Shares of

BHP Group

BHP

gained 2% on Dec 21 following news that the company has entered into a Scheme Implementation Deed with OZ Minerals Limited to acquire the latter for a cash price of A$28.25 ($18.67) per share. This brings the mining giant a step closer to closing in on its biggest acquisition in the decade. This takeover would significantly enhance its exposure to future-facing commodities while adding attractive synergies.

The execution of the Scheme Implementation Deed follows the completion of a four-week exclusive due diligence period. OZ Mineral’s Board has unanimously recommended that the company’s shareholders vote in favor of the acquisition. A meeting of OZ Mineral’s shareholders is expected to be held in late March or early April 2023.

BHP made its first offer to acquire OZ Minerals Limited for AUD25 per share on Aug 7, 2022. Its Board had rejected the offer citing that it undervalues the company and was not in the best interests of shareholders. On Nov 18, BHP raised its offer price to A$28.25 per share which represented a 49.3% premium to OZ Minerals’ closing price on Aug 5, 2022 — the last trading day prior to BHP’s initial proposal.

OZ Minerals has a high-quality portfolio of copper and nickel assets, located in a Tier-1 mining jurisdiction with long mine lives and first-quartile cost positioning. It owns and operates Prominent Hill, a high-quality copper-gold mine, and Carrapateena, an iron-oxide-copper–gold underground mine, both located in the highly prospective Gawler Craton in South Australia.

The Carajás East Hub located in Brazil is also part of its portfolio. This hub comprises the Pedra Branca underground mine, which is the beginning of a potential series of small, high-quality copper-gold mines with ore being processed at existing facilities at the nearby, now-depleted Antas mine.

This deal, which values OZ Minerals at AUD9.6 billion ($6.4 billion), would further BHP’s efforts to boost its supplies of copper and nickel, and enable its strategy to capitalize on the surging demand for electric vehicles and renewable energy. The combination will also help BHP unlock potential operational synergies in South Australia as OZ Minerals’ Carrapateena and Prominent Hill mines are in proximity to the Olympic Dam and Oak Dam development resources. OZ Mineral’s West Musgrave project will add a large greenfield nickel option to BHP’s Nickel West premier nickel sulfide resource position in Western Australia.

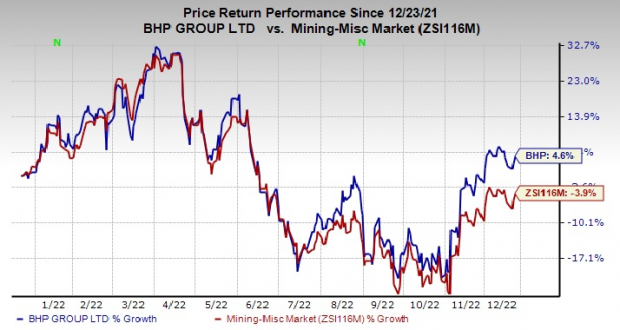

Price Performance

Image Source: Zacks Investment Research

BHP Group’s shares have gained 4.6% over the past year compared with the

industry

’s 3.9% decline.

Zacks Rank & Other Stocks to Consider

BHP currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Some other top-ranked stocks in the basic materials space are

Bunge Limited

BG

,

Sociedad Quimica y Minera de Chile S.A.

SQM

and

Reliance Steel

RS

. While BG and SQM currently sport a Zacks Rank of 1, RS holds a Zacks Rank #2 (Buy).

Bunge Limited has an expected earnings growth rate of 7.4% for the current year. Its earnings estimates for 2022 are pegged at $13.89 per share. BG’s earnings estimates have been revised 9.3% upward in the past 60 days. It has a trailing four-quarter average surprise of 18.7%. The stock has gained 8.4% in a year.

The Zacks Consensus Estimate for Sociedad’s 2022 earnings per share is $13.13, suggesting 540.5% growth from the year-ago reported figure. Earnings estimates have moved 1.5% north in the past 60 days. SQM has a trailing four-quarter earnings surprise of 37.4%, on average. Its shares have surged 72% in the past year.

The Zacks Consensus Estimate for Reliance Steel’s earnings is at $28.71 for the current year, indicating year-over-year growth rate of 29.8%. The consensus estimate for RS’ earnings for the current year has been revised 0.06% upward in the past 60 days. It has a trailing four-quarter average surprise of 13.6% on average. RS has gained 28% in a year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report