BHP Group

BHP

released production details for the quarter ended Sep 30, 2021 and affirmed its previously announced production and cost guidance for fiscal 2022. Total iron ore production dipped 4% to 63 Mt (million tons) in the quarter due to higher planned maintenance and temporary rail labor shortages related to COVID-19 related border restrictions. The company reported declines in quarterly output for copper, metallurgical coal and nickel, while petroleum and energy coal were up year over year.

Last week, the company’s peer,

Rio Tinto plc

RIO

, reported a 4% drop in iron ore production to 83.3 Mt in the July-September quarter citing heritage management, brownfield mine replacement tie-ins and project completion delays. The company now expects to ship iron ore between 320 Mt and 325 Mt this year, down from the previous range of 325 Mt to 340 Mt as a tighter labor market in Western Australia led to delay in the completion of a new greenfield mine at Gudai-Darri and the Robe Valley brownfield mine replacement project.

BHP’s Production Highlights

In the third quarter, BHP’s iron ore production was primarily impacted by a 6% decline in production at Western Australia Iron Ore (“WAIO”). This was due to planned maintenance during the quarter, including major maintenance of car dumper one and the train load out at Jimblebar, and temporary rail labor shortages related to COVID-19 related border restrictions. This was partially offset by strong mine performance and optimization of Yandi’s end-of-life ramp-down.

Total petroleum production was 27.5 MMboe (million barrels of oil equivalent) for the period under review, up 3% year over year driven by higher volumes due to increased production from Ruby and higher seasonal gas demand at Bass Strait. Copper production was down 9% year over year to 377 kt in the quarter due to lower volumes at Olympic Dam on account of the commencement of the planned smelter maintenance campaign, which was delayed by one month owing to COVID-19 related border restrictions.

Metallurgical coal production fell 9% to 9 Mt due to planned maintenance. Energy coal production was up 17% to 4 Mt on increased stripping enabled by continued improvement in underlying truck productivity. Nickel production slumped 20% year over year to 17.8 kt due to planned maintenance across the supply chain.

Maintains Fiscal 2022 Production & Cost Guidance

In fiscal 2022, BHP expects to produce between 249 Mt and 259 Mt of iron ore compared with 253.5 Mt produced in fiscal 2021 as WAIO continues to focus on incremental volume growth through productivity improvements. The company’s petroleum production guidance for fiscal 2022 is expected to be 99-106 MMboe. BHP anticipates copper production between 1,590 kt and 1,760 kt in fiscal 2022. Production guidance of Metallurgical coal for fiscal 2022 is at 39-44 Mt, while the same for energy coal is at 13-15 Mt. Nickel production for fiscal 2022 is anticipated between 85 kt and 95 kt.

For fiscal 2022, WAIO unit cost guidance is projected at $17.50-$18.50 per ton. Escondida unit cost is estimated to be $1.20 to $1.40 per pound. The Queensland Coal unit cost for fiscal 2022 is expected to be $80-$90 per ton. Conventional Petroleum unit cost is projected at $11-$12 per boe for fiscal 2022. NSWEC unit costs are expected between $62 per ton and $70 per ton.

Development Projects on Track

As of Sep 30, 2021, BHP had four major projects under development in petroleum (Mad Dog Phase 2 and Shenzi North development) and potash (Jansen mine shafts and Jansen Stage 1). This calls for a combined budget of $11.2 billion over the life of the projects.

The company also stated that the previously announced agreement to pursue a proposed merger of its Petroleum business with Woodside, which would create a global top 10 independent energy company, is progressing according to the plan. Following receipt of all approvals, the merger is expected to be completed in the second quarter of the 2022 calendar year. The company’s intention to unify its dual listed company structure is expected to happen in the March 2022 quarter.

BHP’s efforts to make operations more efficient through smart technology adoption across the entire value chain will continue to aid in reducing costs, thereby boosting margins. Focus on lowering debt will fuel growth. Iron ore prices have been down this year due to weak demand in China on account of its intensified curbs on steel production and slowdown across its property sector. This remains a headwind for the company.

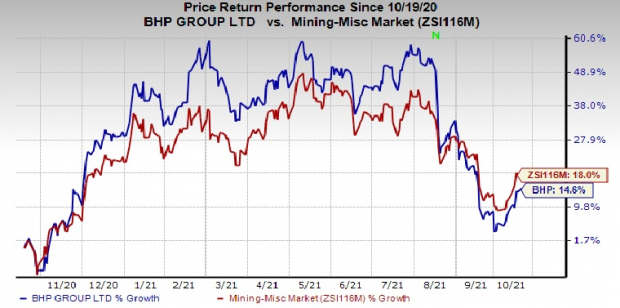

Price Performance

Image Source: Zacks Investment Research

Over the last year, BHP’s shares have gained 14.6%, compared with the

industry

’s rally of 18%.

Zacks Rank & Stocks to Consider

BHP currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

and

Methanex Corporation

MEOH

. Both of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Nucor has an estimated earnings growth rate of 537.4 % for the ongoing year. In a year’s time, the company’s shares have appreciated 109%.

Methanex has a projected earnings growth rate of 409.3% for 2021. The company’s shares have gained 77% in a year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report