Clearway Energy

CWEN

announced that it has entered into an agreement with Capistrano Wind Partners, LLC, to acquire its operating wind projects. The Capistrano portfolio consists of five wind projects spread across Texas, Nebraska and Wyoming, and has a total generating capacity of 413 megawatts (MW). The total consideration, including assumption of debts, will be $415 million.

These wind projects would be a perfect fit for Clearway Energy’s existing portfolio, allowing it to further increase its renewable power generation capability. The acquired assets operate under long-term power purchase agreements, with an average remaining contract duration of nearly 10 years. The acquisition is expected to close by end of 2022 and should boost Clearway Energy’s operations and financial results from 2023.

Clearway Energy’s Focus on Clean Energy

Clearway Energy’s primary business strategy is to focus on the acquisition of clean assets and ownership of assets that have predictable and long-term cash flows. Apart from buying assets from Clearway Group, under the Right to First Offer agreement, exploring new opportunities from third parties is allowing the company to expand its clean power generation capacity.

Clearway Energy will focus on clean energy and has already sold its thermal business to KKR for $1.3 billion. Clearway Energy used a portion of the net proceeds to lower debts and another part to fund the acquisition of the Capistrano wind projects.

Increasing Usage of Clean Energy

A transition is evident in the U.S. utility space, with more operators coming out with their plans to become carbon neutral and provide emission-free electricity to their customers. The same is reflected in the U.S. Energy Information Administration (“EIA”) report, which indicates that renewable energy will provide 22% of U.S. generation in 2022 and 24% in 2023, up from a share of 20% in 2021.

Notaby, EIA expects solar and wind to be the major contributors to clean energy generation. Per EIA, solar capacity additions in the electric power sector will total 20 gigawatts (GW) in 2022 and 22 GW in 2023, while wind capacity additions in the U.S. electric power sector will total 11 GW this year and 5 GW in the next.

Large utilities operating in the United States like

NextEra Energy

NEE

,

Duke Energy

DUK

and

Dominion Energy

D

, among others, are using more and more clean sources in their generation portfolio to curb emission.

NextEra Energy has announced plans to achieve Real Zero Emission by 2045. To achieve the Real Zero Goal, NextEra will take steps to decarbonize its own business, and invest in wind, solar, battery storage, green hydrogen and other renewable energy developments.

Duke Energy has taken an initiative to expand the renewable asset base and aims to reach its target of net-zero carbon emissions from electric generation by 2050. The company has already lowered its carbon emissions in 2021 by more than 44% since 2005.

Dominion Energy also has a well-chalked-out plan to reduce emissions. Dominion aims to attain net-zero carbon and methane emissions from its electric generation and natural gas infrastructure by 2050 from the 2005 level. By 2035, Dominion Energy intends to make zero and low-emitting resources accountable for 99% of the company-wide electric generation.

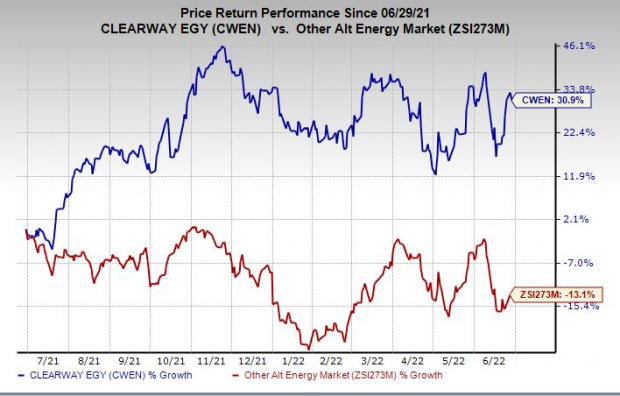

Price Performance

Shares of Clearway have risen 30.9% in the past year against the

industry

’s 13.1% decline.

Image Source: Zacks Investment Research

Zacks Rank

Clearway Energy currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report