American Water Works Company

AWK

recently announced that its subsidiary, California American Water, has acquired the privately held East Pasadena Water Company. California American Water, through this acquisition, will be providing water services to 3,000 homes and businesses in the region.

The acquired assets are located near California American Water’s Los Angeles County operations center in Rosemead, CA, which will aid the company to extend its high-quality water services to new customers. The former East Pasadena Water customers will be eligible for new services such as conservation programs, MyWater, and other beneficial schemes offered by the company.

California American Water also makes essential investments to upgrade and maintain its water and wastewater facilities in the region to efficiently serve its expanding customer base. Despite the challenges posed by the outbreak of COVID-19 in 2020, the company invested $68 million in system upgrades and various improvement projects. The company is expected to continue system upgrades projects in 2021 and over the long term.

California American Water provides water and wastewater services to nearly 880,000 people. The company continues to expand operations through systematic acquisitions and has six acquisitions pending in its jurisdiction. The company makes strategic acquisitions to expand its operation and last year, in June, it acquired Hillview Water Company, which added nearly 1,500 new customers to its portfolio.

Acquisition is Essential in Fragmented Water Industry

Per the U.S. Environmental Protection Agency reports, more than 53,000 community water systems and 16,000 wastewater systems in the United States are providing water solutions to customers. This highly fragmented industry creates operational challenges as a major portion of existing water infrastructure in the United States is approaching toward the end of its effective service life. At times it becomes quite difficult for the small service providers to make costly investment to upgrade the infrastructure.

There lies the need of consolidation in the water space, as large water utilities with deep pockets can make the necessary investment and provide high-quality water and wastewater services to the customers. A substantial portion of potable water is wasted every day in the United States due to pipeline breaks. Timely repairs and investments can stop this wastage.

American Water is quite active in making acquisitions to expand operations and make the necessary investments to upgrade the acquired property. From the start of the year till Aug 1, the company expanded the customer base by 11,200 through organic means and acquisitions. Its pending acquisitions (as of Aug 1), when completed, will add another 86,900 customers. The company remains committed to expanding the business through inorganic and organic ways.

Likewise, another water utility,

Essential Utilities

WTRG

has not only expanded water and wastewater operations through acquisitions but also ventured into the natural gas distribution business through the acquisition of Peoples. Essential Utilities completed the acquisition of wastewater system of the Village of Bourbonnais on Sep 14, 2021, which added 6,500 customers. The company plans to invest $3 billion through 2023 to fortify water and natural gas operations as well as efficiently serve the expanding customer base.

Another water utility,

Global Water Resources, Inc

.

GWRS

is taking the inorganic route to expand operations in the United States and making investments to upgrade its infrastructure. It announced on Sep 22, 2021, that it has signed an agreement to acquire Las Quintas Serenas Water Company, which will add 1,100 water customers.

California Water Service

CWT

has decided to invest in the range of $270-$300 million in 2021 and expand operations through strategic acquisitions. In August, the company received regulatory approval to acquire the water and wastewater systems serving the Preserve at Millerton.

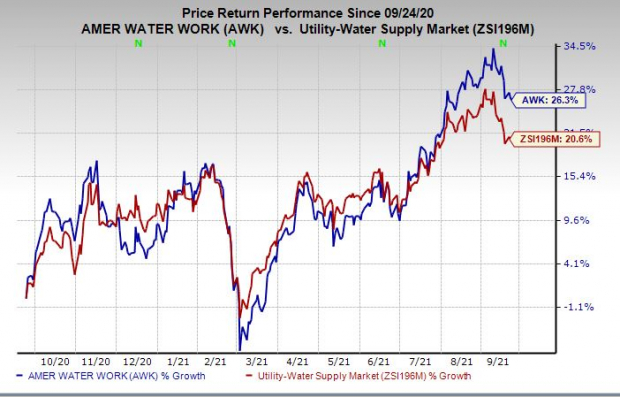

Price Performance

Shares of American Water have outperformed the

industry

in the past 12 months.

Image Source: Zacks Investment Research

Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report