Barrick Gold Corporation

GOLD

is scheduled to report

fourth-quarter 2021

results before the opening bell on Feb 16. The company’s results are expected to reflect the benefits of sequentially higher gold and copper production and realized gold prices.

The gold mining giant surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 10.1%. It posted an earnings surprise of 4.4% in the last reported quarter.

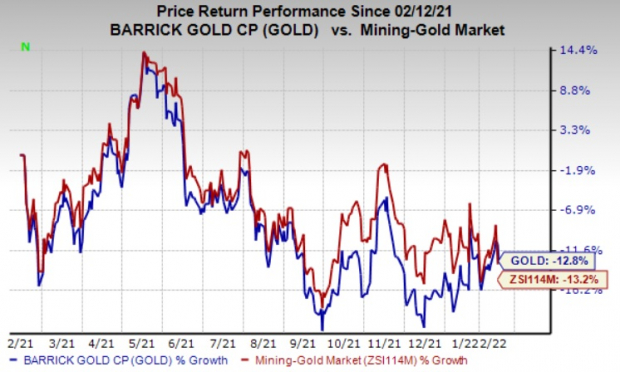

The stock is down 12.8% in the past year compared with the

industry

’s 13.2% decline.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Barrick this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP:

Earnings ESP for Barrick is +0.85%. The Zacks Consensus Estimate for the fourth quarter is currently pegged at 30 cents. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Barrick currently carries a Zacks Rank #3.

What Do the Estimates Say?

Last month, Barrick announced preliminary results for the fourth quarter. It reported preliminary fourth-quarter production of 1.20 million ounces of gold and 126 million pounds of copper. It also reported preliminary fourth-quarter sales of 1.23 million ounces of gold and 113 million pounds of copper. The average market price for gold in the quarter was $1,795 per ounce, while the average market price for copper was $4.40 per pound.

All-in sustaining costs (AISC) per ounce for gold are projected to be 4-6% lower than third-quarter levels. Gold cost of sales per ounce is forecast to be 3-5% lower sequentially.

The Zacks Consensus Estimate for fourth-quarter consolidated revenues for Barrick is currently pegged at $3,424 million, which calls for a rise of around 4.4% year over year.

Some Factors to Watch For

Sequentially higher gold and copper production is likely have aided the company’s performance in the quarter to be reported. The preliminary gold production in the fourth quarter was 10% higher than the previous quarter’s level of 1.09 million ounces, driven by strong performance from Carlin and Cortez mines. Preliminary copper production was also higher sequentially in the fourth quarter, helped by increased throughput levels at Lumwana.

The company’s fourth-quarter results are also expected to reflect sequentially higher realized gold prices. Gold suffered a roughly 3.5% loss in value in 2021 largely due to vaccine rollouts, optimism over economic recovery, lower investment demand and consistent dollar strength.

However, the yellow metal rallied roughly 4% in the fourth quarter amid the surge in the Omicron variant across the globe and worries over inflation. Notably, the average market price for gold for the fourth quarter, as reported by the company, reflects an increase from $1,771 per ounce it had recorded in the third quarter. Lower AISC for gold is also expected to have contributed to its fourth-quarter performance.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these too have the right combination of elements to post an earnings beat this quarter:

Huntsman Corporation

HUN

, scheduled to release earnings on Feb 15, has an Earnings ESP of +0.09% and carries a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Huntsman’s fourth-quarter earnings has been revised 4.1% upward over the past 60 days. The consensus estimate for HUN’s earnings for the quarter is currently pegged at 88 cents.

CF Industries Holdings, Inc.

CF

, slated to release earnings on Feb 15, has an Earnings ESP of +7.88% and carries a Zacks Rank #3.

The consensus estimate for CF Industries’ fourth-quarter earnings has been revised 28.2% upward over the past 60 days. The Zacks Consensus Estimate for CF’s earnings for the quarter stands at $3.41.

Nutrien Ltd.

NTR

, scheduled to release earnings on Feb 16, has an Earnings ESP of +2.61% and sports a Zacks Rank #1.

The Zacks Consensus Estimate for Nutrien’s fourth-quarter earnings has been revised 0.9% upward over the past 60 days. The consensus estimate for NTR’s earnings for the quarter is currently pegged at $2.30.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report