Dominion Energy

D

has been gaining from steady investments in regulated infrastructure and the addition of clean sources to the production portfolio to achieve net-zero emissions by 2050.

Its earnings surpassed estimates in the last four quarters, with an average of 3.2%. Long-term (three to five years) earnings growth of the company is projected at 6.7%.

Tailwinds

Dominion plans to invest $72 billion to strengthen its infrastructure and add more clean power generation assets to its portfolio in the next 15 years. In addition, the divestment of gas transmission and storage assets to an affiliate of

Berkshire Hathaway

(

BRK.B

) has supported Dominion’s transition toward regulated and sustainable operations. Currently, up to 88% of operating earnings are generated from the portfolio of regulated electric and natural gas utility companies.

The company is in the process of adding 4,000 MW of solar or wind generation in the state of Virginia. Its long-term objective is to add 24 GW of battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 as well as increase renewable energy capacity by more than 15% per year, on average, over the next 15 years. The company aims to cut emissions by 70-80% by 2035 from 2005 levels. Dominion aims to attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050 from 2005 levels.

Dominion continues to replace the aging equipment to improve system reliability and serve the customer base more efficiently. The company is also working on a project of strategic undergrounding of 4,000 miles of distribution lines. It has already completed undergrounding 1,300 miles of distribution lines. These initiatives will increase the resilience of operations and enable it to serve the expanding customer base more efficiently.

Headwinds

Dominion is exposed to risks associated with the operation of nuclear facilities and unplanned outages at power stations in which the company has ownership interest. This might derail management’s planned production goal and adversely impact its earnings. Even if planned outages continue for more than the forecast period, it can adversely impact earnings of the company.

Dominion and its gas unit depend on third-party producers for the supply of natural gas. If a producer refuses or fails to deliver a specific quantity of natural gas or natural gas liquids (NGL) to Dominion, consequently, the volume of natural gas and NGL available for the company’s pipelines and other assets would fall. This will certainly affect revenues, in case Dominion fails to replace the lost volumes.

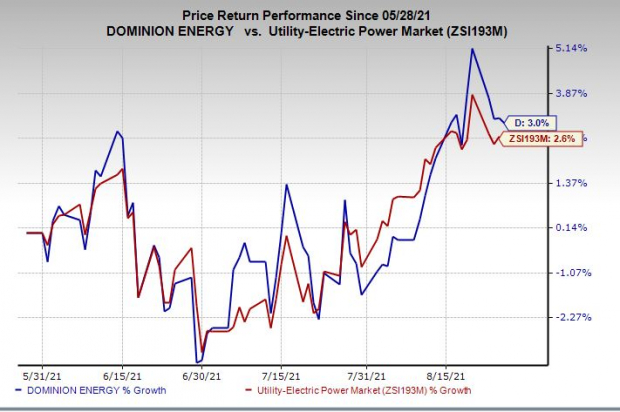

Price Performance

In the past three months, shares of this utility have gained 3%, outperforming the

industry

’s 2.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Dominion currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the same sector include

Middlesex Water Company

MSEX

and

Otter Tail Corporation

OTTR

. Middlesex Water has a Zacks Rank #2 (Buy) while Otter Tail sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Middlesex Water and Otter Tail’s dividend yield is 1.01% and 2.92%, respectively.

The Zacks Consensus Estimate for 2021 earnings per share of Middlesex Water and Otter Tail’s has moved up 3.7% and 39.2%, respectively, in the past 60 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report