Duke Energy Corporation

DUK

recently announced that it has completed the first phase of a two-phase transaction of minority interest sale of its subsidiary Duke Energy Indiana (“DEI”). The company sold 11.05% of DEI to an affiliate of GIC Private Limited for $1.025 billion.

On Jan 28, 2021, Duke Energy announced its intention to sell 19.9% interest in DEI to GIC for $2.05 billion. The transaction will be completed in two phases. Duke Energy has the authority to determine the timing of the second phase closing, but it will occur no later than January 2023.

Usage of Sales Proceeds

Proceeds from this transaction will help fund its capital expenditure and satisfy all equity capital raising needs through 2025. During the 2021-2025 time period, Duke Energy expects to spend $59 billion, which includes investment in clean energy generation and transmission investments across the Carolinas, Indiana, and Florida.

Net-Zero Carbon Emission

Duke Energy is on the path of achieving net-zero carbon emission by 2050 and now owns or purchases more than 10,000 MW of solar and wind energy. It has plans to add more renewable energy in its generation portfolio and aims to reach 16,000 MW of renewables by 2025. Duke Energy has plans to invest in the range of $65-$75 billion in the 2025-2029 time period to further strengthen its infrastructure, including its renewable power generation portfolio.

A transition is quite evident in the utility space, with utilities on their own are setting up targets to achieve net-zero emission over the next three decades. Per the U.S. Energy Information Administration report, electricity generating capacity increase in the 2021-2050 time period will essentially come from solar, wind, and natural gas.

Utilities are cutting down usage of coal in electricity generation and are relying more on natural gas and clean alternate sources of energy to produce electricity. The ongoing research & development and investment in renewable is making utility scale renewable plants viable compared with conventional sources of energy. Utilities like

Dominion Energy

D

,

The Southern Company

SO

, and

Xcel Energy

XEL

have decided to achieve net-zero emission by 2050.

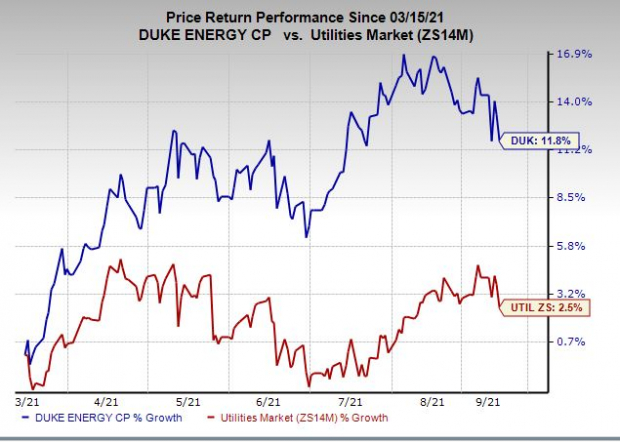

Price Performance

In the past six months Duke Energy’s shares have gained 11.8%, outperforming the

industry

’s growth of 2.5%.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report