Verizon Communications Inc.

VZ

recently offered the best of LTE and 5G Ultrawideband facilities with the launch of On Site 5G — a transformative on-premises, private 5G network —for business enterprises. This customized solution enables firms that were hitherto crippled with coverage gaps, lost connectivity, fractured security, data congestion and inconsistent service quality to have a dedicated capacity with adequate bandwidth to minimize costly downtime and missed opportunities.

On Site 5G is a secure, scalable, wireless network and is the first commercially available private 5G solution from Verizon in the United States. This non-standalone network combines 5G Ultra Wideband small cells with the LTE packet core and radios of On Site LTE network for high security and low latency processes and applications. While maintaining interconnection facility with the networking infrastructure of the company, it enables authorized remote user access to enterprise applications, thereby protecting the inherent privacy of on-premises network.

Leveraging AI capabilities and ML techniques for real-time analytics, On Site 5G offers improved network competences for a dynamic all-in-one solution and a consistent, predictable performance that accelerates digital transformation. This, in turn, enables business enterprises to better adapt to the evolving hybrid workforce requirements and embrace the ‘new normal’. It is interoperable with most existing IT and IoT infrastructure and can support several connected devices, and can be even based on multiple spectrum scenarios.

With one of the most efficient wireless networks in the United States, Verizon continues to deploy the latest 4G LTE Advanced technologies to deliver faster peak data speeds and capacity for customers, driven by customer-focused planning, disciplined engineering and constant strategic investments. In addition, Verizon has been aggressively forging ahead to expand its fiber optics networks to support 4G LTE and 5G wireless standards as well as wireline connections.

The 5G Ultra Wideband network uses a millimeter-wave spectrum and is designed to provide customers significantly faster download speed and greater bandwidth compared with 4G. Verizon’s 5G mobility service offers an unparalleled experience that impacts industries as diverse as public safety, health care, retail and sports. The company’s 5G network hinges on three fundamental drivers to deliver the full potential of next-generation wireless technology. These include massive spectrum holdings, particularly in the millimeter-wave bands for faster data transfer, end-to-end deep fiber resources and the ability to deploy a large number of small cells.

The company remains focused on making necessary capital expenditures to support increased demand for network traffic. At the same time, Verizon is focusing on build-out of its 5G Ultra Wideband network, deployment of fiber assets across the country and shift toward Intelligent Edge Network architecture. In order to expand coverage and improve connectivity, Verizon acquired 161MHz of mid-band spectrum in the C-Band auction for a total consideration of $45.5 billion. These airwaves offer significant bandwidth with better propagation characteristics for optimum coverage in both rural and urban areas. Verizon reportedly secured 3,511 of the 5,684 licenses up for grabs.

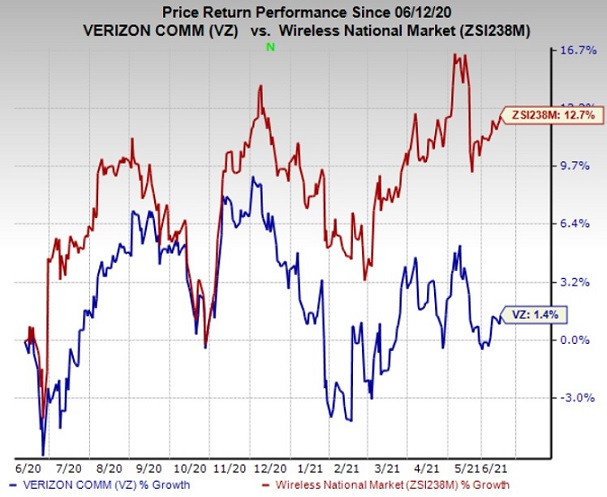

The stock has gained 1.4% in the past year compared with the

industry

’s growth of 12.7%.

Image Source: Zacks Investment Research

We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock. Some better-ranked stocks in the industry are

United States Cellular Corporation

USM

,

Cogent Communications Holdings, Inc.

CCOI

and

ATN International, Inc.

ATNI

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

U.S. Cellular delivered a trailing four-quarter earnings surprise of 123.9%, on average.

Cogent delivered a trailing four-quarter earnings surprise of 29%, on average.

ATN International delivered an earnings surprise of 424.2%, on average, in the trailing four quarters.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report