CenterPoint Energy, Inc.

’s

CNP

subsidiary, CenterPoint Energy Indiana South, has received the official go-ahead for the construction of two natural gas combustion turbines from the Indiana Utility Regulatory Commission (“IURC”). This comes as a major achievement for the company’s long-term electric generation transition plan.

The move is in sync with the company’s intent to swap its carbon-emitting infrastructure with options that offer lower emissions while assisting the company in accomplishing its commitment to net-zero emissions by 2035.

Key Details of the Facility

The aforementioned natural gas facility, which boasts an investment of $334 million, is capable of providing an output of 460 megawatts (MW) and capacity efficient enough to fulfill the future energy needs as the company approaches the retirement of A.B. Brown units 1 and 2 in late 2023.

Moreover, the move is likely to result in up to $60 million in additional savings for CNP customers, while the average residential customer is likely to witness a less than $10-per-month impact on bills for the total generation transition.

This initiative by the company exemplifies its efforts to provide next-generation energy for its 150,000 customers, whom it serves in southwestern Indiana.

CenterPoint’s Clean Energy Goals

Per CenterPoint’s 2020 Integrated Resource Plan, the company strives to generate approximately two-thirds of energy from renewable resources, coupled with natural gas generation. This, in turn, is expected to save electric customers an estimated $320 million over the 20-year planning period.

With this aim, CenterPointplans to retire 730 MW of coal units by 2025. The two natural gas combustion turbines, to be constructed by CNP, are in sync with this plan as these are going to replace a portion of its existing coal-fired generation fleet.

Moreover, the construction of these turbines will aid the company in mitigating the higher compliance cost associated with changing environmental regulations and offsetting escalating operating costs linked with aging units.

Utility Moves

Per U.S. Energy Information Administration’s latest short-term outlook, the consumption of natural gas in the United States is expected to average 85.3 billion cubic feet per day in 2022, up 3% from 2021. This reflects ample growth opportunities for U.S. utilities that strive to replace their aging, coal emission-generating fleet with natural gas power plants.

Other than CenterPoint, utilities that are investing in natural gas-fired power plants include

Duke Energy

DUK

,

Dominion Energy

D

and

CMS Energy

CMS

.

Duke Energy invested $817 million to build the Asheville combined-cycle station. Its other combined-cycle stations include the Citrus combined-cycle station and a 750 MW combined-cycle natural gas plant at the W.S. Lee.

Duke Energy boasts a long-term earnings growth rate of 6.1%. DUK shares have appreciated 7.7% in the past year.

Dominion Energy has invested in the natural gas combined-cycle plant to boost its attainment of clean energy goals. Dominion Energy’s natural gas combined-cycle plants include the 540 MW Columbia Energy Center, the 875 MW Jasper Generating Plant, the 250 MW McMeekin Station and the 650 MW Urquhart Station.

Dominion Energy’s long-term earnings growth rate is pegged at 6.3%. D shares have returned 6.7% in the past year.

CMS Energy’s subsidiary, Consumer Energy, has two natural gas combined-cycle plants — one in Zeeland and one in Jackson — with a total generating capability of 1117 MW. The Zeeland facility employs two natural gas simple-cycle units providing an additional 360MW of generating capability. Together, the Zeeland and Jackson Generating Stations are capable of contributing more than 1,470 MW of clean energy to the grid.

CMS Energy boasts a long-term earnings growth rate of 8.1%. CMS shares have returned 12.7% in the past year.

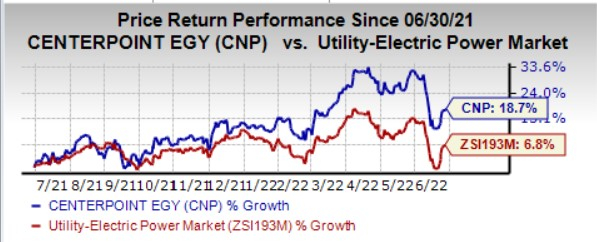

Price Movement

In the past year, CenterPoint Energy shares have rallied 18.7% compared with the

industry

’s growthof 6.8%.

Image Source: Zacks Investment Research

Zacks Rank

CenterPoint Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report