With economic operations returning to normalcy owing to the proper administration of vaccines and better medical knowledge to deal with the coronavirus, the stocks from the

Zacks Utility – Electric Power

industry are witnessing a rise in demand from the commercial and industrial group and the same from the residential players.

The regulated nature of operations and the companies’ focus on domestic operations make these stocks one of the safest investment bets. Also, given the prevalent low-interest rates, the players’ consistent dividend payments make them more attractive than bonds.

Utilities are capital-intensive. They constantly require funds to build power-generation plants, strengthen transmission and distribution lines, and use modern technologies to provide 24X7 supply even during extreme weather conditions. Per a National Oceanic and Atmospheric Administration finding, there is a high chance of warmer temperature during the upcoming winter months, adversely impacting demand for utility operators.

Utilities are not only focusing on improving their infrastructure but are also investing in clean and sustainable energy. To meet all investment needs, internal funding does not always suffice. Hence, they need to borrow and with the current interest-rate scenario, it becomes easy for the operators to procure necessary capital investments at reasonable rates. Amid improving demand, we run a comparative analysis of two major electric power utilities, namely

Dominion Energy, Inc.

D

and

Duke Energy Corporation

DUK

, to determine which stock is better poised right now.

Both stocks currently carry a Zacks Rank #3 (Hold). Dominion Energy and Duke Energy have a market capitalization of $61 billion and $76.20 billion, respectively. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Estimate Movement

The Zacks Consensus Estimate for 2021 earnings per share of Dominion Energy and Duke Energy has moved 0.5% north to $3.89 and 0.2% up to $5.22, respectively, in the past 60 days.

While the Zacks Consensus Estimate for Dominion Energy’s 2022 earnings per share has moved 0.5% north to $4.15, the same for Duke Energy has been unchanged at $5.47 in the past 60 days.

Earnings Surprise Trend & Long-Term Growth

Dominion Energy delivered a trailing four-quarter surprise of 2.39%, on average. Its long-term (three to five years) earnings growth is projected at 6.76%.

Duke Energy delivered a trailing four-quarter surprise of 2.29%, on average. Its long-term earnings growth rate is pegged at 5.29%.

Return on Equity (ROE)

ROE measures a company’s efficiency in utilizing its shareholders’ funds. Dominion Energy and Duke Energy have a trailing 12-month ROE of 12.56% and 8.69%, respectively. The industry’s ROE for the same period came in at 8.85%.

Debt to Capital

The long-term debt-to-capital ratio is a good indicator of a company’s financial position and shows how much debt is used in running its business. Dominion Energy has a long-term debt-to-capital of 56.08%, higher than Duke Energy’s 53.06%. The utility electric power industry’s average long-term debt-to-capital is 49.32%.

Times interest earned (TIE) ratio of Dominion Energy at the end of third-quarter 2021 was 3.52, better than 2.03 recorded at the fourth-quarter 2020 end. The same for Duke Energy improved from 1.39 to 2.26. A greater than one TIE ratio reflects the companies’ financial strength and ability to meet debt obligations.

Dividend Yield

Dominion Energy has a dividend yield of 3.34% while Duke Energy’s is 3.98%. The utility electric power industry’s average dividend yield is 3.43%.

Investment & Emission-Reduction Goal

Dominion Energy plans to invest $32 billion in the 2021-2025 time period while Duke Energy projects to spend capital worth $59 billion.

Duke Energy aims to reduce carbon emissionsby 55-75% through 2035 and become net-carbon neutral from electric generation by 2050. DUK also pledged to cut methane emissions to net-zero by 2030 for the natural gas distribution companies.

Dominion Energy aims to cut emissions by 70-80% within 2035 from the 2005 levels, and attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050 from its 2005 baseline.

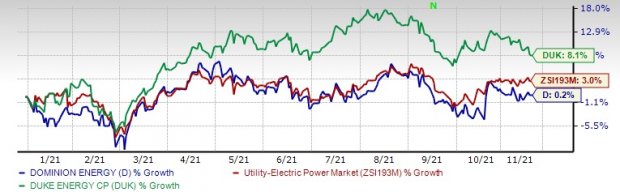

Price Movement

In the year-to-date period, shares of Dominion Energy have gained 0.2% while the Duke Energy stock has rallied 8.1%. The industry has recorded 3% growth in the said period.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Result

Both utilities seem a promising choice to be retained in investors’ portfolio for the upcoming year. Also, their capital budgets are reserved for more clean renewable sources, strengthening and expanding their infrastructure to increase the reliability of their services as well as lowering emissions. However, Dominion Energy looks better positioned for the upcoming period even though it is despite using more debts than Duke Energy to fund its business.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report