B2Gold Corp

BTG

recently completed the sale of its stakes in the Kiaka and Toega gold projects in Burkina Faso to West African Resources Limited (“WAF”). The company signed this agreement on Oct 25.

B2Gold sold its 81% ownership in the Kiaka gold project for cash proceeds of $22.5 million in addition to $450,000 cash payment already received on the completion of the Kiaka deal on Oct 25. It also received 22,190,508 common shares of WAF and 2.7% net smelter return (NSR) royalty interest on the first 2.5 million ounces of gold production at the Kiaka Project and subsequently 0.45% NSR royalty interest on the next gold production of 1.5 million ounces.

B2Gold will receive an additional $45 million on either the commencement of construction in the Kiaka Project (provided it is not earlier than Apr 25, 2022) or completion of a positive feasibility study at the project or on Oct 25, 2022 – whichever is earlier. This payment will be made in cash or WAF shares.

B2Gold divested 90% shareholding interest in the Toega gold project for a cash payment of $9 million, in addition to the $9 million already received during the closing of the agreement. It also got 2.7% NSR royalty interest on the first gold production of 1.5 million ounces at the Toega Project until the royalty payments total $22.5 million and represent 0.45% NSR royalty interest.

Management stated that WAF is a strategic fit for these two projects as it is a reputed operator in Burkina Faso. Its local infrastructure and operating experience will ramp up work on the Kiaka Project. B2Gold will continue to gain from the future development of the projects.

B2Gold is meanwhile focused on achieving solid operational and financial performance from its existing operating mines and expansion of the Fekola Mine throughput and annual gold production.

In the last reported quarter, the company witnessed record quarterly gold production from the Fekola and Otjikoto mine on completion of the significant waste stripping campaigns at both the mines for the development of Phase 5 and Phase 6 of the Fekola Pit, and Phase 3 of the Wolfshag and Otjikoto pits.

B2Gold expects Fekola mine to produce between 560,000 ounces and 570,000 ounces of gold in 2021, while Otjikoto is expected to produce between 190,000 and 200,000 ounces of gold in the current year. Its Masbate Mine now anticipates production between 215,000 and 225,000 ounces of gold in the current year. Considering these factors, the company increased the current-year total gold production guidance to 1,015,000-1,055,000 ounces from the prior range of 970,000-1,030,000 ounces. It produced 1,040,737 ounces of gold in 2020.

B2Gold will gain from its focus on mine expansions and exploration activities. It has planned heavy exploration this year with an approximately $66-million budget, including a record $25 million allocated to high-quality targets for the company’s ongoing grassroot exploration programs.

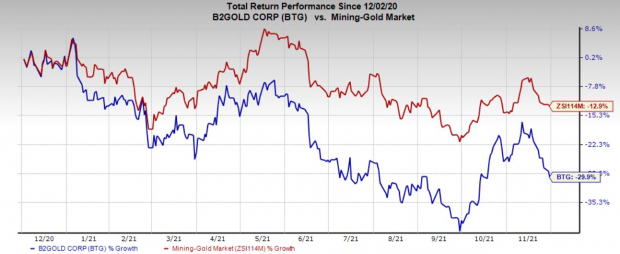

Price Performance

The stock has depreciated 29.9% in the past year compared with the

industry

’s decline of 12.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Olin Corporation

OLN

, Bunge Limited

BG

and Nucor Corporation

NUE

. While Olin and Bunge flaunt a Zacks Rank #1 (Strong Buy), Nucor carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Olin’s third-quarter 2021 adjusted earnings beat the Zacks Consensus Estimate, while revenues missed the same. It has an expected earnings growth rate of around 740% for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has been revised 20.5% upward in the past 60 days.

Olin’s shares have surged 229% in the past year. The company has a long-term earnings growth of 56%.

Bunge’s third-quarter 2021 earnings and sales beat the respective Zacks Consensus Estimate. It has a trailing four-quarter earnings surprise of 105.7%, on average. The company has an estimated earnings growth rate of around 45% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 36%.

Bunge’s shares have appreciated 60% in the past year. It has a long-term earnings growth of 12.6%.

Nucor’s third-quarter adjusted earnings missed the Zacks Consensus Estimate, while sales beat the same. It has a trailing four-quarter earnings surprise of 2.74%, on average.

Nucor has a projected earnings growth rate of around 583% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 18.1% in the past 60 days. The company’s shares have soared 128% in a year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report