Clearway Energy, Inc.

CWEN

, through its unit Clearway Energy Operating LLC, has entered into a definitive agreement to sell the Thermal Business to KKR for a total consideration of $1.9 billion. Net cash proceeds from the transaction are expected to be $1.3 billion after the assumption of projected debt, estimated taxes, obligations owed and transaction expenses.

The net proceeds from the divestiture will provide Clearway with additional financial flexibility and eliminate any need to issue new equity to fund the already committed investments. The proceeds will also provide the company with capital to fund future growth objectives and further enhance shareholder value. Subject to necessary approvals, this transaction is expected to close in the first half of 2022.

Clearway Energy’s Focus on Clean Generation

Clearway owns and operates utility-scale renewable energy and natural gas-fired generation assets, and makes strategic moves to expand operations through the acquisition of renewable, natural gas-fired generation. The decision to sell the thermal business will allow the company to concentrate on clean power generation assets. Clearway, under the Right to First Offer mode, is acquiring renewable power projects from Clearway Group.

It has received an offer from Clearway Group for co-investment in a 1.6-gigawatt (GW) clean project under development. The capital commitment for the transaction is expected in the range of $230-240 million. Clearway is working with Clearway Group for co-investment in a new 1.1-GW partnership, while gaining line of sight on 452 MW of new Texas solar projects and a 133-MW portfolio of distributed solar projects. These drop-down opportunities are targeted for financial closing between second-half 2022 and 2024.

Transition in Utility Space

A clear transition is evident in the utility space, with more utility operators planning to cut emissions from the electricity generation process, and focus on renewables as well as other clean sources to produce electricity. The U.S. Energy Information Administration forecasts that renewables’ share in U.S. generation in 2021 will remain the same as 2020 levels at 20% and then rise to 22% in 2022.

Utilities like

Duke Energy

DUK

,

Xcel Energy

XEL

and

Dominion Energy

D

, among others, have issued detailed plans to achieve net-zero emissions in their respective operations by 2050. Given the declining cost of setting up utility-scale renewable projects, government support, and general awareness against emissions, we expect more utilities to reduce emissions and strive for net-zero emissions from their operations.

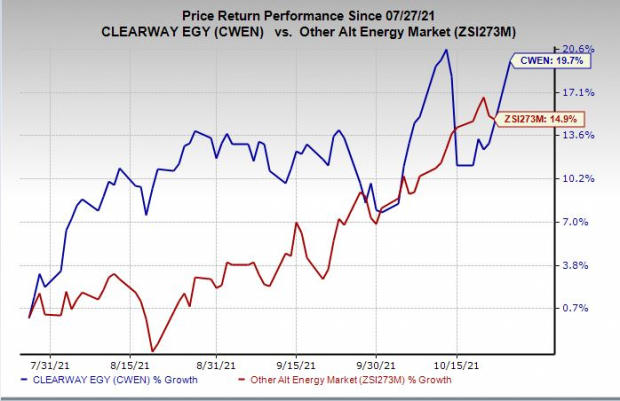

Price Performance

Shares of Clearway have gained 19.7% in the past three months compared with the

industry

’s 14.9% rally.

Image Source: Zacks Investment Research

Zacks Rank

It currently has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report