Daqo New Energy Corp.

DQ

is slated to release

fourth-quarter 2021

results before the bell on Feb 28. The company is likely to have gained from higher prices, strong demand and its efforts to lower costs in the fourth quarter.

This leading producer of high-purity polysilicon beat the Zacks Consensus Estimate for earnings in two of the trailing four quarters while missing the same twice. In this timeframe, it delivered an earnings surprise of 4.9%, on average. It delivered an earnings surprise of 22.5% in the last reported quarter.

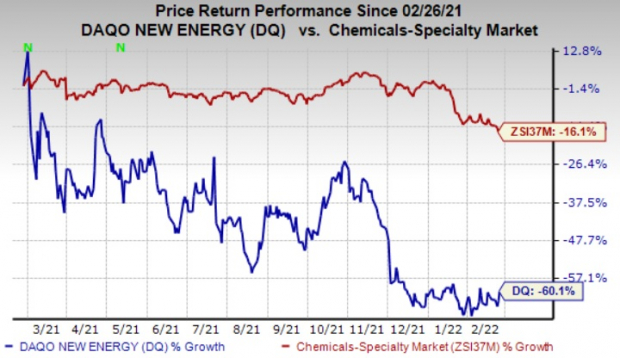

The company’s shares have declined 60.1% in a year compared with the

industry

’s 16.1% decline.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for this announcement.

What Do the Estimates Say?

The Zacks Consensus Estimate for the company’s fourth-quarter sales is currently pegged at $510.3 million, which suggests a rise of 106% from the year-ago quarter’s tally.

Some Factors at Play

Daqo New Energy’s fourth-quarter results are expected to reflect the benefits of healthy polysilicon production and sales volumes. The company is likely to have witnessed strong customer demand for high-purity polysilicon in the quarter. Higher sales volumes are likely to have supported its top line in the quarter.

Daqo New Energy is also likely to have benefited from higher average selling prices and its actions to improve its cost structure in the to-be-reported quarter. The company is expected to have gained from its energy efficiency efforts and enhanced manufacturing efficiencies.

Polysilicon prices are likely to have been driven, in the fourth quarter, by strong downstream demand. Higher prices are expected to have boosted the company’s sales and margins in the quarter. However, the company is likely to have faced headwinds from higher silicon powder costs in the December quarter, which is expected to have raised its production costs.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Daqo New Energy this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP:

Earnings ESP for Daqo New Energy is 0.00%. The Zacks Consensus Estimate for earnings for the fourth quarter is currently pegged at $2.34. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Daqo New Energy currently carries a Zacks Rank #2.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

Sociedad Quimica y Minera de Chile S.A.

SQM

, scheduled to release earnings on Mar 2, has an Earnings ESP of +15.68% and carries a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Sociedad Quimica’s fourth-quarter earnings has been revised 12.8% upward over the past 30 days. The consensus estimate for SQM’s earnings for the quarter stands at 97 cents.

Companhia Siderurgica Nacional

SID

, scheduled to release earnings on Mar 9, has an Earnings ESP of +3.57% and carries a Zacks Rank #3.

The consensus estimate for Companhia Siderurgica’s fourth-quarter earnings has been stable over the past 30 days. The Zacks Consensus Estimate for SID’s earnings for the quarter stands at 28 cents.

Seabridge Gold Inc.

SA

, expected to release earnings on Mar 23, has an Earnings ESP of +14.29% and carries a Zacks Rank #3.

The consensus estimate for Seabridge Gold’s fourth-quarter earnings has been stable in the past 30 days. The Zacks Consensus Estimate for SA’s fourth-quarter earnings is pegged at a loss of 4 cents.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report