Get ready for the ride of a lifetime.

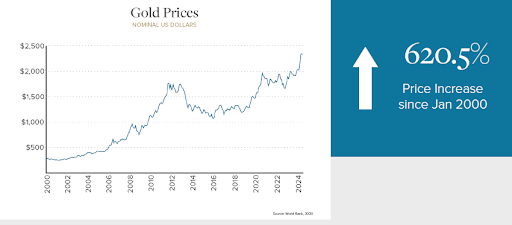

We’re in the thick of a major metals supercycle, with prices surging to record highs across the board.

And according to experts, this is just the beginning.

Sprott and other global heavyweights are eyeing even more unprecedented gains for gold, silver, copper, and zinc thanks to supply shortages, geopolitical unrest, and insatiable demand.¹

Citigroup, Goldman Sachs and Bank of America are all calling for $3,000 gold by mid-2025.²

Silver has already hit $33 per ounce for the first time since 2012—and some are saying it could soar to a jaw-dropping $100 per ounce in what’s being hailed as the “greatest silver bull market of our generation.“³

Silver has already hit $33 per ounce for the first time since 2012—and some are saying it could soar to a jaw-dropping $100 per ounce in what’s being hailed as the “greatest silver bull market of our generation.“³

The price of copper is up over 17% from the beginning of the year.⁴

The price of copper is up over 17% from the beginning of the year.⁴

And zinc is up over 15% since the start of 2024.⁵

The momentum shows no signs of slowing, as electric vehicles, data centers, and emerging markets drive demand through the roof.⁶

The numbers tell the story:

- Investors have added about 2.3 million ounces of gold to their holdings since mid-May⁷

- The silver market is expected to have its 2nd biggest deficit in over 2 decades this year⁸

- Copper demand is expected to grow by 1 million tons per year until 2035 (2x the volume over the last 15 years)⁹

- The zinc oxide market is expected to grow at a CAGR of 5.7% to $9B+ by 2032 due to widespread demand from industrial and healthcare applications¹⁰

For multi-metal miners, this is an opportunity that has not existed since CV-19.

A perfect example is Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF)—a polymetallic powerhouse sitting on a treasure trove of gold, silver, copper, and zinc in one of the world’s most coveted mining jurisdictions.

With low-cost, fast-track development plans, Nova Pacific is primed to ride this metals supercycle to new heights.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Polymetallic Powerhouse: Property, Plan & People for Near-Term Production

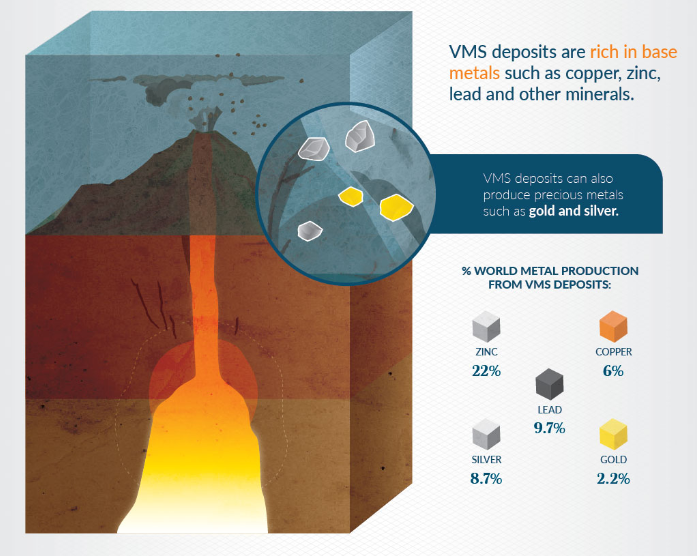

Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) is laser-focused on rapidly advancing its near-surface, volcanogenic massive sulfide (VMS) deposit—one that’s rich in copper, gold, silver, and zinc.

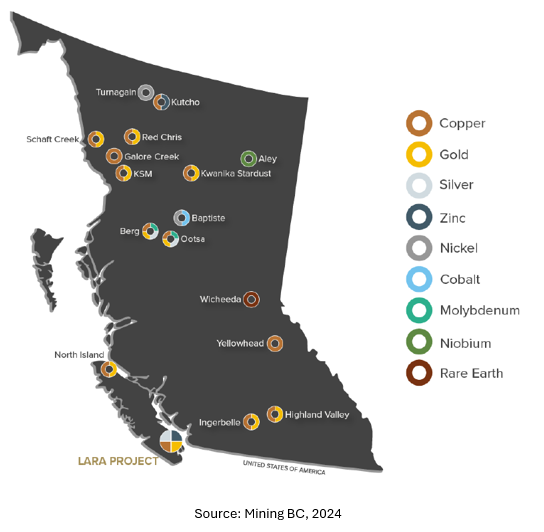

Nova’s flagship Lara VMS Project is located just 40 miles from British Columbia’s capital, Victoria, and a mere 9 miles from a deep-water port, offering unparalleled access to infrastructure.

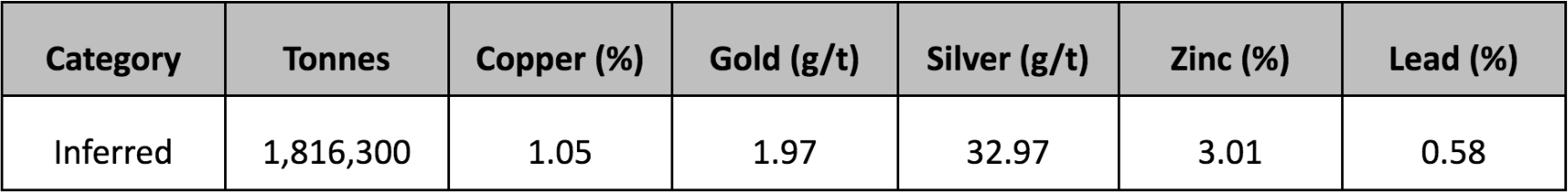

Oh, and did we mention that the project boasts an impressive 1.8 million tonnes of Inferred resources?¹¹

Current Mineral Resource Estimate: 1.8 Million Tonnes (Inferred)

Source: Nova Pacific Metals’ Independent NI 43-101 compliant technical report, July 15, 2024¹²

But here’s what makes this project better than most of the junior miners trading today: 80% of the property is still unexplored, meaning the upside potential of this project is enormous.

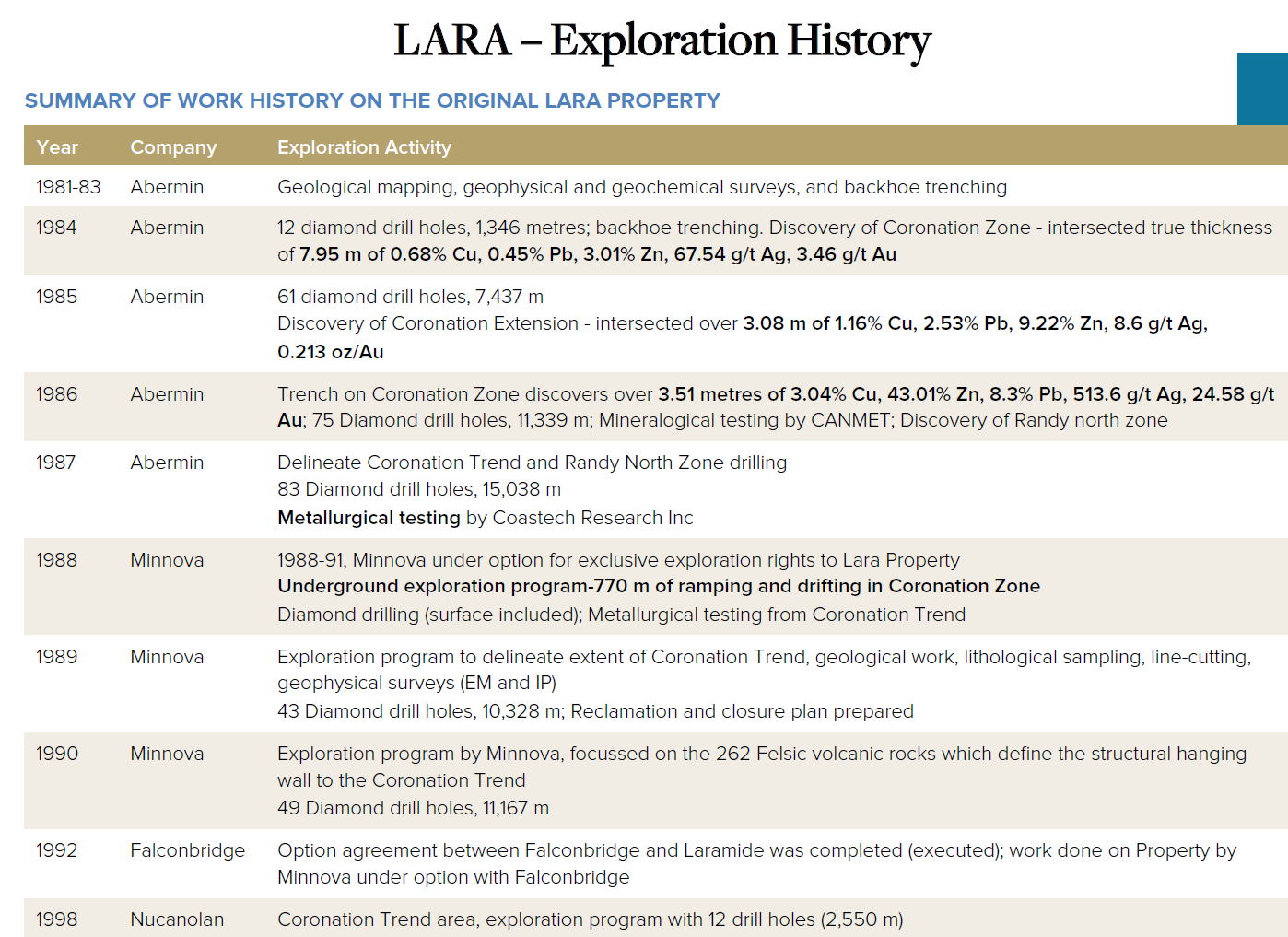

Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) has strategically positioned itself with a world-class asset, supported by a solid history of exploration.

The groundwork has been laid with:

- 323 drill holes¹³

- 58,000+ meters of drilling

- 640 meters of underground development

This extensive work, valued at over $30 million today, accelerates their path to development. Nova Pacific isn’t focused on exploration—they’re fully committed to advancing the development of this project.

That means this mining company isn’t in the exploration business…they’re in the development business. Exploration will be a priority once production revenues are achieved.

Nova Pacific Metals’ (CSE:NVPC) (OTCQB:NVPCF) is executing a strategic plan to revive the Lara deposit, which was placed on care and maintenance in the early ’90s due to low metal prices. Since acquiring the property in June 2024, the company aims to bring it back online quickly.

Key highlights include:

- An industry-leading team with over 120 years of combined experience, including Dal Brynelsen, a founding director of Griffin Mining with four decades of underground mining and project development experience.

- 10-20% insider ownership and a recently upsized $3 million private placement¹⁴ ensure the company continues to be well held and fully funded for its next development stages.

With up to 80% of the project still under-explored¹⁵ and infill drilling scheduled for January 2025¹⁶, Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) is poised to capitalize on the property’s advanced historical results and development potential.

9 Reasons

to Add Nova Pacific Metals (CSE:NVPC) (OTCQB:NVPCF) To Your Watchlist

1

Supercharged Metal Supercycle: Global heavyweights like Sprott are calling it— we’re entering a metals supercycle. Gold, silver, copper, and zinc are all skyrocketing, and Nova Pacific Metals is perfectly positioned to capitalize.¹⁷

2

Soaring Prices & Rising Demand: Prices for key metals are soaring, driven by demand that’s outstripping supply. Gold’s projected to hit $3,000 by 2025¹⁸, and silver’s headed for $100 per ounce.¹⁹

3

Significant Polymetallic Resource: Nova Pacific Metals’s (CSE:NVPC) (OTCQB:NVPCF) Lara Project is sitting on a treasure trove of gold, silver, copper, and zinc, with up to 60% of the deposit’s value in precious metal.

4

Prolific Mining Jurisdiction & Excellent Infrastructure: BC is Canada’s largest mining province²⁰ with $16.6B production value in 2023²¹; all-year direct access to roads, power & deep-water ports.

5

Millions Already Invested in Development: With 323 drill holes, 58,000+ meters of drilling, and 640 meters of underground access—infrastructure that would cost around $30 million today—Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) has a major head start.

6

Excellent Potential for Resource Expansion: Up to 80% of the Lara Project is under-explored & Phase I exploration activities scheduled for Q1 2025.²²

7

Clear Pathway to Production: Brownfield development enables rapid & low-cost development with reduced up-front expenses.

8

Tight Share Structure: Insiders closest to the company’s vision hold 10-20% of shares—ensuring alignment and confidence in the company’s success.

9

An All-Star Team: Led by a proven team with over 120 years of combined industry experience, including Dal Brynelsen—one of the key figures behind discovery and development of one of China’s largest zinc-lead-gold mines²³—Nova Pacific has the leadership to execute and succeed.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Rich Metal Deposit in a Tier 1 Mining Location

Nova Pacific Metals’ (CSE:NVPC) (OTCQB:NVPCF) holds a valuable key asset with its 4,567-acre Lara Project—a polymetallic VMS deposit that offers exposure to multiple high-demand metals.

Up to 60% of the deposit’s potential value is locked in precious metals like gold and silver, giving it a huge edge in today’s market.

VMS deposits are some of the richest metal sources in the world, contributing significantly to global production: 22% of zinc, 9.7% of lead, 6% of copper, 8.7% of silver, and 2.2% of gold come from these types of deposits, making the Lara Project a diversified source of metals.²⁴

Source: Visual Capitalist²⁵

Source: Visual Capitalist²⁵

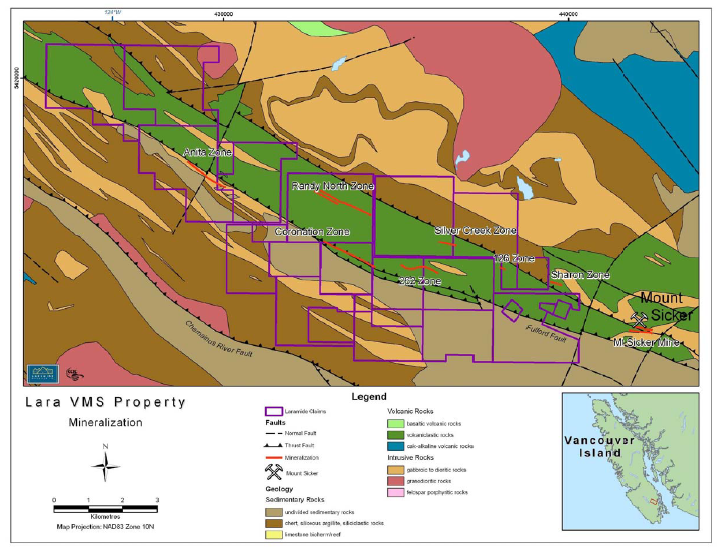

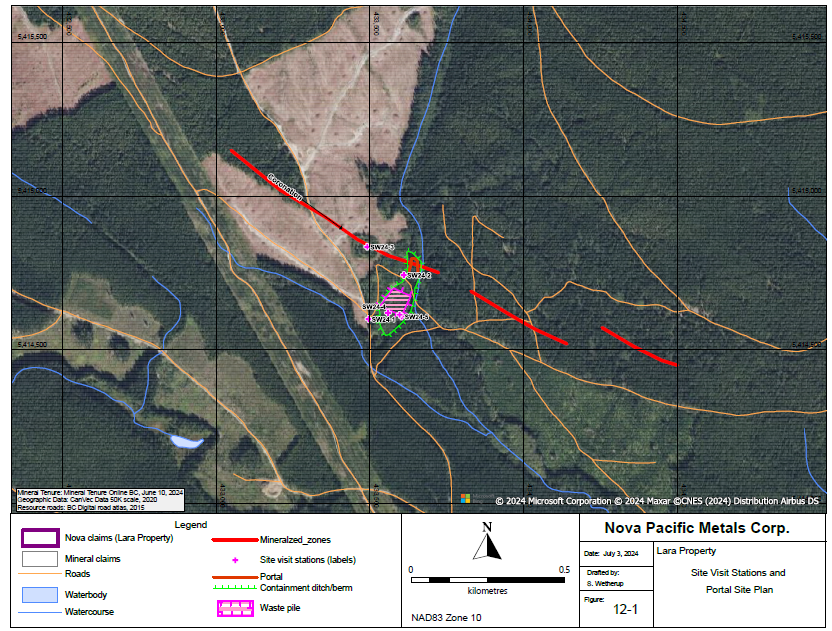

Historical exploration at Lara has already revealed significant results—particularly along the Coronation Trend, which is open to expansion both along strike and at depth. Several other zones have shown similar promise.

Lara VMS Property: Coronation Trend (near center) & multiple surrounding target mineralized exploration zones

Lara VMS Property: Coronation Trend (near center) & multiple surrounding target mineralized exploration zones

The exploration returned high grades of gold, silver, copper, and zinc, including the drill result highlights below.

Lara Project Highlighted Historical Grade Drill Results

Source: Nova Pacific Metals Investor Summary²⁶

Some of the most impressive results from the project include:

- 24.58 g/t gold

- 513.6 g/t silver

- 3.04% copper

- 43.01% zinc over 3.51 meters

These grades highlight the significant value of the mineral resources within this project. And this is just the beginning…²⁷

The Lara Project also shares geological similarities with the Myra Falls Mine, located approximately 90 miles (145 km) to the northwest, where roughly 40 million tons of polymetallic ore was mined.²⁸

As mentioned, Nova Pacific Metals Corp.’s (CSE:NVPC) (OTCQB:NVPCF) flagship project is strategically located in the Tier 1 mining-friendly jurisdiction of BC, Canada’s largest mining province²⁹ with $16.6B production value last year across multiple metals.³⁰

Key infrastructure surrounds the Lara Project, including:

- All-year road access

- BC Hydro power line cutting through the property

- Nearby seaports with direct shipping routes to smelters worldwide

- Skilled labor in nearby population centers³¹

Combined with the project’s strong community ties and supportive regulatory environment, Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) is positioned for de-risked, low-cost, rapid brownfield development and resource expansion.³²

The company’s newly updated NI 43-101 technical report highlights that there’s still a lot of untapped potential for further exploration at the Lara Project.

Only one of the four mineralized zones, the Coronation Trend, has been significantly explored, and there’s strong evidence that deeper drilling and more exploration along this trend could discover even more mineralization. This suggests plenty of room for expansion.

Source: Nova Pacific Metals’ Independent NI 43-101 compliant technical report, July 15, 2024

The report’s recommended next steps were for Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) to drill 40 additional short holes, totaling 6,000 meters, in the Coronation Zone’s historical resource areas, for which the company has already requested the necessary permits. The intent is to confirm the historical mineral estimates as well as potentially expand the project’s existing resources.³³

Multi-Metal Mining Stocks Benefitting from Hot Metals Markets

Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) isn’t alone in tapping into Canada’s rich mineral resources and gaining support from multiple high metals prices.

Foran Mining has nine properties in Canada, including McIlvenna Bay, the largest undeveloped VMS deposit along the prolific Flin Flon Greenstone Belt in Saskatchewan. The project has Probable Mineral Reserves of 25.7 million tonnes (Mt) containing 697 million pounds of copper and 1.4 billion pounds of zinc.³⁴

Canadian mining exploration and development company Skeena Resources is revitalizing two past-producing mines in northwest BC. Their Eskay Creek project is a high-grade VMS gold-silver deposit with Proven and Probable Reserves of 4.6 million ounces (Moz) gold-equivalent (AuEq) at an average grade of 3.6 grams per ton (g/t) AuEq.³⁵

Hudbay Minerals is Canada’s 3rd-largest copper producer in Canada with operations in BC and Manitoba. Production from their gold-zinc-copper-silver Lalor mine in 2023 included 12,154 tonnes copper, 34,642 tonnes zinc, 187,363 ounces gold & DORÉ, and 851,723 ounces silver.³⁶

A closer comparison to Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) would be the junior exploration company Goliath Resources. Their high-grade polymetallic gold-silver discovery at the Golddigger property has been a game-changer³⁷, noting the result of 65,000 meters of drilling across just three seasons.³⁸

That means Goliath Resources has sunk less than a third of the drill holes than there are on Nova Pacific Metals’ (CSE:NVPC) (OTCQB:NVPCF) Lara Property…yet Goliath has a $124M market cap versus Nova Pacific’s ~$5M market cap. That shows the amount that Nova Pacific’s stock is currently undervalued based on level of project development.

Here’s how these multi-metal miners stack up against each other in today’s red-hot metals market:

Strategic Milestones & Upcoming Developments

Nova Pacific Metals’ (CSE:NVPC) (OTCQB:NVPCF) upcoming timeline for the Lara Project³⁹ is a masterclass in rapid milestone execution that only true industry veterans could achieve.

- Application for 50-drill hole permit: Completed and ready to fuel the next phase of exploration.

- 3D georeferencing and infill drill targeting: In progress, unlocking precise drilling locations for maximum impact.

- Infill drilling program: Scheduled to kick off in Q1 2025, aimed at defining a deposit that can support a timely production decision.

- Preparation of a detailed Plan of Operation: Set to begin in Q1 2026, the first critical step toward securing a mining permit.

- Scoping study for sensor-based ore sorting: Planning underway to integrate cutting-edge tech and enhance ore recovery.

- Environmental study enhancements: Set to commence in Q1 2025, building on existing assessments.

- Updated NI 43-101 report: Coming Q2 2025 with updated tonnage and grade estimates, reinforcing the project’s value.

- Completion of underground mining engineering studies: Set for Q1 2026, targeting a high-efficiency 500 tonnes per day operation.

These fast-tracked short-term milestones present a clear pathway toward production and revenue, adding credibility to Nova Pacific Metals’ (CSE:NVPC) (OTCQB:NVPCF) development plan and valuation.

Management Team with Proven Track Records in Mineral Exploration

Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) has the leadership advantage of 120+ years of combined mineral exploration and development expertise, both internationally and in BC.

9 Reasons

to Add Nova Pacific Metals (CSE:NVPC) (OTCQB:NVPCF) To Your Watchlist

1

Emerging Supercycle: Experts predict we’re entering a major metals supercycle.⁴⁰

2

Soaring Prices & Rising Demand: Gold, silver, copper, and zinc are all surging, with demand outpacing supply.

3

Significant Polymetallic Resource: Lara Project boasts high-grade gold, silver, copper, and zinc.

4

Prolific Mining Jurisdiction & Excellent Infrastructure: Based in BC, Canada’s top mining province, with excellent infrastructure.⁴¹

5

Extensive Development Already in Place: $30M worth of historical work already done on-site.

6

Excellent Potential for Resource Expansion: Up to 80% of Lara Project is under-explored; Phase I exploration scheduled for Q1 2025.⁴²

7

Clear Pathway to Production: Brownfield development enables rapid & low-cost development

8

Optimum Share Structure: 10-20% insider ownership of 25.2M shares outstanding

9

Proven Team of Industry Pros: 120+ years of combined experience

Don’t wait until it’s too late—dive deeper into what Nova Pacific Metals Corp. (CSE:NVPC) (OTCQB:NVPCF) has to offer.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

J. Malcolm BellCEO

J. Malcolm BellCEO Dal BrynelsenDirector

Dal BrynelsenDirector David Mark P. GeoDirector

David Mark P. GeoDirector