Something big is happening in the uranium market.

Uranium demand is surging. Supply is tightening. And a new wave of US policies is about to send prices soaring.

The world’s wealthiest, most influential investors are already positioning themselves for what’s to come.

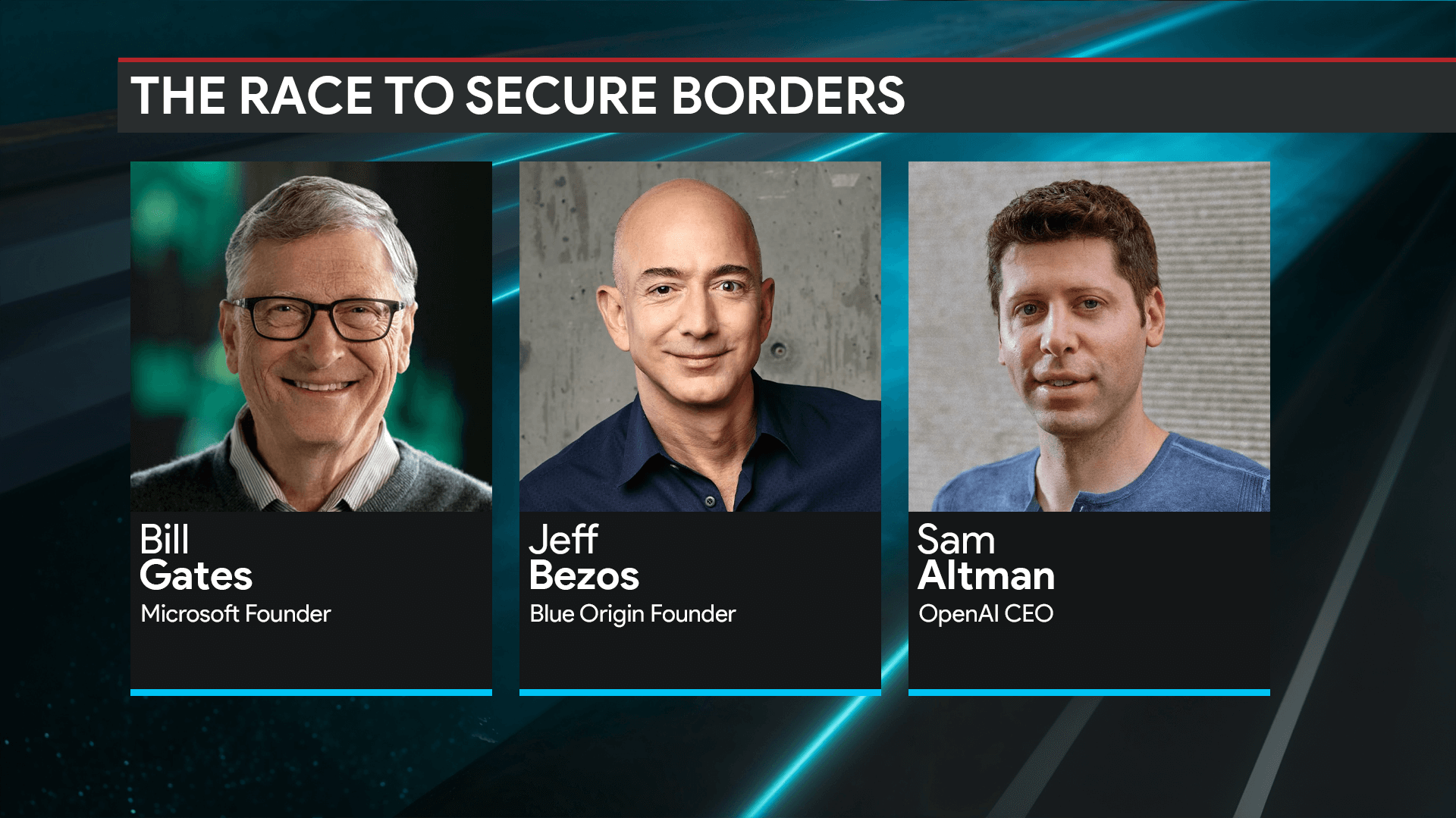

Bill Gates. Jeff Bezos. Sam Altman.

These tech titans made their billions pioneering revolutions in e-commerce, software, and artificial intelligence. Now, they’re placing their bets on nuclear energy—a market set to explode as global power demand skyrockets.

-

-

- Bill Gates founded TerraPower,1 which just secured $2 billion from the US Department of Energy to build next-gen nuclear reactors.2

- Jeff Bezos is backing General Fusion, a Canadian startup working on commercializing nuclear fusion.3

- Sam Altman is going all in on Oklo, a company developing micro-reactors that can run on nuclear waste.4

-

Why? Because the world desperately needs more energy.

The International Energy Agency (IEA) projects global electricity demand will increase by over 50% by 2050—driven by AI-powered data centers, electric vehicles, and the growing push for clean energy.

And nuclear is the only reliable, carbon-free energy source that can scale to meet this demand.

Trump’s Uranium Tariffs Just Changed Everything

In February, the Trump administration threatened new tariffs on imported uranium, sending shockwaves through the nuclear energy sector.6

-

-

- US utilities must now source more uranium from North American suppliers.

- Imported uranium will cost significantly more, forcing utilities to lock in new contracts ASAP.

- With demand rapidly rising and supply tightening, uranium prices could explode.

-

The US relies on nuclear power for 20% of its electricity—but here’s the problem:

-

-

- 99% of US uranium was imported in 20237

- Nearly 25% of that supply comes from Canada.8

- US uranium production is at historic lows.

-

Now, with Trump’s tariffs making imported uranium dramatically more expensive, US energy companies are scrambling to secure domestic-friendly supply.

This is already happening right now—and the companies in position to fill the supply gap could see enormous upside.

For uranium investors, this is the moment—just like oil in the early 2000s or lithium before the EV boom.

And the last time uranium prices surged, a handful of early-stage explorers turned into billion-dollar companies.

The UEC Blueprint: The $3.11 Billion Juggernaut That Started Small

Five years ago, Uranium Energy Corp (AMEX:UEC) was a small uranium junior trading at just $0.60 per share.

Most investors ignored it.

But those who saw the uranium boom coming? They made a fortune.

UEC’s share price exploded by over 2,500%, turning early believers into millionaires.

Now, investors are hunting for the next UEC—and Azincourt Energy (TSXV:AAZ) (OTC:AZURF) could be exactly that.

Azincourt Energy: The Tiny Uranium Junior in the Athabasca Basin with Huge Potential

Azincourt Energy Corp. (TSXV:AAZ) (OTC:AZURF) is positioned right where the world’s richest uranium deposits are found—Canada’s Athabasca Basin.

It’s the same uranium hotspot that produced Cameco’s (NYSE:CCJ) McArthur River mine, the world’s largest high-grade uranium mine.

But unlike many of the companies that have flooded the space as uranium prices climb, Azincourt isn’t a newcomer.

The number of uranium juniors has quadrupled in recent years, with many having little to no experience in exploration. Even fewer have geologists with major uranium discoveries on their resume—Azincourt does.

With years of experience in uranium exploration and a team that has worked on some of the sector’s biggest finds, Azincourt stands apart from the latecomers chasing the uranium boom.

With exploration advancing and new data analysis underway, Azincourt Energy could be on the verge of a breakout.

Why Now?

-

-

- Uranium demand is projected to rise 28% by 2030.9

- The US is scrambling for supply, cutting Russian imports and pouring billions into domestic-friendly uranium sources.10

- Azincourt’s previous drill programs already confirmed uranium-bearing structures in one of the world’s richest uranium zones.

-

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Azincourt Energy’s Flagship Uranium Projects: A Closer Look

With strategic projects in Canada’s premier uranium-producing regions, Azincourt Energy (TSXV:AAZ) (OTC:AZURF) is well-positioned to capitalize on the growing demand for nuclear fuel.

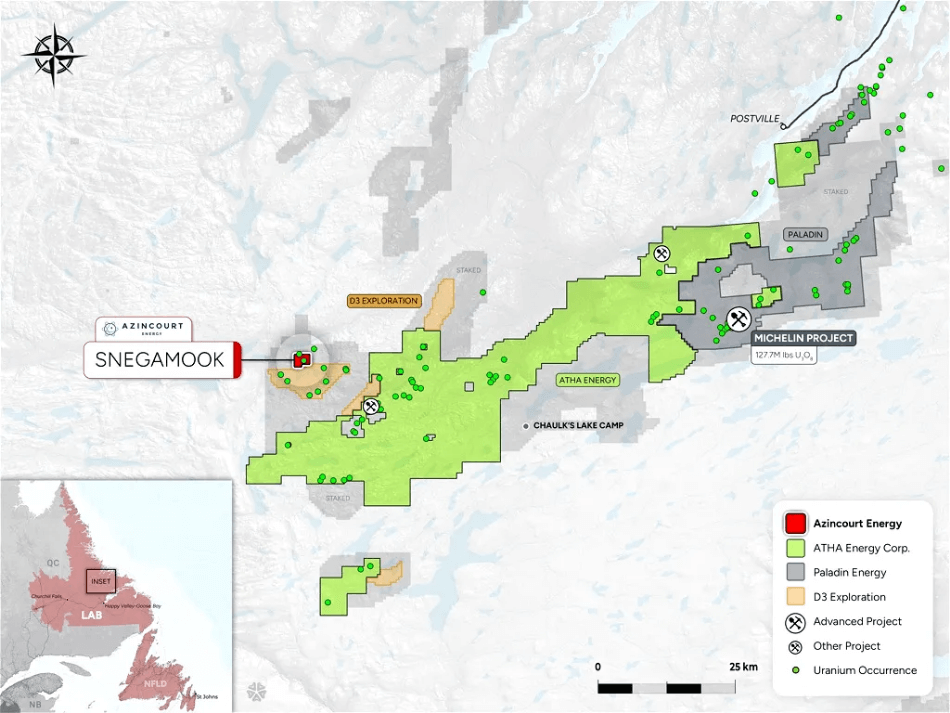

Snegamook Uranium Project – Central Mineral Belt, Labrador

-

-

- 100% optioned ownership in one of Canada’s most underexplored uranium districts.

- Located near several large-scale uranium discoveries including the Two Time, Moran, Kitts, and Jacques Lake deposits. The region also hosts Paladin Energy’s (ASX:PDN) Michelin deposit, which holds over 84 million lbs of uranium.11

- Historical drilling already confirmed uranium mineralization—setting up for a potential breakthrough discovery.

-

Previous exploration (2006-2008) by Silver Spruce Resources identified four uranium-bearing lenses in the “Snegamook Zone” and additional mineralization 500m to the southeast.

Previous exploration (2006-2008) by Silver Spruce Resources identified four uranium-bearing lenses in the “Snegamook Zone” and additional mineralization 500m to the southeast.

Key drill results include:

-

-

-

- Snegamook Zone

- SN-08-8: 206 ppm U₃O₈ over 73 meters

- SN-08-06: 0.11% U₃O₈ over 4.5 meters including 0.97% over 0.5 meters

- Southeast

- SN-08-18: 0.11% U₃O₈ over 3 meters

- SN-08-20: 0.11% U₃O₈ over 2 meters

- Snegamook Zone

-

-

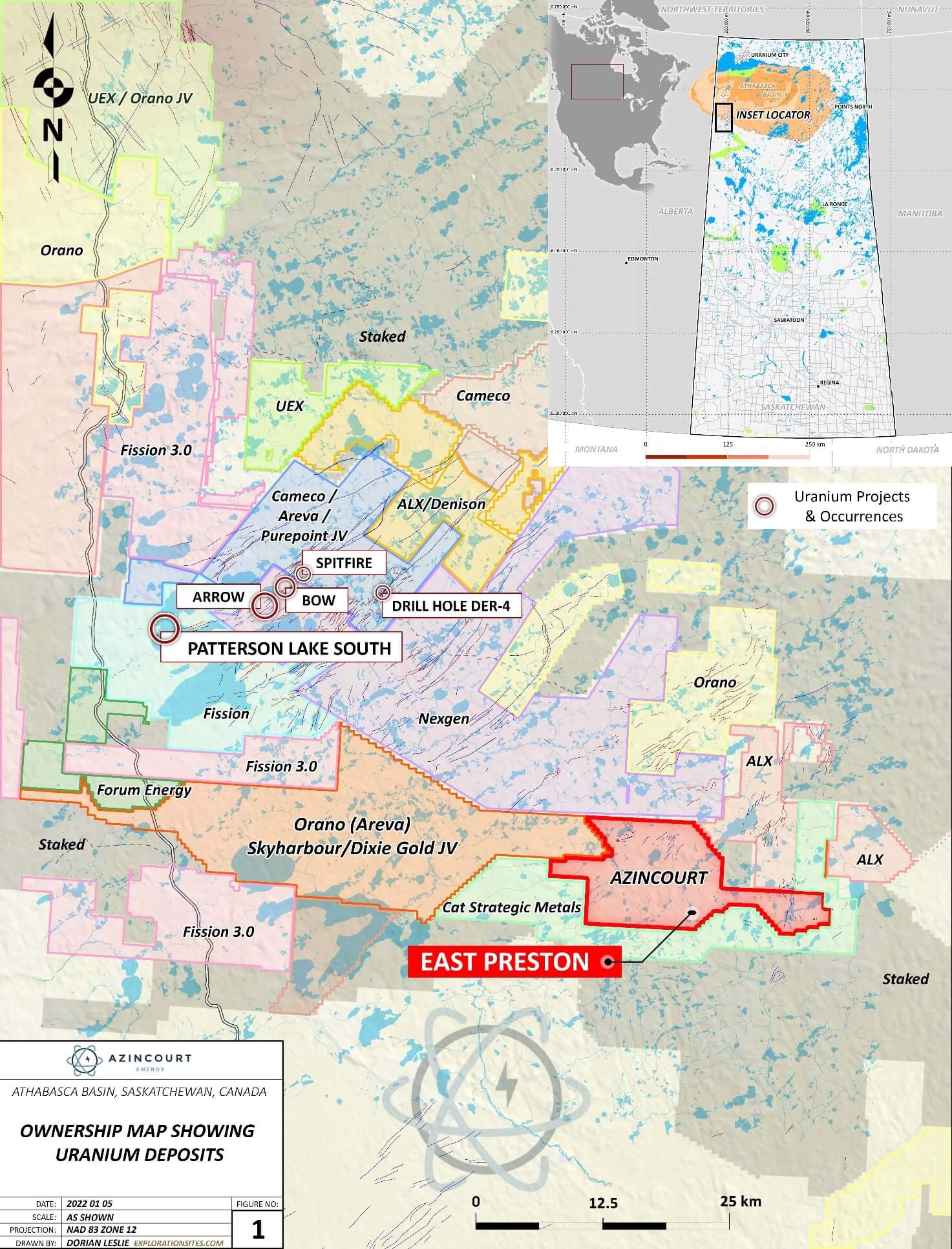

East Preston Uranium Project – Athabasca Basin, Saskatchewan

-

-

- 87% ownership in a 20,674-hectare uranium-rich land package.

- strategically positioned near high-grade uranium discoveries like NexGen Energy’s (TSX:NXE) Arrow Deposit, Paladin’s (OTC:PALAF) Triple R Deposit and Cameco’s (NYSE:CCJ) Spitfire Joint Venture

- Over C$10 million invested in exploration since 2018, identifying multiple uranium targets.

- Drill results have confirmed uranium-bearing alteration zones—a strong indicator of a major uranium deposit.

-

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Why Azincourt Energy (TSXV:AAZ) (OTC:AZURF) Stands Out

1️⃣ Prime Location in the World’s Best Uranium Zones

-

-

- Athabasca Basin: Home to the highest-grade uranium deposits on the planet, a critical supplier of global uranium demand.

- Central Mineral Belt: Massively underexplored, yet home to one of the largest uranium deposits in Canada

-

2️⃣ Drill Programs Are Delivering Results

-

-

- 14,500+ meters drilled

- 10km of uranium alteration zones

- Elevated radioactivity confirmed

-

3️⃣ Uranium Demand is Surging

-

-

- Demand is projected to rise 28% by 2030

- Supply is tightening, which will drive prices higher—a perfect storm for junior miners

-

4️⃣ The US Needs More Uranium—Fast

-

-

- Imports from Russia are being cut off, and the US is scrambling for supply

- Billions in funding is flowing into North American uranium projects

-

5️⃣ Azincourt Looks Like UEC Did 5 Years Ago

-

-

- UEC was once a tiny junior—now it’s a $3.11 billion uranium giant

- Azincourt is sitting on major uranium assets and ramping up drilling—exactly how UEC started

-

Could Azincourt Energy Be the Next UEC?

A decade ago, UEC was an unknown uranium junior.

Then, the uranium boom hit, and early investors saw 2,500%+ gains.

Now, Azincourt Energy (TSXV:AAZ) (OTC:AZURF) is positioned just like UEC was back then:

✅ Uranium-rich projects in world-class mining districts

✅ Drilling success confirming high-potential zones

✅ A market starved for supply amid rising demand

Yet, the market hasn’t caught on—yet.

For those looking for the next breakout uranium stock, Azincourt Energy (TSXV:AAZ) (OTC:AZURF) is definitely a company you want to watch.

Uranium is back in the spotlight—billionaires, hedge funds, and governments are all piling in.

And the uranium juniors with the best projects? They could be tomorrow’s majors.

Azincourt Energy (TSXV:AAZ) (OTC:AZURF) is already making progress—but the market hasn’t realized it yet.

Get ahead of the curve.

Subscribe now to download Azincourt Energy’s (TSXV:AAZ) (OTC:AZURF) corporate presentation and get exclusive investor insights.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers