Should Investors Consider Adding These Top Mining Stocks To Their Portfolio This Month?

There are many types of

mining stocks

that have been trending in the market. The pandemic last year caused the price of many different minerals to skyrocket in price. This included gold, which at one point reached more than $2,000 per ounce last year. This rally for

top mining stocks

attracted many new investors to the sector that may have not paid attention to before. Now we’ve reached 2021, so things have changed in the market. Gold and silver, for example, have still been able to hold themselves at the key price points of $1,800 per ounce and $25 per ounce respectively. But gold and silver related mining stocks are not the only types of mining stocks that exist in the market.

One trending sector in the mining niche is

lithium stocks

. Lithium is a material that is used to create lithium-ion batteries. Lithium-ion batteries are used in a variety of tech, including electric vehicles. As you know, electric vehicles experienced an insane rally in the last years, with companies like Tesla (

NASDAQ: TSLA

) exploding in value. As a result, when these EV stocks are performing well, often lithium stocks will perform well too.

On February 11

th

, the U.S. Labor Department released the latest jobless reports. These reports said that claims for unemployment fell back to 793,000. While a declining number, this number for unemployment is still very high. Even though COVID cases are declining in the United States, many people are still relying on unemployment checks right now to stay afloat. This affects mining stocks as when there is more unemployment it hurts the economy. When the economy is hurt, mining stocks generally will perform better in the market. Let’s take a look at four mining stocks that have been trending in the

stock market

this past year, and could continue that momentum in 2021.

Top Mining Stocks To Watch Now

-

Yamana Gold Inc

. (

NYSE: AUY

) -

IAMGOLD Corporation

(

NYSE: IAG

) -

Kinross Gold Corporation

(

NYSE: KGC

) -

Equinox Gold Corp.

(

NYSE: EQX

)

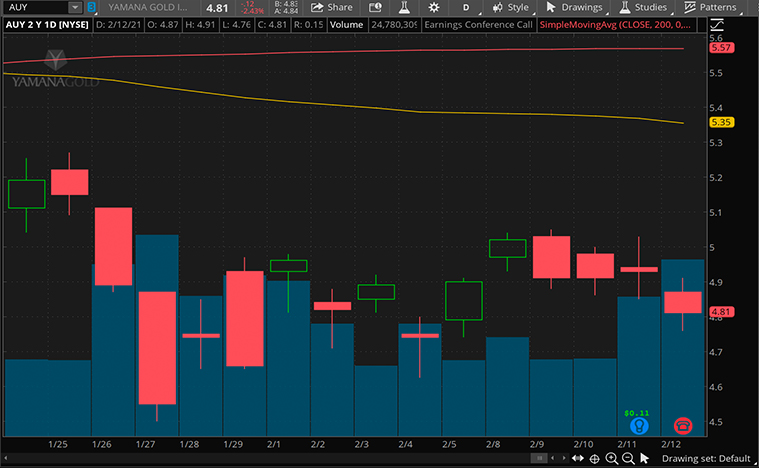

Yamana Gold Inc.

The first mining stock to watch on this list is Yamana Gold Inc. Yamana Gold produces precious metals in various locations around the world. These locations include Canada, Chile, Argentina, and Brazil. The company explores for and produces gold and silver ores. Currently, Yamana has an interest in the Cerro Moro mine, Malartic mine, Minera Florida mine, Jacobina mine, and more. So how has the company been performing in 2021 so far?

Its latest update is from February 11

th

, in which it announced its fourth quarter and full-year 2020 results. Many of its numbers fell year over year, while others actually increased year over year. Its gold production in particular was very strong throughout 2020. AUY stock price is at $4.86 a share as of February 12

th

, 2021. That is the latest that has come from Yamana Gold.

Read More

-

Making A List Of Gold Stocks To Buy Now? 4 Names To Know

-

Best Software Stocks To Buy Right Now? 3 Reporting Earnings Next Week

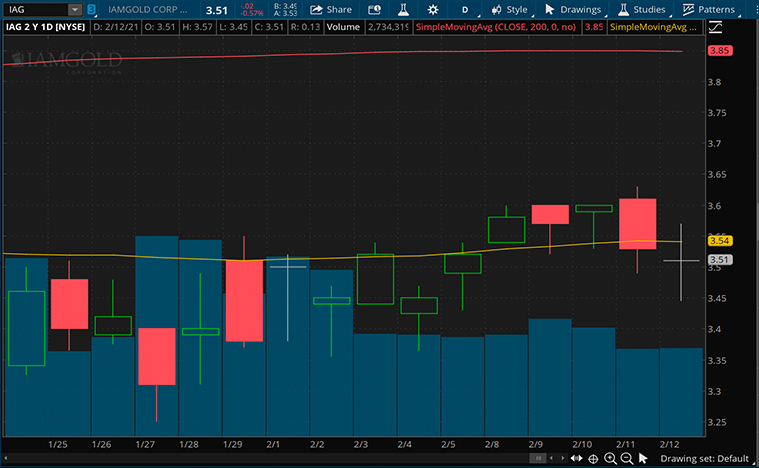

IAMGOLD Corporation

Next up on this mining stock list is IAMGOLD Corporation. IAMGOLD is a mining corporation that explores, operates, and develops a variety of mineral properties. The company’s assets are located in North America, South America, and West Africa too. It normally looks for gold but also has interest in other assets like silver too. IAMGOLD owns the Essakane mine, Westwood mine, Roebel mine, and others. So how has the company performed in 2021 so far?

Its last update was on January 29

th

, 2021. The company announced that it has maintained its interest in INV Metals Inc. and acquired more shares. It purchased 4,848,287 common shares at CAD $0.45 per share. Its stock price is at $3.51 a share on Friday’s close. This company could potentially see more movement once its earnings are released. For now, this is a mining stock to watch.

[Read More]

Looking For Biotech Stocks To Buy Now? 4 Names To Know

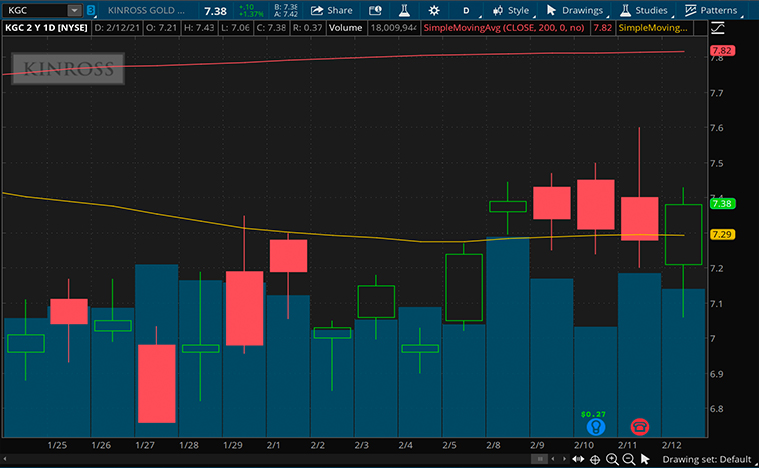

Kinross Gold Corporation

Now let’s talk about Kinross Gold Corporation. Kinross Gold is a mining corporation that explores land, acquires land, and develops gold assets on its properties. The company operates out of the United States, Canada, Russia, and more. It extracts and processes gold ores, then produces and sells the precious minerals. Its last mineral reserve reports were very high. So let’s see how this company is performing in 2021 so far.

On February 10

th

, the company provided an update on its projects. It also gave its full-year 2020 exploration results. The CEO of the company, J. Paul Rollinson stated, “

In 2020, we made excellent progress advancing our high-quality and diversified project pipeline and added 5.7 million gold ounces to our mineral reserve estimates after depletion. We extended mine life at Chirano by three years, and by one year at Kupol and Paracatu, and we continue to focus on opportunities for further mine life extensions.

” The company’s proven and probable reserves went up year over year, but its measured and indicated resources fell down.

[Read More]

4 Ad Tech Stocks To Watch Right Now

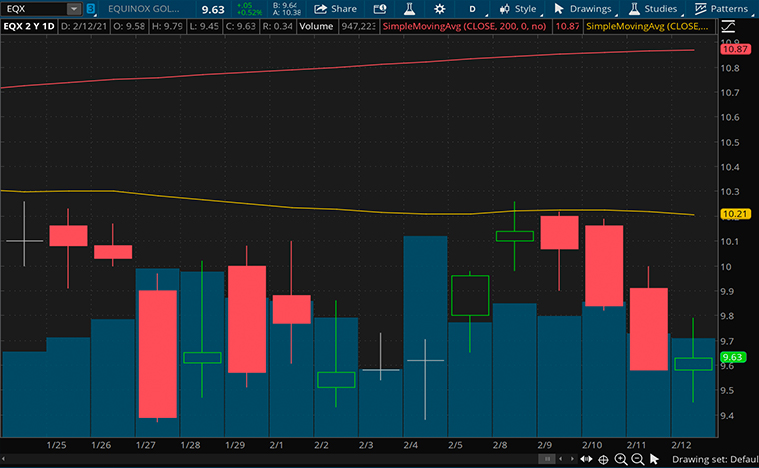

Equinox Gold Corp.

The final mining stock to watch is Equinox Gold Corp. Equinox is an acquisition, exploration, and development based company. It will explore gold, silver, and copper at various mineral deposits. Its main properties are the Aurizona gold mine covering 107,023 hectares in Brazil; and the Mesquite gold mine and Castle Mountain properties in California. Let’s dive right into its 2021 performance so far this year. Last year, EQX stock experienced a large amount of positive momentum.

On February 9

th

, Equinox Gold provided its 2021 guidance and a growth and investment plan. In regards to investment plans, Christian Milau, CEO of Equinox Gold said, “

These investments in 2021 will set the foundation for lower-cost production, longer-life mines, and substantial near-term production growth with an increase to approximately 900,000 ounces of gold at significantly lower costs in 2022 and approximately one million ounces of gold from 2023.

” The company expects consolidated gold production to increase each quarter during the year, and 30% of its production to happen in Q4. This is when its mines access higher-grade ores at the Los Filos mine and the Mesquite mine.