B2Gold Corp.

BTG

entered into a Scheme Implementation Agreement with Oklo Resources Limited to acquire 100% of the fully-paid ordinary shares of Oklo for A$91.3 million ($65 million) or 17.25 cents per share (12 cents). This includes a cash payment of approximately A$27.4 million ($19.6 million).

Per the agreement, each Oklo shareholder will receive 0.0206 of B2Gold’s share and A$0.0525 (3 cents) in cash. Additionally, B2Gold expects to issue up to 10,754,284 shares to Oklo stakeholders upon execution of the agreement.

The latest deal is expected to provide B2Gold with an additional landholding capacity of 1,405 km2 with potential greenstone belts in Mali, West Africa, including Oklo’s leading Dandoko Project.

The Oklo properties are strategically located in Senegal-Mali Shear Zone, within 25 kilometers from the Fekola Mine and the Anaconda area. B2Gold is currently conducting approximately 225,000 meters of drilling in the Fekola and Anaconda area.

On Dec 9, 2021, B2Gold entered into an agreement with Mali’s government related to issuing a permit for the Menankoto exploration near the Fekola mine. In exchange for this permit, the company stated that it would withdraw the arbitration proceedings that its Malian subsidiary, Menankoto SARL, started in June against the Republic of Mali over the denial of an extension for the Menankoto exploration permit. The government agrees to grant a new exploration permit covering the same perimeter as the Menankoto permit to a new Malian subsidiary of B2Gold. On Feb 2, B2Gold’s Malian subsidiary received the new Menankoto Permit from the Malian government in compliance with the procedures and requirements per the Malian 2019 Mining Code that provides a permit for an initial period of three years, which is renewable for two additional three years. Following this, B2Gold plans to expand the scope of its exploration activities in the Anaconda Area (comprised of the Menankoto Permit and the Bantako North Permit) to build on the successful ongoing exploration programs.

This month, B2Gold reported first-quarter 2022 adjusted earnings per share (EPS) of 6 cents, beating the Zacks Consensus Estimate of 5 cents. The bottom line fell 33% year over year. The company generated revenues of $366 million, up 1% year over year. The top line also surpassed the Zacks Consensus Estimate of $343 million.

In first-quarter’s earnings call, B2Gold reaffirms financial guidance for the current year. It expects current-year total gold production guidance between 990,000 ounces and 1,050,000 ounces. Total consolidated cash operating costs are projected between $620 per ounce and $660 per ounce. Total consolidated All-in sustaining cost (AISC) is anticipated to be between $1,010 and $1,050 per ounce.

B2Gold intends to pursue additional internal growth through further exploration, development and expansion of the existing projects, following a very successful year for exploration in 2021. The company is planning for heavy exploration this year as well.

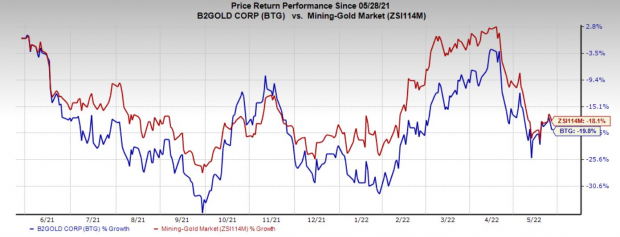

Price Performance

In the past year, B2Gold’s shares have depreciated 19.8% compared with the

industry

’s loss of 18.1%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

B2Gold currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are

Allegheny Technologies Inc.

ATI

,

Nutrien Ltd.

NTR

and

Albemarle Corporation

ALB

.

Allegheny has a projected earnings growth rate of 869.2% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 27.3% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI has gained around 15.2% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has a projected earnings growth rate of 161.9% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 26.9% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 5.8%. NTR has gained 59.5% in a year. The company flaunts a Zacks Rank #1.

Albemarle has a projected earnings growth rate of 175% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 85.8% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 22.5%. ALB has gained 49.8% in a year. The company flaunts a Zacks Rank #1.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report