Washington is rewriting the rules of global trade, and the resource market is already reacting.

The latest headlines out of DC aren’t about rhetoric. They’re about money.

Billions of dollars are being redirected into North American supply chains to secure critical minerals before the next administration resets the agenda.1

This is no longer about speeches. It’s about checks being written, mines being financed, and production being booked before demand spikes again.

When Washington moves, the market follows.

We’ve already seen what happens when the White House signals a new priority.

In early October, Lithium Americas grabbed the spotlight after a minerals pact announcement with Australia. The stock jumped from $5.71 to $10.52 in just two weeks. Volume tripled overnight. That wasn’t luck. It was policy turning into price.

Now, the same spotlight is swinging toward copper, nickel, platinum, and other metals that feed AI data centers, renewable grids, and defense manufacturing.

And this time, the setup points directly toward Canada.

That’s where Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) comes in.

The White House Is Driving a Minerals Arms Race

Trump’s second-term policy agenda is expected to include one of the most aggressive friendshoring programs in history.

The goal is simple. Secure supply of critical metals from trusted allies.

China controls most of the world’s refining capacity and a growing share of mine supply.

The US knows that dependency is a national security threat.

So Washington is making it clear: either mine it at home, or buy it from friends.

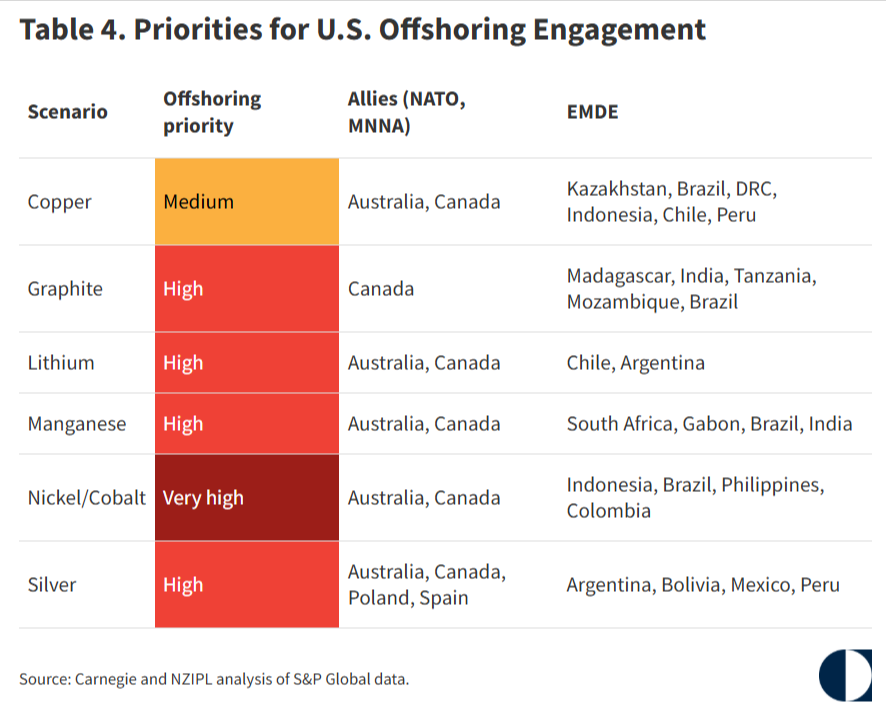

The Carnegie Endowment just ranked Canada and Australia as the top allies for offshoring critical minerals. These are the countries where American capital will go first.

Source: Carnegie Endowment, “Securing America’s Critical Minerals Supply,” October 2025, built on S&P Global data (carnegieendowment.org/research/2025/10/securing-americas-critical-minerals-supply?lang=en).

That puts Quebec and Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) in the direct slipstream of this historic policy shift.

Friendshoring Favors Quebec, Canada

Quebec isn’t just another mining jurisdiction. It’s one of the safest and most advanced in the world.

Hydropower, highways, and a world-class workforce are already in place. The provincial government backs mining with generous tax incentives that cover up to 50% of exploration and development costs.

When Washington says “source from allies,” Quebec becomes ground zero.

That’s why investors are paying attention to Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) and its flagship Nisk Project, a 331-square-kilometer land package in one of the world’s richest geological belts.2

This is no grassroots exploration story.

It’s a polymetallic system containing copper, nickel, platinum group metals, gold, and silver, the exact metals Washington needs to keep its industrial base running.

Policy Into Price: The Proven Playbook

We’ve already seen how one policy headline can light a fuse.

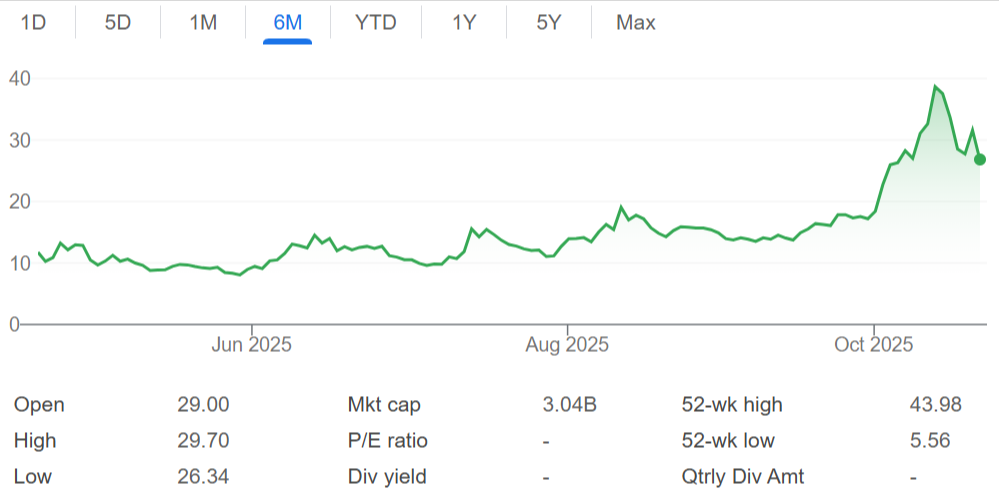

A simple mention of “rare earth security” recently sent USA Rare Earth soaring from $18 to $43.98 – a 144% gain in weeks.

It’s the same dynamic unfolding again, only this time the focus is broader.

The next headlines will revolve around battery metals, grid copper, and hydrogen catalysts.

Each new announcement from Washington has the potential to trigger revaluations across the entire sector.

That’s why Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is positioned right where the capital will flow.

It’s not about speculation. It’s about alignment.

When policy favors Canadian supply and the market rewards real assets in safe jurisdictions, the companies with credible tonnage and strong financing tend to move first.

Press Releases

- Power Metallic Intercepts 4.40 Meters of 12.18% Cu (14.34% CuEqRec) included within 20.40 Meters of 2.91% Cu (3.58% CuEqRec) in Hole 25-029b at Lion, and Completes the Extension of PN-24-064 to define large off-hole BHEM anomaly

- Power Metallic Intercepts 5.35 Meters of 11.97% Cu (16.35% CuEqRec) in Hole 25-022 Infill Drilling Expanding the Lion Zone and Updates on Fall/Winter Drill Program and Land Assembly

- Power Nickel Recognized as a 2024 Top 50 Performer on the TSX Venture Exchange and Ranked #1 Mining Company

- Power Nickel Hole PN-24-095a Delivers 10.60% CuEq1 over 5.35 Metres Within 3.61% CuEq1 over 19.40 Metres

- Power Nickel and Chilean Metals Announce Completion of Spin-Out

What Makes Power Metallic Mines Stand Out

The numbers speak for themselves.

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) delivered one of the most impressive polymetallic drill results in recent years: 32 meters at 6.97% copper equivalent and 34.2 meters at 5.8% CuEq Rec.3

Those grades rank among the best copper intercepts globally in 2024.4

It’s not just the grades that stand out. It’s the mix.

Copper for data centers and the grid. Nickel for EV batteries. PGMs for hydrogen fuel cells. Silver and gold for cost offsets and margin expansion.

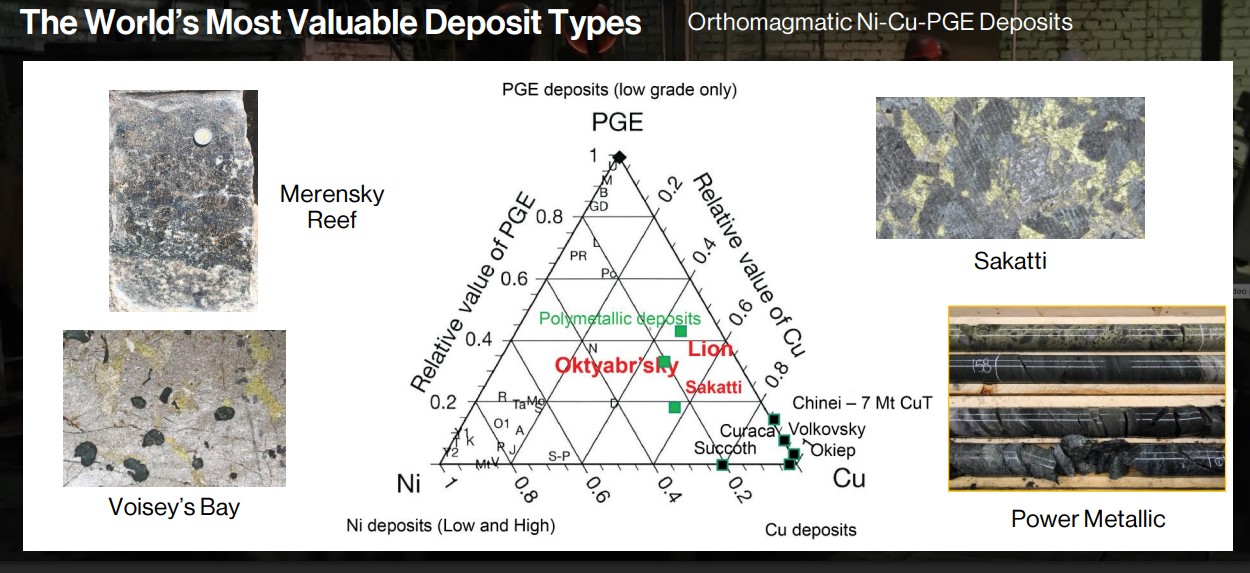

This is a rare geological cocktail, the kind that built Norilsk, the world’s richest polymetallic mine.

From Nickel to Nirvana

As many great discoveries have occurred serendipity was involved. Nisk started as a normal medium grade Nickel sulfide

Nisk’s 2023 NI 43-101 Mineral Resource Estimate highlights a robust resource base:5

-

-

- Indicated Underground Resource: 4.91 Mt @ 1.07% NiEq (including 0.78% Ni, 0.42% Cu, 0.05% Co, and 0.78 g/t Pd).

- Inferred Underground Resource: 1.8 Mt @ 1.35% NiEq (including 0.98% Ni, 0.45% Cu, 0.06% Co, and 1.11 g/t Pd).

- Open Pit Resource (Indicated): 0.52 Mt @ 0.84% NiEq (including 0.63% Ni, 0.30% Cu, 0.04% Co, and 0.56 g/t Pd).

-

Then Lady Luck appeared when Power Metallic drilled what it thought was another nickel target 5.5 kilometres away and discovered the Lion Zone.

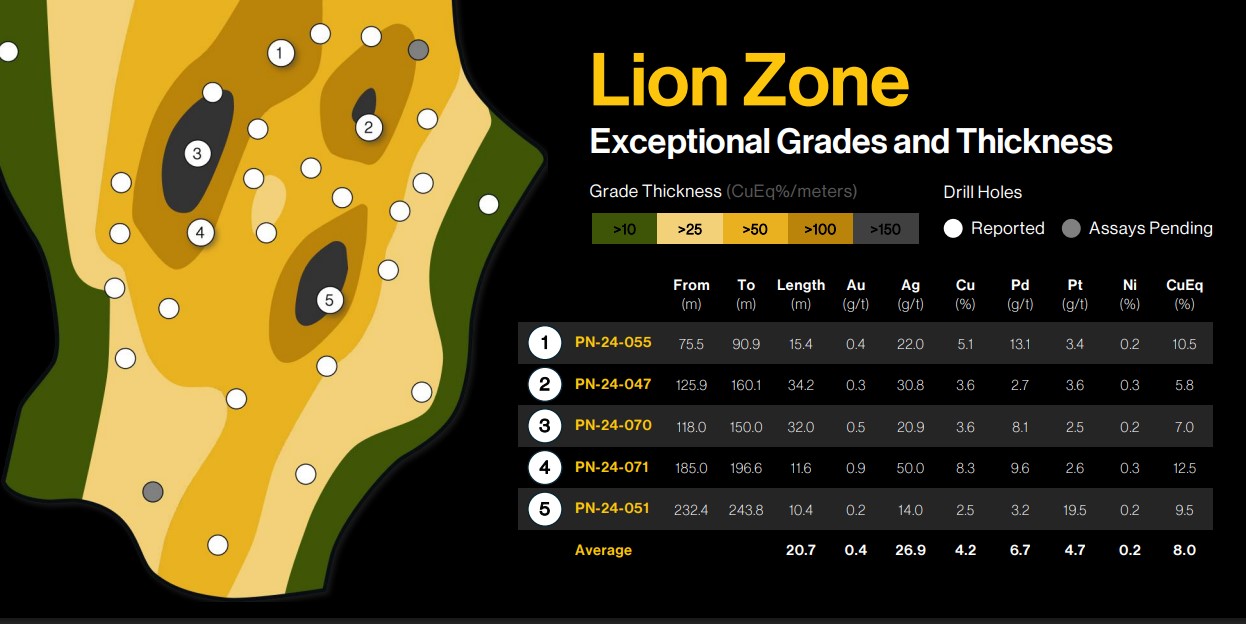

The Lion Zone Could Be a Game-Changer

The Lion Zone at Nisk is shaping up to be a game-changing discovery, delivering results that are nothing short of extraordinary.

Step-out drilling has revealed 32 meters at 8.4% CuEq Rec and 17 meters at 4.64% CuEq Rec.

These are high-grade numbers even by global standards.

The Lion Zone sits just 5.5 kilometers from the main Nisk deposit and could represent a second major mineralized body within the same system.

Analysts estimate it could contain over 9.4 million tonnes at 7% CuEq, potentially ranking among the top polymetallic discoveries in the World.6

Every new assay builds confidence that Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is sitting on a district-scale system rather than a single deposit.

And because the company owns 80% of the original discovery package and 100% of the surrounding 270 square-kilometer land package, any new zone discovered automatically adds value to shareholders.

Insiders and Institutions Are Already In

When you see names like Robert Friedland7 and Rob McEwen on the shareholder list, you know something special is happening.

These aren’t traders chasing momentum. They’re builders of billion-dollar mining companies who recognize world-class potential when they see it.

Friedland helped turn Ivanhoe Mines into a $15 billion powerhouse. McEwen founded GoldCorp, one of the biggest gold producers in North America.

Both have backed Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) — aligning their money and reputation with its success.

In the last financing round, led by these investors, the company brought in C$50 million priced at C$1.45 per share.8 Today, the stock trades at almost 20% less, a disconnect from the company’s drill success and land acquisition program. Power Metallic is executing where it matters most, yet the market hasn’t caught up. For anyone watching the story unfold, this kind of disconnect is what makes early discovery phases so compelling.

“Raising the $50 Million will enable us to accelerate the pace of exploration dramatically…These are exciting times for our management team and our shareholders. We very much appreciate the faith shown by our newest investors and look forward to delivering even more impressive results in the weeks and months ahead.” – Terry Lynch Chief Executive Officer, Power Metallic9

This is not a retail-driven promotion. It’s a professionally run development story with institutional support and a clear path to value creation.

They’re fully funded for their drilling program through the end of 2026, with over $40 million in the bank as of last quarter.10

The Nisk Advantage: Low-Cost, High-Impact. Building the World’s First Carbon-Neutral Polymetallic Mine

Mining is about more than grades. It’s about economics.

The Nisk Project’s location in Quebec gives Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) a structural advantage few others can match.

Quebec’s hydroelectric power is among the cheapest and cleanest in the world. That cuts costs and carbon emissions simultaneously.

Road access, local talent, and a mining-friendly regulatory regime make development faster and less risky.

It’s the opposite of the logistical nightmare most miners face.

That’s why Quebec is attracting capital from global funds, and why American policymakers see it as a secure extension of their own supply chain.

This story isn’t just about metal in the ground. It’s about how mining is evolving.

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) aims to build the world’s first carbon-neutral polymetallic mine.

By partnering with Karbon X to offset emissions, using hydropower from Quebec, and working with CVMR to process metals through cleaner refining methods, the company is aligning with the ESG mandates that institutional investors demand.

Even the leftover rocks, called ultramafic tailings, naturally capture and trap CO₂ from the atmosphere.

That means the Nisk Project could remove carbon rather than emit it.

It’s a bold vision: mining that’s profitable, sustainable, and future-proof.

The Names That Make Institutions Pay Attention

Execution matters as much as the asset.

At the helm of Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is CEO Terry Lynch, a veteran of both mining and capital markets.

He’s also the founder of Save Canadian Mining, an initiative supported by major industry players to restore fairness in junior capital markets.

Lynch is backed by an elite technical team:

-

-

- Joe Campbell, VP Exploration, a geologist with over 40 years of experience managing discoveries now operated by majors like Agnico Eagle.

- Dr. Steve Beresford, polymetallic specialist and former Chief Geologist at First Quantum and MMG and CSO of IGO

- Seamus O’Regan Jr., former Canadian Minister of Energy and Natural Resources, who also served as Minister of Indigenous Affairs and several other portfolios, bringing direct policy insight.

- Jon Christian “JC” Evensen, ex-Morgan Stanley Managing Director and advisor to Patriot Battery Metals during its breakout phase.

-

Together, they combine the science of discovery with the discipline of finance — a rare mix in the junior mining world.

It’s why Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) has moved from concept to credibility faster than most explorers ever do.

The Moment Before the Move

While peer companies like Foran Mining and Adriatic Metals trade near or above the billion-dollar mark, Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) remains valued at roughly C$275 million.

Yet its grades, jurisdiction, and backers rival or exceed theirs.

Foran’s McIlvenna Bay deposit averages 2.04 % CuEq.11 Power Metallic is hitting over 6% CuEq.

That’s why early investors see a disconnect between market value and geological reality.

History shows these gaps don’t last forever.

Every commodity cycle has a defining moment.

The winners are the companies that are permitted, financed, and positioned before the next policy announcement hits.

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) checks those boxes.

-

-

- Fully funded through 2026.

- A steady cadence of drill results.

- Growing zones with record-high copper equivalent grades.

- Backed by industry legends and aligned insiders.

-

And all of it happening as Washington prepares another round of critical-minerals actions that could ignite the sector again.

This is the window before the wave.

When policy becomes price, this is the kind of stock that moves first.

You’ve seen how fast capital moves when the headlines hit.

You’ve seen what happens when a small-cap explorer sits in the right jurisdiction, with the right mix of metals, at the right time.

Now is the moment to learn more about Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) and the extraordinary Nisk Project in Quebec.

Download the corporate presentation and see why institutions, insiders, and policy makers are all looking north for the metals America needs most.

The story is unfolding fast and every headline out of Washington could be the catalyst for the next move.

Click here to download the corporate presentation now.[\popuplink]