Apogee Enterprises, Inc.

APOG

reported adjusted earnings per share (EPS) of $1.07 for third-quarter fiscal 2023 (ended Nov 26, 2022), surpassing the Zacks Consensus Estimate of 98 cents. The bottom line surged 69.8% from the prior-year quarter’s 63 cents per share.

Including one-time items, EPS in the quarter under review was $1.07 compared with EPS of 44 cents reported in the prior-year quarter.

Apogee generated revenues of $368 million in the quarter under review, up 10.2% from the year-ago quarter. The top line beat the Zacks Consensus Estimate of $355 million.

Operational Update

Cost of sales in the fiscal third quarter moved up 4.5% from the prior-year quarter to $281 million in the quarter under review. The gross profit increased 33.8% from the prior-year quarter to $87 million. The gross margin expanded to 23.5% in the reported quarter from the prior-year quarter’s 19.4%.

Selling, general and administrative (SG&A) expenses moved up 10.4% from the prior-year quarter to approximately $52 million. The adjusted operating income rose 64.5% from the year-earlier quarter’s actuals to $35 million.

Segment Performance

In the fiscal third quarter, revenues in the Architectural Framing Systems segment climbed around 17% from the prior-year quarter’s actuals to $165 million. Revenue growth was primarily driven by inflation-related pricing. The segment’s adjusted operating profit was $22 million compared with the year-ago quarter’s $12 million. The operating income of the segment was positively impacted by improved pricing and mix, which helped more than offset the negative impacts of inflation.

Revenues in the Architectural Glass segment increased 10% from the prior-year quarter’s actuals to $81.5 million. The segment reported an adjusted operating income of $7.5 million, up from $2.2 million in the third quarter of fiscal 2022.

Revenues in the Architectural Services segment fell 3% from the prior-year quarter’s actuals to $102 million. The segment’s operating profit declined 23% from the prior-year quarter to $6 million. The segment’s results reflect costs related to investments to support future growth and lower profitability on legacy Sotawall projects.

Revenues in the Large-Scale Optical Technologies segment decreased 3% from the prior-year quarter’s reported number to $27 million. The segment posted an operating profit of $7.1 million in the fiscal third quarter compared with the prior-year quarter’s $6 million.

Backlog

The Architectural Services segment’s backlog was $741 million at the end of the fiscal third quarter compared with $785 million at the end of the second quarter of fiscal 2023. Backlog in the Architectural Framing segment amounted to $246 million, down from $286 million at the end of second-quarter fiscal 2023.

Financial Position

Apogee had cash and cash equivalents of $21.7 million at the end of third-quarter fiscal 2023 compared with $37.6 million at the end of third-quarter fiscal 2022. Cash utilized in operating activities was $51.1 million in the nine months ended Nov 26 compared with the prior-year period’s cash inflow of $86.3 million.

Long-term debt was $203.7 million at the end of third-quarter fiscal 2023 compared with $162 million at the end of fiscal 2022.

Apogee returned $88.7 million of cash to its shareholders so far in fiscal 2023 through dividend payments and share repurchases.

Fiscal 2023 Guidance

Apogee expects fiscal 2023 adjusted EPS between $3.90 and $4.05, narrower than the prior stated $3.75-$4.05. APOG anticipates revenue growth of 10% for the full year to be primarily driven by growth of Architectural Framing Systems. Management projects capital expenditure of $40 million for fiscal 2023.

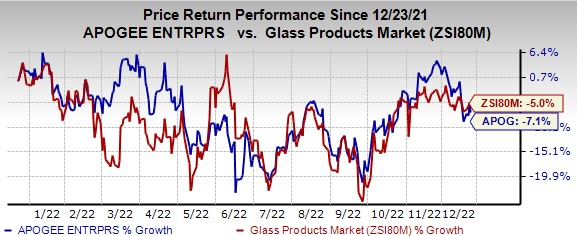

Price Performance

Shares of Apogee have lost 7.1% in the past year compared to the

industry

‘s decline of 5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Apogee currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are

KnowBe4

KNBE

,

Hudson Technologies

HDSN

, and

Hubbell

HUBB

. KNBE and HDSN flaunt a Zacks Rank #1 (Strong Buy) at present, while HUBB has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

KnowBe4’s earnings surprise in the last four quarters was 216.7%, on average. The Zacks Consensus Estimate for the company’s 2022 earnings is pegged at 24 cents per share, indicating a year-over-year increase of 118.2%. The consensus estimate has moved up 20% in the past 60 days. KNBE’s shares have gained 6.7% in a year.

The Zacks Consensus Estimate for Hudson’s current-year EPS is pegged at $2.16, suggesting an increase of 213% from that reported in the last year. The consensus estimate has moved up 20.7% in the past 60 days. It has a trailing four-quarter average earnings surprise of 297%. HDSN’s shares have surged 131.7% in the past year.

Hubbell has an average trailing four-quarter earnings surprise of 10.6%. The Zacks Consensus Estimate for HUBB’s current-year earnings is pegged at $10.41 per share. This indicates a 29.3% increase from the prior year’s reported figure. The consensus estimate has been revised 4.8% north in the past 60 days. HUBB’s shares have gained 14.8% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report