Agnico Eagle Mines Limited

AEM

and

Kirkland Lake Gold Ltd.

KL

announced that they have agreed on a merger of equals, with the combined company to continue under the former’s name.

The combination is expected to establish the new Agnico Eagle as the industry’s highest-quality senior gold producer (with expected 2021 production of roughly 3.4 million ounces), with the lowest unit costs, highest margins, most favorable risk profile and industry-leading best practices in key areas of environmental, social and governance.

After completion of the merger, the integrated entity is expected to have $2.3 billion of available liquidity, a mineral reserve base of 48 million ounces of gold, which has doubled over the last decade and an extensive pipeline of development and exploration projects to drive sustainable, low-risk growth.

At closing, all Kirkland Lake Gold common shares will be exchanged for the consideration, being 0.7935 of an Agnico Eagle common share, for each Kirkland Lake Gold common share held. The arrangement needs the approval of at least 66 2/3% of the votes cast by the Kirkland Lake Gold shareholders voting at a special meeting. The issuance of shares by Agnico Eagle is subject to the approval of a simple majority of votes cast by its shareholders at a special meeting.

The combined leadership team is expected to retain the consistent and proven strategy of growing both production and profitability per share. The deal combines the only two major gold companies to have increased mineral reserves and production per share over the last decade through consistent investment in exploration and value-added acquisitions. Total mineral reserves surged 127% from 2011 to 48 million ounces as of Dec 31, 2020 (on a pro- forma basis).

The merger also improves the financial flexibility to finance a strong pipeline of growth projects and creates opportunities to boost sustainable returns to shareholders, while maintaining a strong balance sheet. Collectively, the companies have returned $1.6 billion to shareholders through dividends and share repurchases since the beginning of last year and forecasts to further raise returns to shareholders in the future.

The deal, which has been unanimously approved by the boards of the companies, is expected to be completed in December 2021 or in first-quarter 2022.

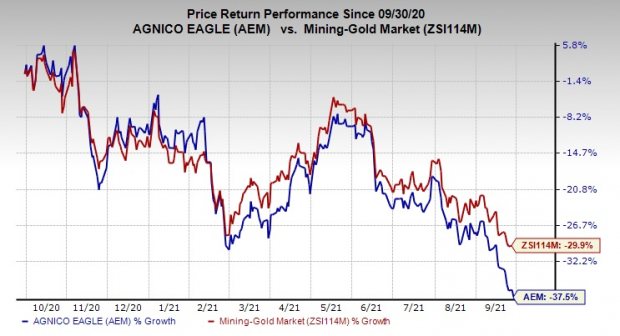

Shares of Agnico Eagle have declined 37.5% in the past year compared with 29.9% fall of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

and

The Chemours Company

CC

.

Nucor has a projected earnings growth rate of around 534.4% for the current year. The company’s shares have surged 129.4% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.4% for the current year. The company’s shares have gained 39.9% in the past year. It currently sports a Zacks Rank #1.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report