The world is standing on the brink of a food crisis. Climate change, international conflicts, and fragile supply chains are putting unprecedented strain on global food security.

In 2023 alone, nearly 282 million people faced severe food shortages1—a stark indication of the urgent need to bolster agricultural resilience worldwide. At the core of this issue lies a vital resource that’s often overlooked: potash, a potassium-rich mineral crucial for crop growth and yields.

The Brazil Potash Corp. (NYSEAMERICAN:GRO) Solution

Brazil, one of the world’s largest agricultural powerhouses, ironically imports over 95% of its potash, relying heavily on suppliers in Canada, Russia, and Belarus.

The ongoing conflict between Russia and Ukraine has only exacerbated this dependency, with Russia and Belarus accounting for about 40% of global potash exports2. This instability has heightened price volatility, leaving Brazil’s food production and security vulnerable.

Brazil Potash Corp. (NYSEAMERICAN:GRO), with its Autazes project, offers a groundbreaking solution: to produce potash locally, meeting ~20% of Brazil’s current needs and reducing the reliance on international imports.

Brazil Potash is set to revolutionize the nation’s agricultural sector with its Autazes project. The company has recently completed a $30 million IPO3 to fund the $2.5 billion initiative.4

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Why Brazil Potash Corp. (NYSEAMERICAN:GRO) Stands Out: 8 Reasons to Watch

1

Strategic Location in Brazil’s Agricultural Heartland: The Autazes project is strategically located near major inland river transportation routes, in very close proximity to the heart of Brazil’s agricultural regions. This proximity to farms means reduced transport costs and emissions, faster access to potash for farmers, and a reduced environmental footprint.

2

Significant Environmental Impact: By eliminating the need to transport potash across continents, Brazil Potash (NYSEAMERICAN:GRO) management believes the company can cut greenhouse gas emissions by 1.4 million tons annually—equivalent to planting over 56 million trees.

3

Full Construction Permitted, Ready to Build: Brazil Potash Corp. (NYSEAMERICAN:GRO) has required construction permits, making Autazes one of the most shovel-ready projects in the potash sector today. This advanced regulatory status minimizes delays and accelerates their path to production.

4

Essential for Brazil’s Food Security: Brazil’s status as a top agricultural exporter makes potash essential. By establishing a local source, Brazil Potash (NYSEAMERICAN:GRO) is not only bolstering national food security but also ensuring that Brazil’s farmers have a stable supply, irrespective of geopolitical turmoil.

5

High Profit Margins with Low-Cost Production: Brazil Potash’s management believes the Autazes project is expected to be highly cost-effective. Its location reduces transportation expenses, while Brazil’s favorable growing conditions allow for efficient, profitable production that strengthens the company’s bottom line.

6

Secured Demand Through Strong Partnerships: Brazil Potash’s (NYSEAMERICAN:GRO) offtake agreement with the Amaggi Group guarantees demand and mitigates market risk, which the company’s leadership team believes it will provide a reliable revenue stream and faster path to profitability.

7

Led by Industry Veterans with Proven Track Records: Advisory board headed by Mayo Schmidt, former Chairman and CEO of Nutrien, Brazil Potash’s (NYSEAMERICAN:GRO) leadership brings deep experience in the fertilizer sector, ensuring that the company operates with insight, expertise, and strategic foresight.

8

Top-Notch ESG Commitment: With an “A” MSCI sustainability rating, Brazil Potash Corp. (NYSEAMERICAN:GRO) is dedicated to environmental, social, and governance (ESG) standards, positioning itself as a responsible and forward-thinking leader in sustainable mining.

Brazil Potash’s Autazes Project: An Asset with Billion-Dollar Potential

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) mission is to produce up to 2.4 million tons of potash annually, meeting up to 20% of Brazil’s national demand5. The Autazes project has an estimated production capacity that positions it as one of the most significant developments in the global potash industry.

With Brazilian agriculture generating $167.41 billion in exports between August 2023 to July 2024, 6 a local potash source is crucial for maintaining high crop yields.

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) domestic production will support Brazil’s farmers and strengthen the country’s agricultural backbone.

Construction is expected to start immediately post IPO, providing a rare near-term opportunity in the potash market.

By tapping into Brazil’s underground potash reserves, Brazil Potash Corp. (NYSEAMERICAN:GRO) will boost food production resilience and cut dependency on international suppliers.

Press Releases

- Global Food Security at Risk: The Urgent Need for Sustainable Solutions

- Brazil Potash Announces Pricing of Initial Public Offering

- Brazil Potash Receives Mine Installation License to Start Project Construction of the Autazes Potash Project in Brazil

- Brazil Potash Signs Binding Offtake, Marketing and Barge Transportation Agreements With AMAGGI, One of the World’s Largest Private Producer of Soyabeans

- Brazil Potash Closing Regulation A Financing and Provides Corporate and Industry Update

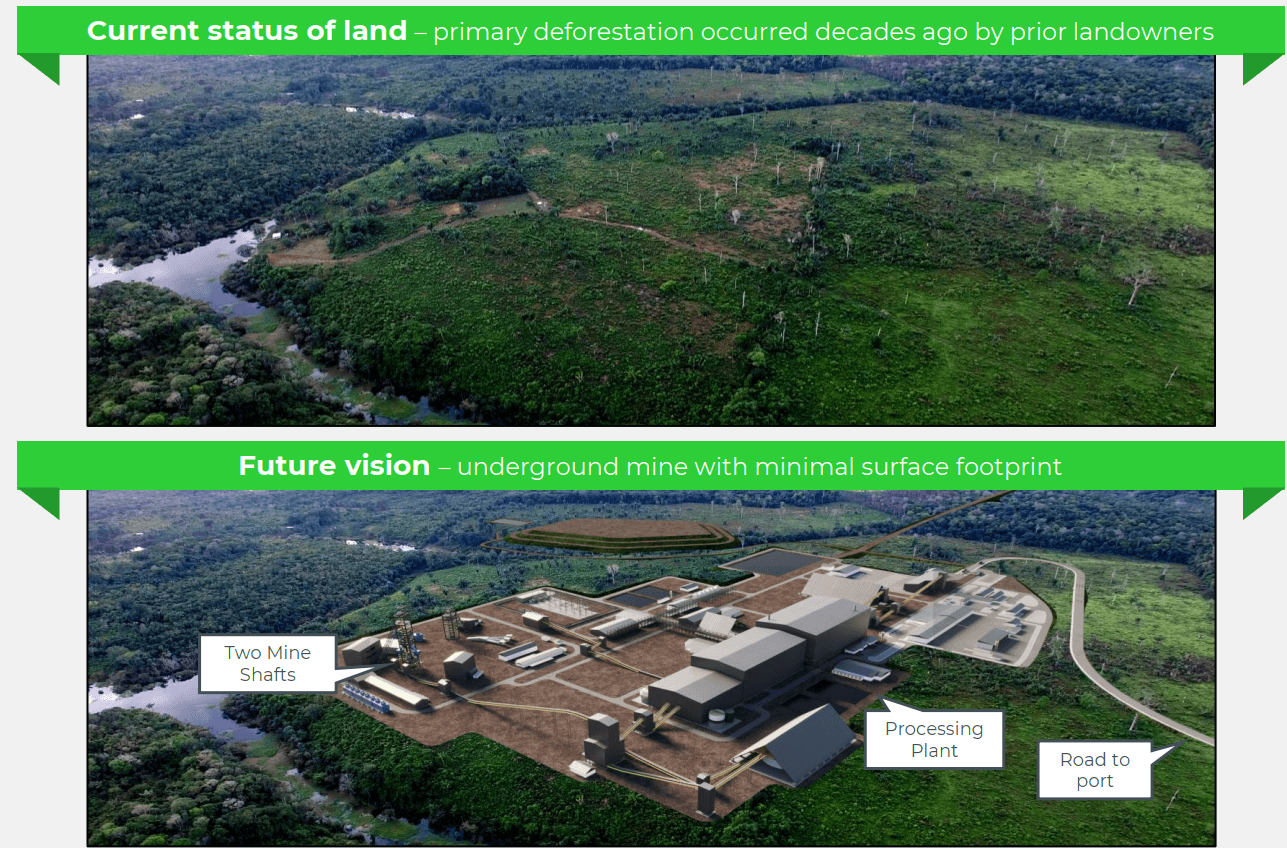

Strategic Positioning with a Low Environmental Footprint

Located 100 miles from a city of 1.7 million people, called Manaus7 and 5 miles from a major river,8 the Autazes project benefits from nearby infrastructure, minimizing environmental impact and construction costs.

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) anticipated closed-loop extraction process is expected to use only hot water to concentrate potash, with salt tailings to be dry stacked prior to being returned back underground. This environmentally responsible method stands in stark contrast to traditional mining practices and the company believes that it sets a high standard in eco-friendly resource management.

Competitive Comparison: How Brazil Potash (NYSEAMERICAN:GRO) Measures Up

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) unique position as Brazil’s significant domestic potash mining project gives it a substantial advantage over its global competitors.

While companies like Nutrien and Mosaic dominate North America, their products still incur high transportation costs and emissions to reach Brazilian farmers. Brazil Potash (NYSEAMERICAN:GRO) eliminates these barriers, offering a more sustainable and efficient supply chain.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Backing from the Best: The Institutional Muscle Behind Brazil Potash

Brazil Potash’s impressive shareholder base showcases the strong confidence major players have in the company’s vision and potential. Leading the charge are some of the industry’s most respected institutional investors, each bringing unique strengths to support Brazil Potash’s ambitions:

-

-

- CD Capital (30.5%): Known for its strategic focus on natural resources, CD Capital’s significant stake brings credibility and financial stability to Brazil Potash.

- The Sentient Group (20.4%): With deep experience in the resource sector, Sentient provides essential backing to drive Brazil Potash’s growth.

- Forbes & Manhattan (11.4%): This investment bank and advisory firm offers an expansive network and valuable insights, aligning closely with Brazil Potash’s long-term goals.

- Additional Investors (37.7%): A mix of individual and institutional investors broadens Brazil Potash’s support network, adding further stability and diversification to the shareholder base.

-

This solid lineup of investors positions Brazil Potash Corp. (NYSEAMERICAN:GRO) for steady growth, robust strategic support, and sustainable market expansion.

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) project is supported by a take-or-pay agreement with the Amaggi Group, securing demand for approximately 551,000 tons of potash annually.9

Franco-Nevada, a global royalty leader, has shown confidence in Brazil Potash (NYSEAMERICAN:GRO) by securing an option for a 4% gross revenue royalty on production, providing robust financial backing from one of the most respected names in mining finance.

A New Standard in Environmental Responsibility

Brazil Potash Corp. (NYSEAMERICAN:GRO) is setting a new benchmark in mining with a strong commitment to environmental and social responsibility.

By sourcing potash locally and tapping into Brazil’s renewable energy grid, the company expects to reduce its environmental footprint, contrasting sharply with the carbon-heavy global supply chains typical of traditional potash production.

Respecting Indigenous Rights and Cultural Preservation

Brazil Potash (NYSEAMERICAN:GRO) goes above and beyond in its respect for Indigenous rights, adhering to United Nations protocols for free, prior, and informed consultations. This dedication to community and cultural preservation is woven into every layer of the project.

With an ‘A’ MSCI sustainability rating, Brazil Potash (NYSEAMERICAN:GRO)10 stands as a leader in responsible operations, supporting several environmental and social programs to safeguard heritage, promote public health, and drive sustainable growth.

Empowering the Community Through Education and Skills

Brazil Potash (NYSEAMERICAN:GRO) understands that sustainable growth means investing in the community’s future. The company provides education and skills training, focusing on mining and environmental management, to empower local residents and build lasting economic resilience.

This is about more than short-term benefits; it’s about creating a self-sustaining economy in Autazes that will thrive long after the mine reaches full production.

Through partnerships the company is building with local and Indigenous communities, Brazil Potash Corp. (NYSEAMERICAN:GRO) is building a legacy of shared prosperity.

From infrastructure investments to environmental education, every step aligns with the needs and values of the Amazon’s people. For market participants, Brazil Potash offers long-term value, driven by a vision of sustainability, cultural respect, and regional empowerment.

The Power Team Behind Brazil Potash’s Sustainable Vision

Brazil Potash Corp. (NYSEAMERICAN:GRO) has assembled a powerhouse leadership team committed to pioneering sustainable resource development in Brazil. With deep experience in agriculture, mining, and environmental stewardship, this team is propelling Brazil Potash’s mission to the forefront of the global fertilizer market.

Meet the Key Leaders

-

-

- Matt Simpson, CEO & Director: With over two decades of mining industry experience, including roles as General Manager at Rio Tinto’s Iron Ore Company of Canada and CEO of Black Iron Inc., Matt Simpson brings expertise in mine design, operations, and large-scale project management to Brazil Potash. His leadership positions the company for strategic growth and operational excellence.

- Mayo Schmidt, Advisory Board Chair: The former Chairman and CEO of Nutrien, the world’s largest fertilizer producer, Schmidt offers unparalleled insights and connections in the agriculture industry, giving Brazil Potash a competitive edge as it reduces Brazil’s reliance on imported potash.

- Adriano Espeschit, President: With over 35 years of global mining experience, including leadership roles at Vale, BHP Billiton, and Mirabela Nickel, Adriano Espeschit brings extensive expertise in mine development and operations. His proven ability to navigate Brazil’s licensing processes and engage with indigenous communities ensures Brazil Potash’s commitment to sustainability and responsible mining practices.

-

Final Thoughts: A Strategic Bet on Brazil’s Agricultural Independence

Brazil Potash Corp.’s (NYSEAMERICAN:GRO) Autazes project is not just a business venture; it’s a key element to help ensure global food security. By potentially reducing Brazil’s

dependency on foreign suppliers, lowering carbon emissions, and creating jobs, Brazil Potash is making a lasting impact on the country’s economy and environment.

This project’s strategic location, strong profit potential, and positive environmental impact position it as a standout opportunity for those seeking both meaningful impact and significant returns.

Discover why Brazil Potash Corp. (NYSEAMERICAN:GRO) is a game-changer for Brazil’s agriculture and a pivotal force in global food security.

Click here to see the corporate prospectus for Brazil Potash Corp (NYSEAMERICAN:GRO)

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers