In an era where global food security is increasingly threatened by climate change, geopolitical tensions, and supply chain disruptions, the stability of our food systems hangs in the balance.

Recent reports indicate that nearly 282 million people faced acute food insecurity in 2023, a stark reminder of the vulnerabilities within our agricultural frameworks.1

A critical, yet often overlooked, component in this equation is potash—a potassium-rich mineral essential for plant growth and crop yields. As the world’s population continues to rise, the demand for potash escalates, making its availability a linchpin in the quest to feed billions.

Brazil, a nation with vast agricultural potential, currently imports approximately 98% of its potash needs,2 primarily from Canada, Russia, and Belarus.3 The ongoing conflict between Russia and Ukraine has further complicated this dependency.

Russia and Belarus together account for about 40% of global potash exports.4 The war has led to disruptions in fertilizer supplies, causing massive price volatility and raising concerns about global food security.

This heavy reliance on foreign sources not only exposes the country to supply chain vulnerabilities but also contributes to a significant carbon footprint due to long-distance transportation.

Enter Brazil Potash Corp. (NYSEAMERICAN:GRO) and its Autazes project—a groundbreaking initiative poised to transform the nation’s agricultural landscape. A $30 million IPO5 towards financing construction of the $2.5 billion Autazes project recently closed on November 29, 2024.6,7,8

Enter Brazil Potash Corp. (NYSEAMERICAN:GRO) and its Autazes project—a groundbreaking initiative poised to transform the nation’s agricultural landscape. A $30 million IPO5 towards financing construction of the $2.5 billion Autazes project recently closed on November 29, 2024.6,7,8

By developing a domestic source of potash, Brazil Potash Corp. (NYSEAMERICAN:GRO) leadership believes that it will be capable of reducing Brazil’s dependency on imports, enhancing food security, and promoting sustainable farming practices.

This endeavor not only addresses immediate agricultural needs but also aligns with global sustainability goals, offering a beacon of hope in the fight against food insecurity.

As the world grapples with the complexities of feeding a growing population amidst environmental and geopolitical challenges, innovative solutions like those proposed by Brazil Potash are not just beneficial—they are imperative.

Brazil Potash Corp. (NYSEAMERICAN:GRO) is leading the charge in reshaping Brazil’s potash market. Here are the top eight reasons why investors should pay attention to this forward-looking company.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Compelling Reasons to Watch Brazil Potash Corp.

1

Prime Location with Logistical Advantages: Located near the heart of Brazil’s agricultural region only 5 miles from a major inland river system,9 the Autazes project has immediate access to these major low cost transportation routes, reducing the environmental impact of long-distance imports. Its proximity to key farming areas means the potash will reach end users faster and more efficiently.

2

Significant Environmental Impact: By sourcing potash domestically, Brazil Potash Corp. (NYSEAMERICAN:GRO) believes the company can reduce greenhouse gas emissions by 1.4 million tons annually10—equivalent to planting over 56 million trees.11 This substantial reduction positions the company to become a leader in sustainable resource production.

3

Regulatory Approval Secured: Brazil Potash Corp. (NYSEAMERICAN:GRO) has obtained certain environmental licenses and all necessary construction permits. This means Brazil Potash is not only shovel-ready but also adheres to certain strict sustainability and environmental standards.

4

Vital for Global Food Security: Brazil is one of the world’s largest agricultural exporters, yet it depends on international potash supplies. By establishing a reliable domestic source, Brazil Potash Corp. (NYSEAMERICAN:GRO) expects to enhance the nation’s agricultural independence and reduce vulnerability to international disruptions.

5

Low-Cost Production with High Profit Margins: The Autazes deposit is strategically located very close to its farmer customers and will leverage existing infrastructure, which could translate to lower construction and operating costs. Combined with Brazil’s favorable climate and long growing seasons, Brazil Potash believes the Autazes project is primed for profitability.

6

Strong Partnerships and Market Demand: Brazil Potash Corp. (NYSEAMERICAN:GRO) has secured an offtake agreement with the Amaggi Group, a global leader in soybean production. This long-term agreement is expected to mitigate market risk and guarantee steady demand at competitive prices.

7

Led by Industry Veterans: With Mayo Schmidt, former Chairman and CEO of Nutrien, leading the advisory board, Brazil Potash Corp. (NYSEAMERICAN:GRO) is backed by seasoned professionals with deep knowledge in agriculture and resource extraction.

8

ESG-Focused Operations: Brazil Potash operates with a commitment to environmental, social, and governance (ESG) criteria, with an MSCI sustainability rating of A.

The Autazes Project: A Multi-Billion-Dollar Asset for Food Security and Sustainability

Brazil Potash’s (NYSEAMERICAN:GRO) mission is to meet up to 20% of Brazil’s potash demand,12 and upon construction will have an estimated production capacity of approximately 2.4 million tons of potassium chloride annually, drastically reducing the country’s dependence on imports from Canada, Russia, and beyond.

With more than $167 billion worth of agricultural products13 flowing from Brazil each year, the country’s reliance on potash for high crop yields is indispensable.

The Autazes project offers an innovative solution, extracting potash from rich, local deposits to enhance the resilience of Brazil’s food production.

With construction ready to start, Autazes represents a rare near-term opportunity in the potash market.

The deposit is part of Brazil’s extensive underground potash reserve, positioned within reach of critical agricultural zones and equipped with infrastructure to facilitate quick and efficient distribution.

Press Releases

- Brazil Potash Announces Closing of Initial Public Offering

- Brazil Potash Announces Pricing of Initial Public Offering

- Brazil Potash Receives Mine Installation License to Start Project Construction of the Autazes Potash Project in Brazil

- Brazil Potash Signs Binding Offtake, Marketing and Barge Transportation Agreements With AMAGGI, One of the World’s Largest Private Producer of Soyabeans

- Brazil Potash Closing Regulation A Financing and Provides Corporate and Industry Update

Autazes’ Strategic Positioning

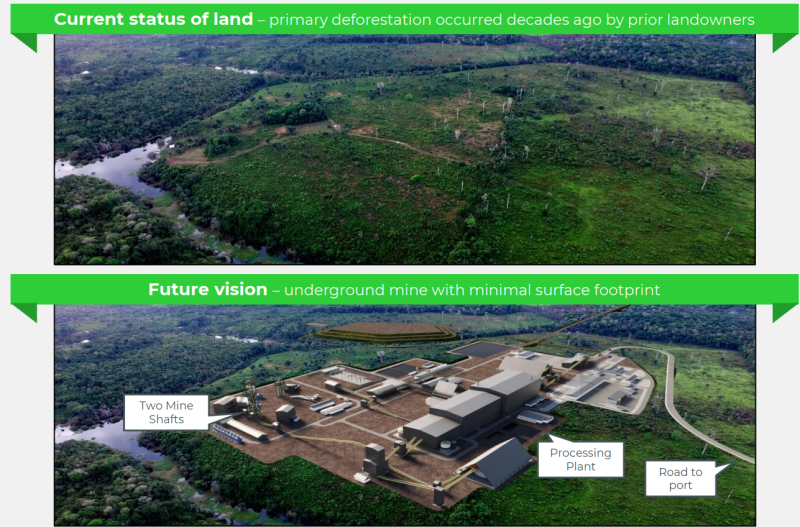

Located in the Amazonas Potash Basin and close to essential transportation channels, the Autazes project is strategically designed to minimize environmental impact while maximizing accessibility.

Only 100 miles from a city with over 1.7 million residents and just 5 miles from a major river system,14 Brazil Potash Corp. (NYSEAMERICAN:GRO) believes the project’s logistics are efficient and cost-effective, with minimal infrastructure required beyond a 100-mile power line.

Cutting-Edge Operations with Significant Environmental Benefits

At the core of Brazil Potash’s (NYSEAMERICAN:GRO) operations is an industry proven, closed-loop extraction system that uses only hot water to concentrate potash, producing little to no chemical waste.

This sustainable extraction method offers a stark contrast to traditional mining, where environmental disruption is at times unavoidable.

What Sets Autazes Apart

- Location: Brazil Potash‘s Autazes project is strategically located approximately 100 miles southeast of Manaus, near the Madeira River, providing access to essential transportation routes and infrastructure, reducing construction costs and transportation emissions.15

- Reserves: It is estimated that the deposit is capable of sustaining approximately 2.4 million tons of potash production annually for over 23 years.16

- Economic Viability: Brazil Potash believes that the cost-effective extraction and minimal additional infrastructure requirements create a strong potential for high profit margins.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Financial Outlook: Autazes’ Significant Growth Potential

Brazil Potash Corp. (NYSEAMERICAN:GRO) has secured necessary construction permits and is in the process of obtaining the required operational licenses and mining concession.

As previously mentioned, they’re situated just a few miles from major rivers and roadways, the Autazes project enjoys logistical advantages that few others can match.

This advanced regulatory status means that the company is ready to proceed with construction, significantly reducing the risk of delays and making the Autazes project one of the most shovel-ready potash projects in the world.

The financial viability of Brazil Potash’s project is underpinned by a strategic “take-or-pay” agreement with the Amaggi Group,17 one of the world’s largest agribusiness players.

- Offtake Agreement, with take or pay terms and conditions for approximately 551,000 tons per year of potash following a three-year ramp-up period.18

- Distribution and Marketing Agreement to sell any remaining spot tons of potash per year that are not under long term offtake contracts.

- Hermasa Shipping Agreement: ensures the transport of 2.2 to 3.0 million tons of potash annually from the Autazes Project to key ports like Miritituba and Porto Velho,19 supporting efficient delivery to Brazil’s major farming regions. This 15-year agreement includes exclusive transport rights, fuel-adjusted delivery fees, and penalties for unmet obligations, ensuring a reliable supply chain for agricultural demands.20

The offtake agreement with Amaggi Group may guarantee the sale of potash annually at market prices, which is expected to provide stable revenue streams and a potential path to profitability.

This guaranteed offtake agreement, alongside Brazil’s rapidly growing demand for potash, positions Brazil Potash Corp. (NYSEAMERICAN:GRO) for sustainable, long-term growth.

Franco-Nevada, a leading global royalty and streaming company, has secured an option to acquire a 4% gross revenue royalty on potash production from Brazil Potash‘s Autazes project.21 This strategic move underscores Franco-Nevada’s confidence in the project’s potential and provides Brazil Potash Corp. (NYSEAMERICAN:GRO) with substantial financial backing from a reputable industry leader.

Funding for Growth: With construction permits in place and early construction set to begin, Brazil Potash’s capital needs are fully aligned with the project’s development timeline, ensuring a smooth transition to production.

A Commitment to Environmental Stewardship

Brazil Potash Corp. (NYSEAMERICAN:GRO) isn’t just another mining operation. The company has embedded sustainable practices into every layer of its operations.

By sourcing electricity from Brazil’s ~80% renewable sourced grid and prioritizing domestic sales, Brazil Potash Corp. (NYSEAMERICAN:GRO) minimizes its environmental footprint compared to traditional potash production, which often relies on extensive global transportation networks.

By sourcing potash domestically, Brazil could eliminate the need for long-distance transportation, thereby reducing these emissions. While the exact reduction would depend on the efficiency of domestic logistics, the potential decrease in CO₂ emissions is significant. This aligns with Brazil’s broader environmental goals and commitments to reducing GHG emissions.

Community-Centric Development: Building Prosperity in Autazes

The Autazes project will be transformative not only for Brazil’s agriculture but also for the local community.

Autazes is a town with ~41,000 population and limited access to essential services like sanitation and stable electricity. Brazil Potash Corp.’s (NYSEAMERICAN:GRO) commitment to this region goes beyond economic development, creating infrastructure and improving quality of life for local families.

Brazil Potash Corp. (NYSEAMERICAN:GRO) goes beyond standard corporate responsibility, embracing a deep commitment to the rights and traditions of local indigenous communities.

Adhering to United Nations protocols for free, prior, and informed consultations, the company has prioritized building genuine, respectful relationships with the people and land of the Amazon.

This dedication forms the backbone of Brazil Potash’s environmental, social, and governance (ESG) efforts, which are not just add-ons but core to the company’s mission.

With a stellar ‘A’ MSCI sustainability rating,22 Brazil Potash Corp. (NYSEAMERICAN:GRO) leads in responsible operations, boasting several environmental and social programs that are actively safeguarding local heritage, enhancing public health, and supporting economic growth.

These initiatives span emissions reduction, biodiversity preservation, and natural landscape restoration, all carried out with careful regard for the indigenous cultural landscape.

The social dimension of Brazil Potash’s (NYSEAMERICAN:GRO) ESG strategy is particularly notable. By funding education, healthcare, and critical infrastructure in Autazes, the company is not only providing immediate benefits but is also laying the groundwork for sustainable regional progress.

Brazil Potash’s partnerships with local and indigenous communities extend far beyond the Autazes project. From critical infrastructure investments to environmental education, the company ensures that every step aligns with the values and needs of the people.

Indigenous communities are active participants at every phase, shaping social and environmental standards to ensure their heritage, culture, and way of life are respected and preserved.

In doing so, Brazil Potash Corp. (NYSEAMERICAN:GRO) not only strengthens its community ties but builds a legacy of sustainability and shared prosperity, offering long-term value for both investors and the people of the Amazon.

The Next Big Player in Potash? How Brazil Potash Stacks Up Against Industry Giants and Why It Could Transform Brazil’s Agricultural Future

While current leaders like Nutrien and Mosaic maintain high production volumes, they are heavily centered in North America and face significant costs in transporting potash across continents.

Brazil Potash Corp. (NYSEAMERICAN:GRO), however, aims to leverage its presence in Brazil to directly supply the Brazilian market, the world’s largest importer, reducing logistical expenses and environmental impacts associated with long-distance potash shipping.

This home-field advantage not only positions Brazil Potash to potentially capture up to 20% of the Brazilian market but also enables it to compete effectively with large North American and European players by eliminating the need for expensive, carbon-heavy transportation.

This model aligns Brazil Potash’s goals with global sustainability trends, emphasizing the reduced carbon footprint that local production provides—a key factor for ESG-focused investors.

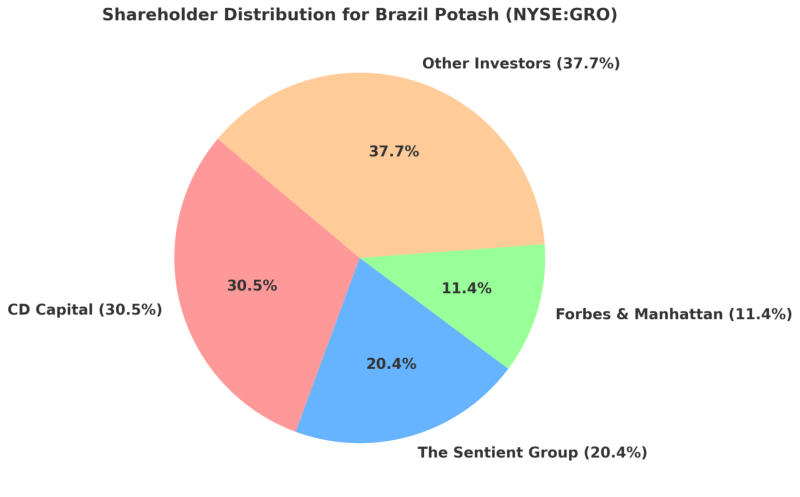

Institutional Support and Ownership Breakdown

Brazil Potash’s (NYSEAMERICAN:GRO) shareholder base includes some of the industry’s most reputable institutional investors, which speaks volumes about the confidence in the company’s vision and potential.

The shareholding is divided among:

- CD Capital: Holding a significant 30.5% stake, CD Capital is known for its strategic investments in natural resources, lending credibility and financial strength to Brazil Potash Corp. (NYSEAMERICAN:GRO).

- The Sentient Group: With 20.4% ownership, this group brings experience and backing in resource sector investments, supporting Brazil Potash’s growth initiatives.

- Forbes & Manhattan: Holding an 11.4% stake, this investment bank and advisory firm provides a deep network and strategic insights, aligning with Brazil Potash’s long-term goals.

- Other Investors: Comprising 37.7% of ownership, this diversified segment includes a mix of individual investors and additional institutions, further stabilizing the shareholder base and broadening the company’s support network.

Investor Takeaway:

With a robust resource base, sustainable practices, and the potential to drastically reduce Brazil’s dependency on foreign potash, Brazil Potash Corp. (NYSEAMERICAN:GRO) represents an exciting, early-stage opportunity.

As the Autazes project progresses toward construction and production, the company could establish itself as a significant player, potentially catching up to industry giants like Nutrien and Mosaic in the long term.

The Brazil Potash Dream Team: Leading the Charge in Sustainable Agriculture

Brazil Potash Corp. (NYSEAMERICAN:GRO) has assembled a leadership team unrivaled in expertise, vision, and dedication, positioning the company at the forefront of sustainable resource development in Brazil.

This elite group, with deep roots in agriculture, mining, and environmental stewardship, brings both industry insights and an unwavering commitment to Brazil’s economic growth and sustainability.

Together, they ensure that Brazil Potash’s projects are executed with precision, environmental care, and strategic foresight—qualities that set the company apart in the global fertilizer market.

Meet the Leadership Powerhouse

Brazil Potash’s (NYSEAMERICAN:GRO) leadership is more than just a collection of executives—it’s a team with unmatched credentials and a unified vision. Each member contributes specialized knowledge, from operational efficiency to strategic financing, all underpinned by a shared commitment to sustainability.

This powerhouse team combines decades of experience in agriculture, mining, and finance to drive Brazil Potash’s mission of reducing Brazil’s potash dependence, cutting greenhouse gas emissions, and supporting sustainable food production.

With this elite group steering the ship, Brazil Potash Corp. (NYSEAMERICAN:GRO) isn’t just positioned for success—it’s primed to redefine the standards of responsible resource development in Brazil. Their collective expertise, global connections, and unwavering dedication make this company a trusted opportunity for those looking to support sustainable growth in one of the world’s most essential sectors.

Why Brazil Potash Should Be On Your Watchlist

Brazil Potash’s (NYSEAMERICAN:GRO) Autazes project stands out as a strategic opportunity with significant growth potential.

The Autazes deposit is uniquely positioned to meet the surging demand for sustainable agriculture solutions in Brazil, one of the world’s top agricultural exporters.

With construction licenses obtained, secured funding, and experienced leadership, Brazil Potash Corp. (NYSEAMERICAN:GRO) is set to become a cornerstone of Brazil’s food security strategy.

Key Points of Differentiation:

- Largest Domestic Potash Source: Autazes is the largest near-ready potash project in Brazil, with potential to reduce the country’s dependency on imports by approximately 20%.

- High ESG Standards: An MSCI rating of “A” underscores the company’s commitment to sustainable practices, making it a responsible choice for ESG-focused investors.

Experienced Team and Strategic Partnerships: Led by industry veterans and supported by global investors, Brazil Potash Corp. (NYSEAMERICAN:GRO) is equipped with the expertise and funding necessary for success.

Final Thoughts: A Timely Project in Food Security and Sustainability

With construction slated to begin, Brazil Potash Corp. (NYSEAMERICAN:GRO) offers a rare opportunity in a transformative project that will shape the future of Brazilian agriculture.

In an era where food security and sustainability are paramount, Brazil Potash’s Autazes project stands out as a high-impact investment that promises both substantial financial returns and environmental benefits.

Market participants seeking exposure to sustainable agriculture, renewable resources, and emerging markets will find Brazil Potash Corp. (NYSEAMERICAN:GRO) to be a compelling addition to their portfolio.

The project’s strategic advantages, potential for future high margins, and environmental impact make it an exceptional opportunity for those looking to make a difference while capturing market gains.

Don’t miss the chance to learn more about Brazil Potash—a game-changer in Brazil’s agriculture industry with the potential to redefine food security on a global scale.

Click here to see the corporate prospectus for Brazil Potash Corp (NYSEAMERICAN:GRO)

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Matt Simpson CEO & Director

Matt Simpson CEO & Director Mayo SchmidtAdvisory Board Chair

Mayo SchmidtAdvisory Board Chair Adriano Espeschit President

Adriano Espeschit President