Agnico Eagle Mines Limited

AEM

reported a net income of $109.8 million or 29 cents per share in first-quarter 2022, down from $145.2 million or 60 cents per share reported in the year-ago quarter.

Barring one-time items, adjusted earnings per share came in at 61 cents. The bottom line surpassed the Zacks Consensus Estimate of 36 cents per share.

The company generated revenues of $1,325.7 million, up 39.6% year over year. The top line surpassed the Zacks Consensus Estimate of $1,153.3 million.

Operational Highlights

Payable gold production was 660,604 ounces (806,329 ounces including production from the legacy Kirkland Lake Gold mines) in the reported quarter, up from 516,804 ounces in the prior-year quarter.

Total cash costs per ounce for gold were $811, up from $734 in the year-ago quarter. All-in sustaining costs (AISC) were $1,079 per ounce in the quarter compared with $1,007 per ounce in the prior-year quarter.

Financial Position

Agnico Eagle ended the quarter with cash and cash equivalents of $1,062 million, up471.6% sequentially. Long-term debt was around $1,340.7 million, slightly higher than $1340.2million in the prior quarter.

Total cash from operating activities amounted to $507.4 million in the first quarter, up 38.4% year over year.

Outlook

The company expects payable gold production for 2022 in the range of 3.2-3.4 million ounces. It also projects total cash costs per ounce of $725-$775 and AISC of $1,000-$1,050 per ounce for 2022.

The forecast for 2022 capital expenditures is pegged at roughly $1.4 billion.

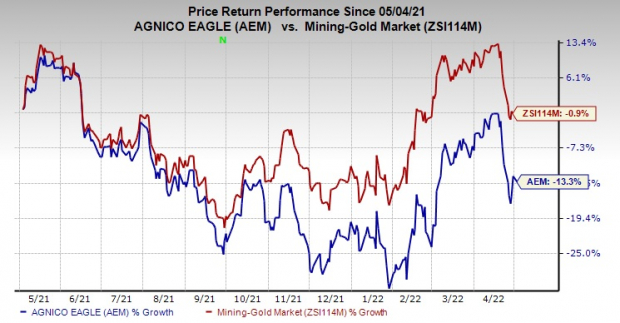

Price Performance

Shares of Agnico Eagle have declined 13.3% in the past year compared with a 0.9% decline of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Nutrien Ltd.

NTR

,

AdvanSix Inc.

ASIX

and

Allegheny Technologies Incorporated

ATI

.

Nutrien has a projected earnings growth rate of 127.9% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 31.1% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, while missing once. It delivered a trailing four-quarter earnings surprise of roughly 5.9%, on average. NTR has rallied around 70% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 54.7% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised 43.6% upward in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 23.6%. ASIX has surged 40.7% in a year. The company carries a Zacks Rank #1.

Allegheny, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 707.7% for the current year. The Zacks Consensus Estimate for ATI’s earnings for the current year has been revised 6.1% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 127.2%. ATI has rallied around 15.4% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report