Apogee Enterprises, Inc.

APOG

reported first-quarter fiscal 2022 (ended May 29, 2021) adjusted earnings per share of 42 cents. The bottom line surged 180% year over year.

Including one-time items, the company delivered earnings per share of 42 cents compared with the year-ago quarter’s 11 cents.

Apogee generated revenues of $326 million during the quarter, up 13% year over year, with solid growth witnessed across each of the segments. The company’s business strongly recovered from the pandemic-induced losses witnessed in the prior-year quarter.

Operational Update

Cost of sales in the fiscal first quarter was up 13% year on year to $258 million. Gross profit improved 12% year over year to $68 million. Gross margin came in at 21% during the quarter, flat year over year.

Selling, general and administrative (SG&A) expenses declined 4% year over year to $52 million. Adjusted operating income surged 104% year over year to $16 million. Operating margin in the reported quarter was 4.9% compared with the prior-year quarter’s 2.7%.

Segment Performance

In the fiscal first quarter, revenues in the Architectural Framing Systems segment inched up 1% year over year to $152 million. The segment’s operating profit was $8 million compared with the year-ago quarter’s $7.3 million.

Revenues in the Architectural Glass Systems segment increased 8% year on year to $83 million, driven by higher volume and favorable sales mix. The segment reported an operating profit of $2 million as against the year-ago quarter’s operating loss of $494 million, driven by increased productivity in core glass operations, favorable sales mix, and higher volumes.

Revenues in the Architectural Services segment grew 19% year over year to $76 million, driven by increased volume from executing projects in backlog. The segment’s operating profit declined 15% year over year to $4.5 million.

Revenues in the Large-Scale Optical Technologies segment skyrocketed 284% year over year to $24 million. The segment reported an operating profit of $6 million during the fiscal first quarter as against the prior-year quarter’s operating loss of $3 million.

Backlog

The Architectural Services segment’s backlog decreased to $559 million from the $571 million witnessed at the end of fourth-quarter fiscal 2021. Backlog in the Architectural Framing segment amounted to $423 million, up from $411 million at the end of fourth-quarter fiscal 2021.

Financial Position

Apogee had cash and cash equivalents of $36.4 million at the end of first-quarter fiscal 2022 compared with $47 million at the end of fiscal 2021. Cash generated from operating activities came in at $6.9 million in the fiscal first quarter compared with the year-ago quarter’s $24 million.

Long-term debt was $162 million as of May 29, 2021, compared with $163 million as of Feb 27, 2021.

During the fiscal first quarter, Apogee repurchased $12.6 million shares and returned $5 million to shareholders through dividend payments.

Fiscal 2022 Guidance

Apogee now projects fiscal 2022 earnings per share to lie between $2.20 and $2.40 per share, up from the prior guidance of $2.10-$2.35 per share. Management expects capital expenditures of $45 million.

The company continues to aggressively manage costs and improve execution across the business. Apogee has initiated an effort to reduce its fixed cost base, which will lead to incremental cost savings in fiscal 2022.

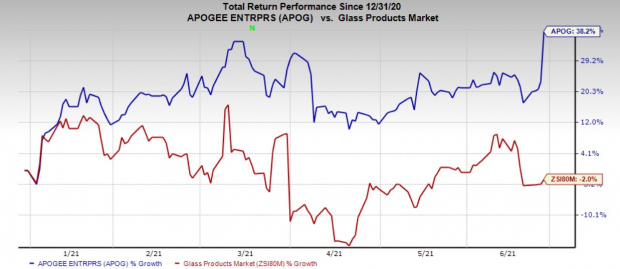

Price Performance

Shares of the company have gained 38.2% so far this year, as against the

industry

’s loss of 2%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Apogee currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are

Tennant Company

TNC

,

Encore Wire Corp.

WIRE

and

Arconic Corp.

ARNC

. All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Tennant has an anticipated earnings growth rate of 49.5% for 2021. The company’s shares have gained around 18%, year to date.

Encore Wire has an estimated earnings growth rate of 49.5% for the ongoing year. Year to date, the company’s shares have rallied nearly 36%.

Arconic has a projected earnings growth rate of 447% for the current year. The stock has appreciated around 21%, so far this year.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report