Air Products and Chemicals, Inc.

APD

is slated to release

second-quarter fiscal 2022

results before the bell on May 5. The company is expected to have gained from cost-improvement programs and productivity initiatives in the quarter. However, the impacts of energy cost inflation are likely to get reflected in its performance.

The industrial gas giant missed the Zacks Consensus Estimate for earnings in two of the last four quarters, while registering a beat twice. It has a trailing four-quarter negative earnings surprise of around 1.1%, on average. The company reported an earnings surprise of around 0.8% in the last reported quarter.

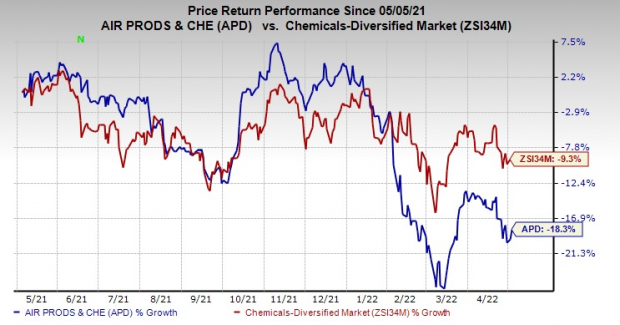

Shares of the company have declined 18.3% in the past year compared with a 9.3% fall of the

industry

.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What do the Estimates Say?

The Zacks Consensus Estimate for Air Products’ second-quarter revenues is currently pegged at $2,939 million, suggesting a rise of 17.5% year over year.

The Zacks Consensus Estimate for the Industrial Gases — Americas segment’s revenues is currently pegged at $1,266 million, calling for a rise of 19.9% year over year. The consensus mark for the Industrial Gases — Asia segment’s revenues is pegged at $759 million, which suggests 8.7% year-over-year growth.

The Zacks Consensus Estimate for the Industrial Gases — EMEA segment’s revenues is pegged at $704 million, indicating a 20.3% year-over-year increase.

Some Factors at Play

Air Products’ productivity actions, investments in high-return projects and benefits of acquisitions and new plants are expected to get reflected in the company’s results in the to-be-reported quarter. Healthy hydrogen and merchant demand are likely to have supported volumes.

The company is boosting productivity to improve its cost structure. It is seeing the positive impacts of its productivity actions. Benefits from additional productivity and cost improvement programs are likely to have supported margins in the fiscal second quarter. It is also likely to have gained from higher pricing.

However, it is likely to have been impacted by the energy cost inflation in the second quarter. The company’s results are likely to reflect higher power and fuel costs in the EMEA segment.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Air Products this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP:

Earnings ESP for Air Products is -0.06%. The Zacks Consensus Estimate for earnings for the fiscal second quarter is currently pegged at $2.35. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Air Products currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider, as our model shows these have the right combination of elements to post an earnings beat this quarter:

Olympic Steel, Inc.

ZEUS

, scheduled to release earnings on May 5, has an Earnings ESP of +6.64% and sports a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Olympic Steel’s first-quarter earnings has been revised 7.1% upward in the past 60 days. The consensus estimate for ZEUS’s earnings for the quarter is currently pegged at $2.26.

Sociedad Quimica y Minera de Chile S.A.

SQM

, slated to release earnings on May 18, has an Earnings ESP of 29.73% and flaunts a Zacks Rank #1.

The consensus estimate for Sociedad Quimica’sfirst-quarter earnings has been revised 55.7% upward in the past 60 days. The Zacks Consensus Estimate for SQM’s earnings for the quarter is pegged at $1.23.

Endeavour Silver Corp.

EXK

, scheduled to release earnings on May 11, has an Earnings ESP of 4.35% and carries a Zacks Rank #3.

The consensus estimate for Endeavour Silver’sfirst-quarter earnings has been revised 20% upward in the past 60 days. The Zacks Consensus Estimate for EXK’s earnings for the quarter is pegged at 6 cents.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report