Duke Energy Corp.

DUK

recently announced that its non-regulated commercial brand, Duke Energy Sustainable Solutions has begun the construction of the Pisgah Ridge Solar project in Navarro County, TX. On completion, expected by 2022-end, this 250-megawatt (MW) facility will generate enough electricity to power approximately 63,000 additional residences in Texas.

Three corporations, including

Charles River Laboratories

CRL

have signed separate 15-year virtual power purchase agreements (VPPA), which will enable them to receive the energy generated by the aforementioned project.

Duke Energy’s Solar Commitment

Like many other utility providers, Duke Energy is aggressively investing in solar energy to enhance its renewable asset base. Notably, during 2020, Duke Energy connected nearly 350 megawatts (MWs) of solar power in its North Carolina regulated utilities. In Florida, the company is investing nearly $1 billion in solar projects to bring 700 MW of solar online through 2022.

Moreover, Duke Energy has received approval for its $1 billion Clean Energy Connection shared solar program in Florida, which will add another 750 MWs of solar by the end of 2024. In battery storage, the company aims to invest $600 million during 2021-2025 period and also projects more than 13,000 MWs of energy storage on its system by 2050.

These initiatives are expected to enable the company to duly achieve the target of doubling its enterprise-wide renewable portfolio from 8 GW to 16 GW by the end of 2025. The Pisgah Ridge Solar project, once completed, will put Duke Energy a step ahead toward achieving this target.

Solar Energy Prospects & Utilities

Overcoming the COVID-19 challenges, the solar market in the United States is gradually rallying back on a solid growth trajectory. Looking ahead, per the latest report by Solar Energy Industries Association (SEIA), Wood Mackenzie forecasts that the total operating solar fleet in the United States will more than quadruple by 2030 with utility-scale solar pipeline playing the role of a major catalyst.

Surely such improved projection offers ample growth opportunities for utilities that are expanding their renewable portfolios, with solar constituting major portions. In this regard, utilities that are worth mentioning include

Dominion Energy

D

,

CMS Energy

CMS

, apart from Duke Energy

Notably, Dominion Energy currently plans for a significant expansion of large-scale solar energy in Virginia, wherein at least 15,900 MW of new solar energy could be added in the next 15 years. On the other hand, CMS Energy’s clean energy plans include adding approximately 1,100 MW of solar through 2024 to help achieve net-zero carbon emissions by 2040.

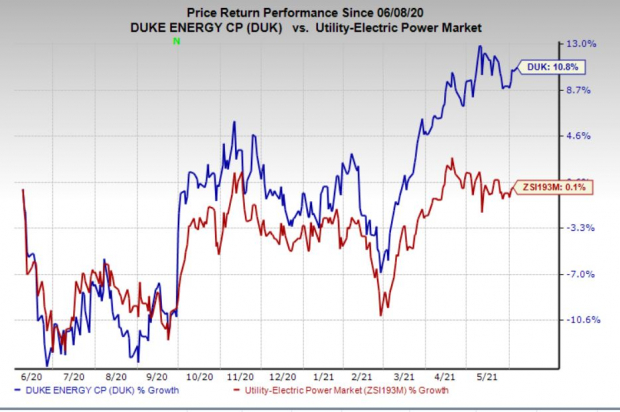

Price Movement

In a year’s time, shares of Duke Energy have increased 10.8% compared with the

industry

’s 0.1% growth.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report