B2Gold Corp

BTG

reported adjusted earnings per share of 12 cents for third-quarter 2021, missing the Zacks Consensus Estimate of 13 cents. The bottom line was down 20%, year over year.

Including one-time items, the company reported earnings of 12 cents per share compared with the prior-year quarter’s 25 cents per share.

B2Gold generated revenues of $511 million in third-quarter 2021, reflecting year-over-year growth of 5%. This upside resulted from the 13% increase in gold ounces sold, partly offset by a 8% decrease in the average realized gold price. The top-line figure missed the Zacks Consensus Estimate of $525 million.

During the September-end quarter, B2Gold recorded consolidated gold production of 295,723 ounces, up 19% year over year on solid performance across three of its operating mines. During the reported quarter, the company increased throughput at the Fekola mill and completed the significant waste stripping campaigns at both Fekola and Otjikoto mines. In fact, the Fekola and Otjikoto mines achieved record quarterly gold production in third-quarter 2021. The total gold production (including 14,538 ounces of attributable production from Calibre) in the quarter was 310,261 ounces, up 18% from the prior-year quarter.

The company reported the consolidated cash operating costs of $418 per ounce in the reported quarter, up 1.7%, year over year. The higher-than-budgeted gold production mitigated the impact of the higher-than-anticipated realized fuel prices, processing costs and stronger local currencies. The consolidated all-in sustaining costs (AISC) of $777 per ounce came in 1.4% higher than the prior-year quarter.

During the July-September quarter, the total cost of sales was $276 million, up 28% year over year. The gross profit declined 13.4%, year over year, to $235 million. The gross margin contracted to 46% in the reported quarter from the prior-year quarter’s 56%.

The operating income in the reported quarter was $218 million, reflecting a year-over-year slump of 49%. The operating margin was 43% compared with the year-ago quarter’s 88%.

Financial Position

B2Gold’s cash and cash equivalents were $547 million at the end of the third quarter compared with the $480 million witnessed at the end of 2020. The company generated $320 million cash from operating activities in the third quarter compared with the prior-year quarter’s $300 million. The company’s long-term debt was $55 million as of Sep 30, 2021, down from $76 million as of Dec 31, 2020.

Outlook

B2Gold has increased the current-year total gold production guidance to 1,015,000-1,055,000 ounces, up from the prior guided range of 970,000 ounces to 1,030,000 ounces. Total cash operating costs are projected between $500 per ounce and $540 per ounce. Total All-in sustaining cost (AISC) is anticipated to be at the upper end of the range of $870 to$910 per ounce.

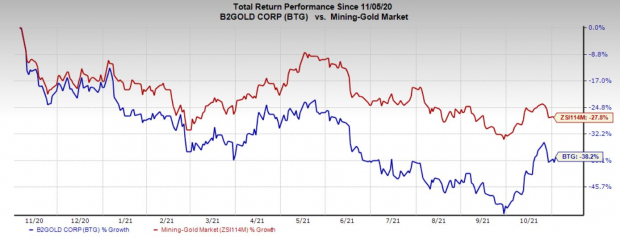

Share Price Performance

Over the past year, B2Gold has depreciated 38.2% compared with the

industry

’s loss of 27.8%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Olin Corporation

OLN

,

Nucor Corporation

NUE

and

Bunge Limited

BG

. All of these stocks currently flaunt a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 740% for the current fiscal year. The company’s shares have surged a whopping 229% in the past year.

Nucor has a projected earnings growth rate of around 583% for 2021. The company’s shares have soared 128% in a year’s time.

Bunge has an expected earnings growth rate of around 26% for the current year. The company’s shares have appreciated 60% in the past year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report