Teck Resources Limited

TECK

, a Zacks Rank #1 (Strong Buy), has surged nearly 600% since the March 2020 bottom after dropping to roughly $5/share during the pandemic-induced market plunge. A very low percentage of companies complete the journey from penny stock to mid-double digits. These companies all experience remarkable growth in terms of both revenue and earnings, and TECK is no exception. The stock is currently hitting decade-long highs even as the general market continues in correction mode.

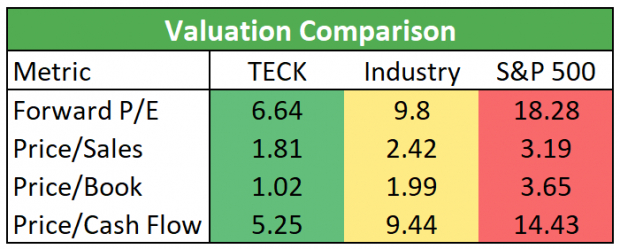

Teck Resources boasts the highest Zacks Momentum Style Score of ‘A’. The company is part of the Zacks Mining – Miscellaneous industry group which ranks in the top 34% out of more than 250 Zacks Ranked Industries. Despite TECK’s impressive run, the stock is still relatively undervalued irrespective of the metric used:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s future price appreciation is due to its industry grouping. By targeting stocks contained within the top industry groups, we provide a constant ‘tailwind’ to our investing success.

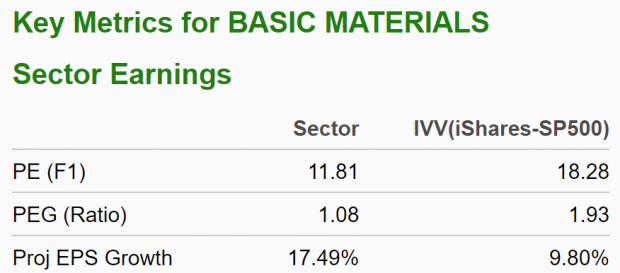

The Mining – Miscellaneous industry group is a component of the Zacks Basic Materials sector, which ranks in the top 32% of all 16 Zacks Ranked Sectors. This sector is also displaying some favorable characteristics:

Image Source: Zacks Investment Research

Company Description

Teck Resources is engaged in the exploration, development, and production of natural resources in Asia, Europe, and North America. TECK’s primary products include steelmaking coal as well as copper and zinc concentrates. The company also produces gold, silver, germanium, and cadmium, as well as chemicals and fertilizers. TECK Resources was founded in 1913 and is headquartered in Vancouver, Canada.

Earnings Trends and Future Estimates

TECK has exceeded earnings estimates in six of the past seven quarters. The lone miss came in Q4 of last year when the metals producer posted EPS of $2.02, barely missing the $2.04 estimate by -0.98%. Investors have been able to look past the slight miss as the stock has continued to outperform the market. TECK has delivered a trailing four-quarter average earnings surprise of +12.98%.

Earnings estimates for the current quarter have seen positive changes as of late. The Q1 consensus estimate has been revised upward by 55.83% to $1.87 in just the past 60 days. If the company is able to achieve this, it would translate to growth of 289.58% relative to the same quarter last year.

Analysts have also increased their full-year EPS estimates for TECK by 29.91% in the past two months. The 2022 Zacks Consensus EPS Estimate now stands at $5.56, translating to potential growth of 23.01% relative to last year. Sales are seen rising 12.15% to $12.05 billion.

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to identify companies that have recently witnessed positive earnings estimate revision activity. The technique has proven to be quite useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

TECK has a substantial +26.91% Earnings ESP for the first quarter. Another earnings beat may be in the cards when the company reports its Q1 results on April 27

th

.

Let’s Get Technical

Shares of TECK are up over 80% in the past year. The price ascent has not slowed down in 2022, as the stock has risen more than 33% this year.

Image Source: StockCharts.com

Notice how the 50, 100, and 200-day moving averages are all sloping upward as evidenced by the blue, red, and green lines, respectively. The stock does appear a bit extended in the short-term, and bullish investors may consider waiting for a slight pullback before initiating a new purchase.

However, empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. And as we know, Teck Resources has seen a steady batch of positive revisions as of late. As long as this trend remains intact (and TECK continues to post earnings beats), the stock should continue its bullish move this year.

Bottom Line

Higher prices of the company’s principal products along with a solid pipeline of projects have contributed to TECK’s bullish run. Historically viewed as a hedge against inflation and currency devaluation, precious metals can be a great portfolio diversifier – particularly during times when most equities are falling. Gold in particular is perceived as a long-term store of value.

One of the best ways to target these metals from an investment perspective is to own the stocks of a mining company such as TECK. While the past few months have been treacherous for passive equity investors, gold and silver have made a stealthy move higher. Both gold (+4.79%) and silver (+7.86%) have outperformed the S&P 500 (-7.79%) year-to-date.

Buoyed by a leading industry group and sector combination, it’s not difficult to see why TECK is a compelling investment. Robust sales and earnings growth along with a strong technical trend certainly warrant a closer look. Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, be sure to put TECK on your shortlist.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report