The first Canadian gold rush—the Klondike–went down with picks and shovels and got individual miners some nice nuggets to take home.

On the other side of the country—the mother lode–could become the second gold rush … and this time it’s high-tech, high-grade, and high-volume.

A discovery last year in Quebec by Amex Exploration netted early-in investors up to 7,000% returns.

But we think this is just the beginning.

And this isn’t just a gold rush.

Gunning for a repeat of the Amex 2020 discovery that for some investors would be a once-in-a-lifetime thing …

Starr Peak Mining Ltd. (

TSX:STE.V

;

OTC:STRPF

)

is on track aiming for something even more than just gold.

The junior miner—with Amex’s founder on its advisory team and technical advisor for exploration—has struck an entire basket of precious and base metals on its maiden drill.

And then again on its second drill.

Now, after hitting high-grade gold, silver, copper, and zinc on its first two drills at the past-producing mine it acquired earlier this year, the company is fast-tracking expansion of its drilling program.

In May, it expanded drilling from 5,000 meters to

20,000 meters

.

Now, it’s doubling even that—to 40,000 meters.

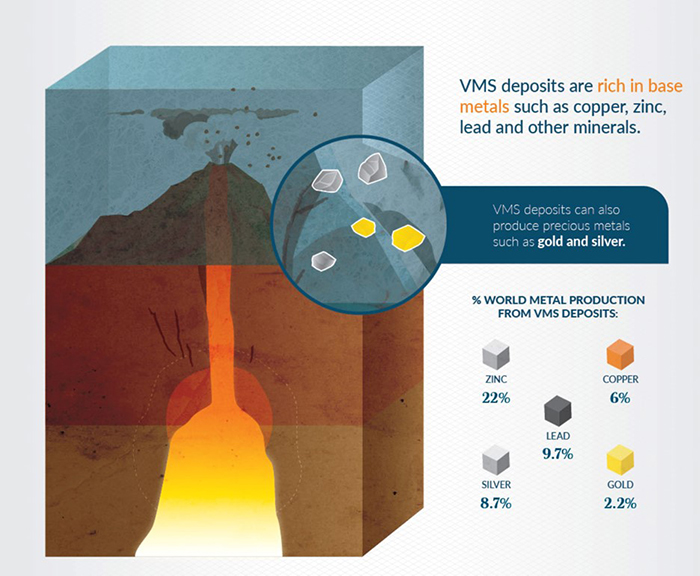

Why? Because this isn’t just gold. It’s a VMS deposit–a

Volcanogenic Massive Sulphide deposit that represents a cornucopia of commodities, many of them soaring in demand and price.

Proving up a commercial deposit of minerals is exactly what the major miners are after.

It’s all setting up Starr Peak to increase chances of success.

There are 3 key reasons we think this is the metals play of the decade for investors:

#1 A VMS proven deposit can attract major miners like nothing else

A junior miner can net investors huge returns if they make a discovery of commercial size and grade, and when that junior miner discovers something that has been eluding the big players, it’s on everyone’s radar.

Even more so when it’s hitting drill hole targets with a 98% success rate.

What exactly has Starr Peak found?

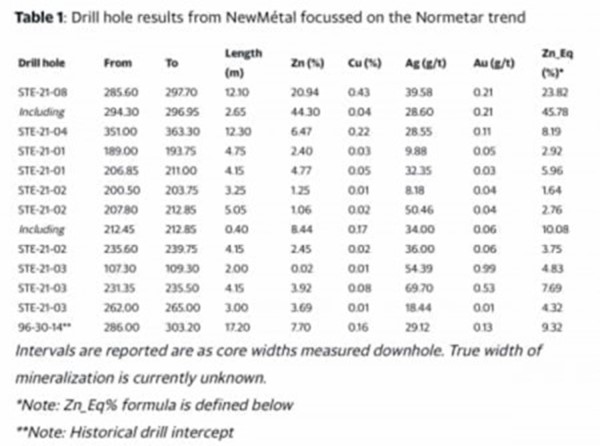

Using the same top geological consulting firm (Laurentia Exploration) that Amex used for its discovery, Starr Peak launched drilling in January, and by March it had released its

first surprise results

, which were big enough to bring on a second drill rig. But less than two months later, in May, investors got another pleasant surprise: indications of a VMS deposit. That sent shares up over 136%.

The May results showed evidence of a possible VMS deposit with rock containing multiple base metals, including zinc, copper, silver, and gold.

With those results, Starr Peak (

TSX:STE.V

;

OTC:STRPF

)

expanded drilling from 5,000 meters to 20,000 meters and brought on a third rig.

In July, Starr Peak drill results returned

even higher-grade results

:

– Upper Zone (above 400m vertically)

* STE-21-09: 8.30 m of 10.09 % ZnEq including 2.70 m of 24.44 % ZnEq

*

STE-21-17: 11.00 m of 9.01 % ZnEq including 3.00 m of 16.56 % ZnEq

*

STE-21-27: 20.55 m of 7.04 % ZnEq including 5.10 m of 11.09 % ZnEq

*

STE-21-29: 15.55 m of 9.94 % ZnEq including 10.10 m of 13.16 % ZnEq

– Deep Zone (below 400m vertically)

* STE-21-14: 6.65 m of 18.07 % ZnEq which includes 1.05% Cu

* STE-21-21: 8.70 m of 8.82 % ZnEq including 2.15 m of 13.38 % ZnEq

Spurred on by July’s high-grade results, Starr Peak moved to double its drilling program from 20,000 meters to

40,000 meters

.

Gold is great.

But VMS deposits are better. They can render a junior mining company valuable beyond gold. These deposits, once proven up, are so incredibly valuable because they have particularly long-term production potential due to what

Mining.com

refers to as “the formation of clusters of deposits or ore lenses in close proximity, and the polymetallic nature of the ore”.

And they are coveted because they are rarer discoveries …

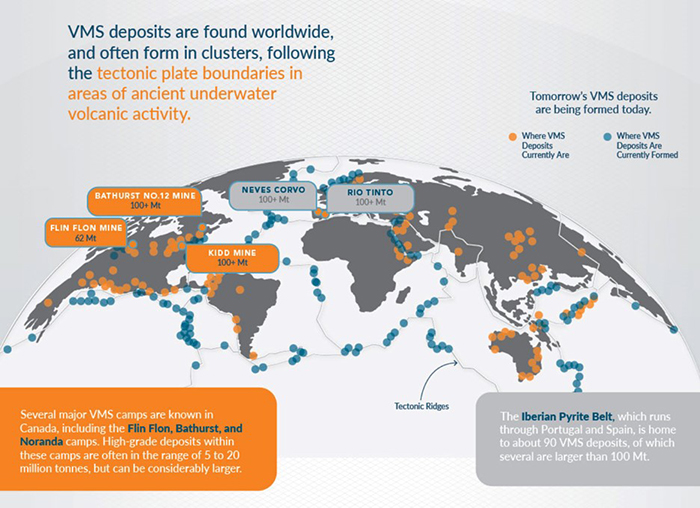

One of the most famous VMS deposits is the Kidd Mine in Australia, which has produced 9 million tons of zinc, over 3.4 million tons of copper, and 12,000 tons of silver since 1966.

And Quebec is one of the hottest spots to search for VMS deposits … even though their discovery has eluded the majors for decades.

But Quebec—a province that spans

1.7 million km²

of a wildly diverse collection of metals—is one of the world’s most tantalizing, untapped mining venues. Right now, only 1% of the province is being mined, and only 5% is covered by mining rights.

That puts Starr Peak right in the middle of VMS discovery sweet spot, with high-grade results already from its first two drills. The hopes are that it could blow even the original Amex discovery away.

#2 One of the Fastest-Moving Expansion Plays We’ve Seen

Since Q2 2019, Starr Peak (

TSX:STE.V

;

OTC:STRPF

) has been on a tear.

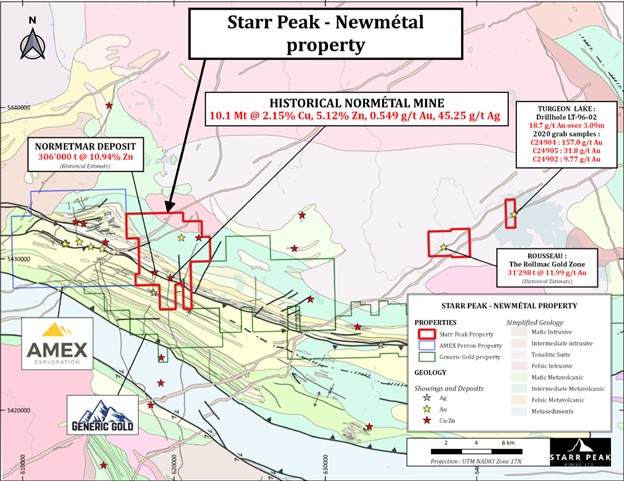

It started in June 2019, when the company acquired a priority land package (

NewMétal

) in northwestern Quebec, directly east of Amex Exploration Inc.’s Perron Property and proximal to the past-producing Normétal Mine. In that move, Starr Peak acquired 53 mineral claims covering 1,420 hectares in the Abitibi Greenstone Belt.

By the same time in 2020, Starr Peak expanded its NewMétal property by acquiring another 11 mineral claims over 468 hectares.

Right afterwards, it acquired the

past-producing Normétal Mine

, with 10 mineral claims over 391.53 hectares. That mine, which was exploited from 1929 to 1975, produced over 10 million tonnes of high-grade gold, silver, zinc and copper through that period.

And then, two more highly-prospective properties: Rousseau Gold Property (12 mineral claims covering 470.17 hectares) and Turgeon Lake Gold Property (2 mineral claims covering 112.91 hectares).

#3 Fully-Funded with a Superstar Team

Starr Peak reports it’s fully funded for drilling, with CAD$7.5 million in the bank as of July 22nd, 2021. It’s easy enough to follow the announcements of private placement money:

– March 2020: closed first tranche of private placement for

$450,000

– May 2020: closed final tranche of PP for

$555,000

– August 2020: closed flow-through PP for

$1,110,000

– November 2020: closed flow-through PP for

$2,650,000

– June 2021: closed institutional flow-through PP for

$3,756,000

– July 2021: closed institutional flow-through PP for $2,310,000

The same expert behind the Amex discovery at the Perron Project is now involved with Starr Peak’s exploration.

Dr. Jacques Trottier, PhD

, founder and executive chairman of Amex Exploration is now Starr Peak’s Chief Technical Advisor. He’s an expert on VMS deposits, and he’s confident we’re looking at another significant find here.

Starr Peak’s (

TSX:STE.V

;

OTC:STRPF

) new VP of Exploration, Yves Rougerie, PGeo, is also a VMS expert, with a track record across North America.

And CEO and Director Johnathan More, also the chairman of Power Metals Corp., was savvy enough to spot the enormity of the Amex Exploration discovery in 2019 and swoop in to scoop up the adjacent property. He’s been on an expansion binge ever since. For the earliest investors it’s paying off in a very short time.

For Starr Peak, it’s just beginning. But the momentum of this VMS discovery is hoped to soar past the “early-in” days very quickly. No doubt, all the major miners are watching this one now because this kind of deposit, if proven to be commercial size, is where economies of scale are creating and cash cost profiles for companies are enhanced significantly. There’s nothing more attractive to some investors.

Gold Majors Are Making Big Moves

Kinross Gold Corp.

(NYSE:KGC, TSX:K), one of the world’s largest gold producers, is constantly looking to expand its operations and has found success in many regions. The company mines for gold across six continents, with operations in Brazil, Ghana, Mauritania, Russia and the United States. It also operates a joint venture with AngloGold Ashanti Limited that provides mining services at two sites in West Africa—one of which was recently awarded an environmental permit from the government of Guinea.

Kinross Gold Corporation is a profitable company–consistently. It’s a safer bet, if not one that will deliver you stunning upside. This is for the more cautious gold investor.

Just like AngloGold, Kinross has been enjoying dramatic improvements in profit margins and cash flow thanks to the surge in gold prices–and this trend appears set to continue with the gold outlook remaining decidedly bullish. With all factors remaining constant, Kinross should be able to realize high single-digit EPS expansion in the current year.

Kirkland Lake Gold (NYSE:KL, TSX:KL)

is another one of Toronto’s finest gold miners. Though not quite as established as Barrick or Newmont, Kirkland is no stranger to striking headline grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry. The two companies have agreed to split the cost 50/50 over five years with each company investing $15 million every year into joint projects between both companies for exploration purposes only – at this point it seems like a win.

According to a joint press release in late 2020, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

After years of anti-gold rhetoric, one of the world’s most famous billionaire investors, Warren Buffett, has finally changed his stance on precious metals. In an announcement last year, Berkshire Hathaway said it was buying half a billion dollars’ worth of

Barrick Gold (NYSE:GOLD

; TSX:ABX

)

shares at a time when gold nearing its all-time highs This change in attitude towards gold by Buffett could affect how many other investors view it as an investment opportunity. Buffett’s investment in Barrick and change in tune on the gold front shouldn’t come as much of a surprise, however. As the future of the economy looks more-and-more uncertain, and the Federal Reserve continues to print money at a record rate, solid gold miners like Barrick have drawn a lot of attention for investors, especially considering the healthy 0.96% dividend per share that comes with the purchase.

Barrick is a top-tier gold miner with a global footprint. The Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d’Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. Though Newmont surpassed Barrick as the largest gold miner when it acquired Goldcorp, Barrick is still a force to be reckoned with.

Newmont

(

NYSE:NEM, TSX:NGT

) is a global mining company with operations in the United States, Australia, Peru and Ghana. They are one of the world’s largest gold producers and they have been operating for over 100 years. Newmont has its headquarters in Greenwood Village, Colorado (a suburb of Denver) where it was founded in 1921 by William Boyce Thompson.

Following its

acquisition

of Goldcorp, Newmont became the single biggest gold company in the world, but that doesn’t mean it doesn’t still have some room to run. As far as management goes Newmont doesn’t have any weak spots. Its board includes veteran mining executives like Bob McAdam of Barrick Gold Corp., Tom Albanese of Rio Tinto plc (NYSE:RIO), Joe Jimenez of Dow Chemical Company (DOW) and John Wiebe of Kinross Gold Corporation (KGC).

Yamana Gold

(NYSE:AUY, TSX:YRI), one of the world’s top gold companies, has seen its share price hit especially hard this year. Yamana had been on an upward trend since February when it announced that three mines were closing and more than 1 billion dollars would be cut from their budgets as part of ongoing austerity measures due to slumping prices for precious metals and weak demand for mining equipment across the industry.

Earlier this year, Yamana

signed a deal

with industry giants Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ

CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for gold, silver, copper, zinc and other base metals will retain their value in future as currently expected, or could continue to increase due to global demand and political reasons; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can continue to achieve drilling and mining success for gold and other metals; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; that Starr Peak will be able to carry out its business plans, including future exploration and drilling programs; that the preliminary drilling results will be confirmed as further exploration continues; that the lab results from Starr Peak’s initial exploration program will confirm evidence of a significant VMS deposit; that Starr Peak’s exploration results will gain the attention and interest of larger mining companies and investors; that Starr Peak’s exploration results will continue to show promising results justifying ongoing exploration and possible development efforts. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold and other base metal prices as expected; that demand for base metals may not continue to increase; that the Company may not complete all its announced mineral property purchases for various reasons; that the Company may not be able to finance its intended drilling and exploration programs; Starr Peak may not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information or testing; that the lab results from Starr Peak’s initial exploration program may not support evidence of a significant VMS deposit; that the preliminary drilling results may not be confirmed during further exploration efforts; that Starr Peak will fail to gain the attention and interest of other mining companies and investors; that Starr Peak’s exploration results may fail to find additional promising results justifying ongoing exploration and/or development efforts; and despite promising results from drilling and exploration, there may be no commercially viable minerals or ore on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Starr Peak and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.