Entergy Corporation

’s

ETR

operating company, Entergy New Orleans, recently announced that it has submitted a grid hardening and resilience filing to Entergy’s local regulator, the New Orleans City Council. The filing includes an extension plan that will harden more than 30,000 miles of distribution power lines and nearly 500,000 distribution poles to lessen the frequency and length of power outages during extreme weather conditions.

As part of the filing, Entergy New Orleans is proposing a variety of options to build electrical infrastructure strong enough to withstand severe storms. Entergy will increase grid resilience, strengthen transmission and distribution electric infrastructure and install new cutting-edge technology and equipment to provide high-quality services for customers.

Entergy New Orleans’ cost of the grid hardening project is expected at $1.5 billion in 10 years. Overall, ETR expects to invest $15 billion to better safeguard against extreme weather scenarios, such as hurricanes and ice storms.

Zacks Rank & Price Performance

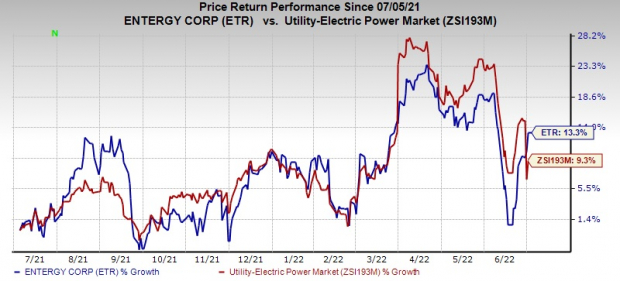

Currently, Entergy carries a Zacks Rank #3 (Hold). In the past year, shares of ETR have rallied 13.3% compared with the

industry

’s growth of 9.3%. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Image Source: Zacks Investment Research

Utilities’ Focus on Infrastructure

To provide a 24X7 electricity supply for consumers despite hurricanes, utilities are investing heavily in strengthening their infrastructure. Hurricanes and extreme climatic conditions bring devastation to the utility electric power infrastructure that includes transmission lines, distribution lines, generation plants and sub-stations, which are adversely impacted by the same. Utilities making significant investments to increase the resiliency of infrastructure for withstanding the impact of extreme weather conditions are

NextEra Energy

NEE

,

Dominion Energy

D

and

Pinnacle West Capital

PNW

.

NextEra Energy continues to invest substantially in its utility assets and aims to strengthen and expand its transmission, distribution, electric generation and renewable projects. NextEra aims to invest $49.5 billion through 2025 to strengthen its infrastructure.

Dominion Energy plans to invest $37 billion during the 2022-2026 period to strengthen its existing infrastructure. Over the next 14 years, the company aims to invest $73 billion to strengthen its infrastructure and add more clean power generation assets to its portfolio.

To efficiently serve its expanding customer base, Pinnacle West Capital has systematic investment plans to increase generation and strengthen its transmission and distribution lines. After investing $1.5 billion in 2021, it aims at investing $1.53 billion in 2022. Pinnacle West Capital also plans to invest $4.7 billion during the 2022-2024 period.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report