Agnico Eagle Mines Limited

AEM

recently announced its shareholders voted in favor of the resolution and approved the issuance of Agnico Eagle common shares in connection with the proposed merger with Kirkland Lake Gold at a special meeting.

The resolution was approved by roughly 99.86% of the votes cast by shareholders of Agnico Eagle at the Meeting, with a shareholder turnout of 69.62%.

Kirkland Lake Gold shareholders also approved the merger at the special meeting of its shareholders.

Agnico stated that its near-term focus would be to complete the integration plan for the two companies while it awaits the final regulatory clearances. It looks forward to providing additional information on the combined businesses once the transaction has been finalized, which is expected to take place in the first quarter of 2022, the company noted.

The combination is expected to establish the new Agnico Eagle as the industry’s highest-quality senior gold producer (with expected 2021 production of roughly 3.4 million ounces), with the lowest unit costs, highest margins, most favorable risk profile and industry-leading best practices in key areas of environmental, social and governance.

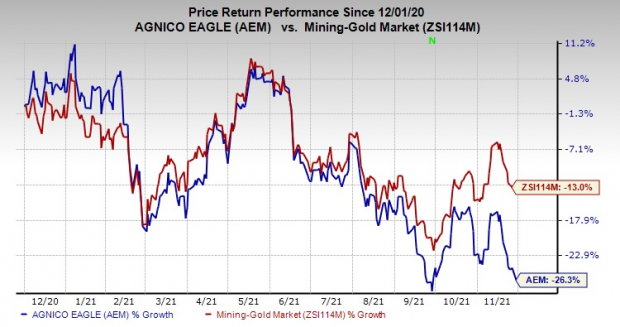

Shares of Agnico Eagle have declined 26.3% in the past year compared with a 13% fall of the

industry

.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it expects gold production for 2021 to be 2,047,500 ounces. It also projects total cash costs per ounce of $700-$750 and AISC of $950-$1,000 per ounce for 2021.

The forecast for capital expenditures for 2021 is roughly $803 million.

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

The Chemours Company

CC

and

Allegheny Technologies Incorporated

ATI

.

Nucor has an expected earnings growth rate of 583.2% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 7.7% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. The stock has surged around 104% in a year. NUE currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. Its shares have also rallied around 22.7% over a year. CC currently sports a Zacks Rank #1.

Allegheny has a projected earnings growth rate of 86.5% for the current year. The consensus estimate for the current year has been revised 75.86% upward in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the last four quarters. ATI has a trailing four-quarter earnings surprise of 98.1%, on average. The company’s shares have gained around 3.3% in a year. It currently carries a Zacks Rank #2.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report