Vancouver, B.C. – October 29th, 2024 – Opawica Explorations Inc. (TSXV:OPW) (FSE:A2PEAD) (OTCQB:OPWEF), (the “Company” or “Opawica”) is a Canadian mineral exploration company focused on precious and base metal projects, is currently undergoing a renaissance in the Canadian gold mining industry. This comes at a time when gold prices continue pushing higher amid heightened demand and tight supplies.

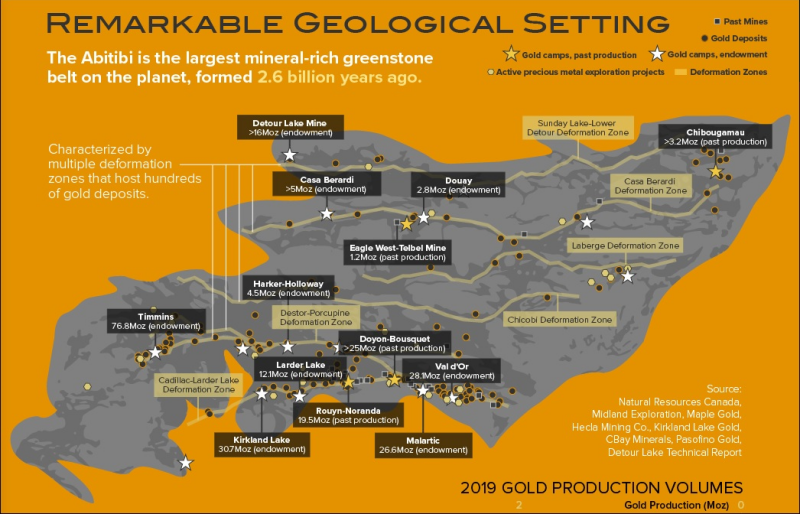

The Company’s primary assets are located in the Abitibi Gold Belt, a region that spans northeastern Ontario and northwestern Quebec. This area is recognized as one of the most prolific gold-producing regions in the world. Since mining began in the early 20th century, the mineral-rich belt has yielded over 200 million ounces of gold and is known for its abundant, easily accessible gold deposits and mining-friendly jurisdiction.

(Source: Resource World)

Historically, The Abitibi Gold Belt is home to several major and current gold producers. Agnico Eagle Mines Limited, established in 1957, is one of the largest gold producers in the region, with key operations at the LaRonde, Goldex, and Canadian Malartic mines.

LaRonde, one of Canada’s largest gold mines, has produced over 5 million ounces of gold, while Agnico’s 50% stake in Canadian Malartic (fully acquired in 2023) solidifies its dominance. In 2022, Agnico acquired Kirkland Lake Gold, which brought the high-grade Macassa Mine and Detour Lake Mine under its umbrella, further boosting its production capacity.

Additional major gold producers in the belt include:

- Hecla Mining expanded its presence in the region through its 2022 acquisition of Alexco Resource Corp and continued exploration in the Abitibi Belt.

- Newmont Corporation, with a long history in the area, operates the Porcupine Gold Mines and is developing the Borden Gold Project, Canada’s first all-electric underground mine.

- Osisko Mining is advancing the high-grade Windfall Lake Project in the Urban Barry Greenstone Belt.

- Monarch Mining is expanding production at its Beaufor Mine and exploring new opportunities at its Croinor Gold Project in Val-d’Or.

As M&A activity intensifies inline with an appreciating gold price, a number of acquisitions have also transpired.

For instance, in 2022, Agnico Eagle Mines completed a $13.5 billion merger with Kirkland Lake Gold, consolidating major assets in the Abitibi Gold Belt, including the high-grade Macassa Mine and the Detour Lake Mine. Agnico Eagle further expanded in 2023 by acquiring Yamana Gold’s 50% stake in the Canadian Malartic Mine for $4.8 billion, gaining full ownership of the mine, while other Yamana assets were acquired by Gold Fields.

Also, among the majors, Newmont Corporation, the world’s largest gold producer, solidified its dominance with the 2019 acquisition of Goldcorp Inc. for $10 billion, which included key Canadian assets like the Porcupine Gold Mines in Timmins. In addition, Hecla Mining expanded its Canadian footprint in 2022 through the acquisition of Alexco Resource Corp, primarily focused on silver but with future potential for gold exploration.

And in yet another recent example of heightened M&A activity in the region, Quebec-focused explorer Yorbeau Resources (TSX: YRB) agreed to sell its flagship Rouyn gold property to Lac Gold Pty Ltd. on October 2, 2024, for US$25 million to strengthen its balance sheet. The Rouyn property spans a 12-km section of the Cadillac-Larder Lake Break, a major fault zone in Quebec’s Abitibi region, covering nearly 27 km². As a result, Yorbeau Resources shares rose by up to 37.5% on the news, touching one-year highs in the process.

Similar to other gold properties in the region, Opawica’s Arrowhead property, fully surrounded by Agnico Eagle Mines and other majors, has the requisite road access, water, and hydroelectric power readily already in place. Thus, exploration costs for future drill programs are expected to remain low, which enhances the overall value of the assets.

Additionally, Opawica’s co-main Bazooka property is contiguous with Yamana Gold’s Wasamac gold Project to the north. As of the latest NI 43-101 data, The Wasamac Gold Project has Measured and indicated resources of approximately 29.86 million tonnes, with an average grade of 2.70 grams per tonne (g/t) of gold, containing around 2.6 million ounces of gold. It further contains inferred resources of approximately 4.16 million tonnes, with an average grade of 2.2 g/t of gold, totaling around 300,000 ounces of gold.

Overall, The Abitibi Gold Belt continues to be a world-class focal point of gold production, exploration, and investment, with major and junior companies actively consolidating assets and expanding operations. Recent acquisitions, such as the Agnico Eagle, Kirkland Lake Gold merger and the Rouyn property purchase have only underscored the region’s importance to the global gold industry.

As gold prices continue to rise and new discoveries are made, the jurisdiction-friendly Abitibi Gold Belt is expected to remain one of the world’s top gold-producing regions for decades to come.

Given this environment, companies with under-developed but high-potential land packages, like Opawica Explorations Inc., may attract increasing interest as the competition for resources among established players intensifies.

M. Yvan Bussieres, P.Eng., is the Qualified Person for Opawica Explorations Inc. and approves the technical content of this news release. * The qualified person has not verified the information on the Abitibi greenstone belt. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the company’s properties.

About Opawica Explorations Inc.

Opawica Explorations Inc. is a junior Canadian exploration company with a strong portfolio of precious and base metal properties within the Rouyn-Noranda region of the Abitibi Gold Belt in Québec. The Company’s management has a great track record in discovering and developing successful exploration projects. The Company’s objective is to increase shareholder value through the development of exploration properties using cost effective exploration practices, acquiring further exploration properties, and seeking partnerships by either joint venture or sale with industry leaders.

FOR FURTHER INFORMATION CONTACT:

Blake Morgan

President and Chief Executive Officer

Opawica Explorations Inc.

Telephone: 604-681-3170

Fax: 604-681-3552

Neither the TSX Venture Exchange nor its Regulation Service Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this news release.

Forward-Looking Statements

This news release contains certain forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. Readers are cautioned that these forward-looking statements are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected including, but not limited to, market conditions, availability of financing, actual results of the Company’s exploration and other activities, environmental risks, future metal prices, operating risks, accidents, labor issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. All the forward-looking statements made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by applicable law.