Agnico Eagle Mines Limited

AEM

reported net income of $189.6 million or 77 cents per share in second-quarter 2021 compared with $105.3 million or 43 cents per share reported in the year-ago quarter.

Barring one-time items, adjusted earnings per share came in at 68 cents, surpassing the Zacks Consensus Estimate of 58 cents per share.

The company generated revenues of $966.3 million, up 73.4% year over year. The figure topped the Zacks Consensus Estimate of $901.4.

Operational Highlights

Payable gold production was up 58.9% year over year to 526,006 ounces in the reported quarter. The figure includes gold production at Hope Bay. Total cash costs per ounce for gold were $748, down 9.3% year over year.

All-in sustaining costs (AISC) were $1,037 per ounce in the quarter, including Hope Bay.

Financial Position

Agnico Eagle ended the quarter with cash and cash equivalents of $277.7 million compared with $126.5 million as of Mar 31, 2021. Long-term debt was around $1,441.5 million as of Jun 30, 2021 compared with $1,565.8 million as of Mar 31, 2021.

Total cash from operating activities amounted to $406.9 million in the second quarter, up 150.2% year over year.

Outlook

The company expects gold production for 2021 to be 2,047,500 ounces. It also expects total cash costs per ounce of $700-$750 and AISC of $950-$1,000 per ounce for 2021.

The quarterly production guidance for Hope Bay is 18,000-20,000 ounces of gold at total cash costs per ounce of $950-$975 and AISC per ounce of $1,525-$1,575.

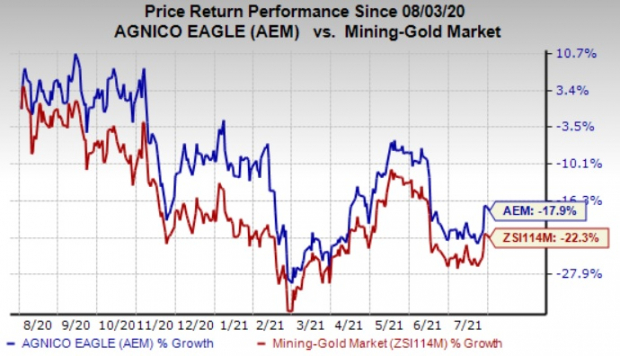

Price Performance

Shares of Agnico Eagle have declined 17.9% in the past year compared with 22.3% decline of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

Dow Inc.

DOW

and

Cabot Corporation

CBT

.

Nucor has a projected earnings growth rate of around 444.9% for the current year. The company’s shares have surged 137.3% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Dow has an expected earnings growth rate of around 403.01% for the current year. The company’s shares have gained 48.2% in the past year. It currently carries a Zacks Rank #2.

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 44.9% in the past year. It currently holds a Zacks Rank #2.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report