AngloGold Ashanti Limited

AU

recently announced that it has entered into a definitive agreement to acquire the remaining 80.5% stake in Corvus Gold in a deal valued at around $370 million. The acquisition will lead to a combination of assets in the world’s top-ranked mining jurisdiction and create a meaningful new production base for AngloGold. This move is in sync with the company’s strategy of growing its reserves, building low-cost production and generating sustainable returns.

AngloGold currently owns 19.5% interest in Corvus and has made an offer to acquire the remaining 80.5% of Corvus’ common shares at a price of C$4.10 in cash. This reflects a 26% premium to the closing price of Corvus’ shares on the Toronto Stock Exchange on Jul 12, 2021 — the day before AngloGold’s announcement that it has submitted a non-binding proposal to Corvus to up its stake.

Corvus owns North Bullfrog, Mother Lode and other exploration assets located in southern Nevada’s Beatty District. These are close to AngloGold’s exploration assets of Silicon, Transvaal and Rhyolite. With this buyout, the company strengthens its presence in the Beatty District, which has been one of the most productive mining districts in the state and a premier mining jurisdiction globally.

The acquisition establishes a relatively low-cost and low-risk production base from North Bullfrog in the near term. North Bullfrog is a well-advanced project and with first gold production expected in the next three to four years, it will mark AngloGold’s first production in North America. The mine will then provide an initial production area that will support the development and funding of the other Beatty District projects in the medium and longer term.

The proximity of these assets provides the opportunity to integrate infrastructure and processing facilities. It has the potential for significant synergies and will help realize the maximum potential from these assets. The company’s increased landholding across the Beatty District creates the scope for further exploration and upside potential. Shared sustainability goals, and opportunities to design projects incorporating renewable energy are other advantages.

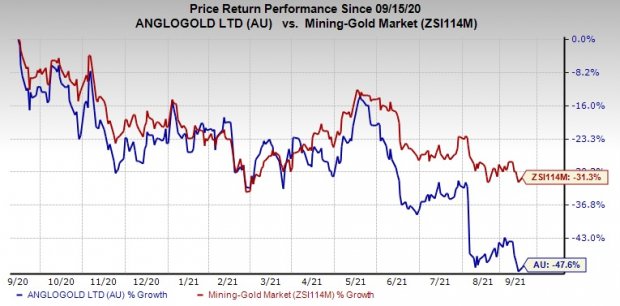

Price Performance

Image Source: Zacks Investment Research

AngloGold’s shares have lost 47.6% over the past year, compared with the

industr

y’s decline of 31.3%.

Zacks Rank & Stocks to Consider

AngloGold currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space include

Nucor Corporation

NUE

,

Veritiv Corporation

VRTV

and

Avient Corporation

AVNT

, all of them flaunting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Nucor has a projected earnings growth rate of 489% for fiscal 2021. The company’s shares have rallied around 127% in a year’s time.

Veritiv has a projected earnings growth rate of 215% for the current year. The company’s shares have soared a whopping 488% over the past year.

Avient has an expected earnings growth rate of around 75% for the current fiscal year. The company’s shares have appreciated 70% in the past year.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers

:

An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report