million, which improved 15% year over year but missed the Zacks Consensus Estimate. The company reported a second-quarter 2021 loss per share of 7 cents, wider than the Zacks Consensus Estimate of a loss per share of 4 cents. The uranium mining company had reported a loss of 8 cents in the second quarter of 2020.

The company has a trailing four-quarter negative earnings surprise of 43.7%, on average.

Factors to Note

Energy Fuels has strategically opted not to enter into any uranium sales commitments in 2021. Consequently, its uranium production is expected to be added to existing inventories, which were anticipated to total around 691,000 pounds at 2021-end. The company intends to hold this inventory until prices for uranium go up significantly. It is also holding on to its vanadium until spot prices spike from current levels. It expects to sell finished vanadium products when justified to the metallurgical industry, and other markets that demand a higher-purity product, including the aerospace, chemical, and potentially the vanadium battery industries.

Meanwhile, the company has been pursuing new sources of revenues, including its emerging REE business, and new sources of alternate feed materials and alternative fee processing opportunities at the White Mesa Mill that can be processed under existing market conditions (i.e., without reliance on current uranium sales prices). It has also been seeking new sources of natural monazite sands for its emerging rare earth business, and continues to support the U.S. governmental activities to assist the U.S. uranium mining industry, including the proposed establishment of a U.S. Uranium Reserve.

In September, the company announced that approximately 15 containers of RE (rare earth) Carbonate (300 ton of product) produced at the White Mesa Mill are being shipped to Europe where it will be processed into separated rare earth oxides and other value-added RE compounds. This creates a new U.S. to Europe RE supply chain along with new opportunities and financial benefits. Energy Fuels is the first U.S. company to produce a marketable mixed REE concentrate ready for separation on a commercial scale.

Energy Fuel’s revenues for the quarter to be reported are likely to reflect fees for ore received from a third-party uranium mine. On Oct 6, 2020, the company announced that it has repaid all of its debt — achieving debt free status for the first time since 2012. This is likely to have reduced interest expenses and thereby, might have favored margins in the third quarter. The company’s ongoing efforts to lower costs are likely to get reflected in the third-quarter bottom line.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Energy Fuels this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP

: The Earnings ESP for Energy Fuels is 0.00%.

Zacks Rank

: The company currently carries a Zacks Rank #3.

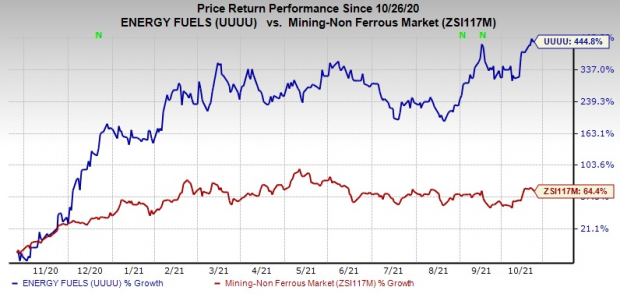

Price Performance

Image Source: Zacks Investment Research

Energy Fuel’s shares have soared 444.8% in the past year compared with the

industry

’s rally of 64.4%.

Stocks Poised to Beat Estimates

Here are some Basic Materials stocks, which you may consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming releases.

Teck Resources Ltd

TECK

has an Earnings ESP of +9.68% and a Zacks Rank of 1, currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Olin Corporation

OLN

, a Zacks #1 Ranked stock, has an Earnings ESP of +5.79%.

Celanese Corporation

CE

has a Zacks Rank #2 and an Earnings ESP of +3.14%, at present.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report