First Majestic Silver

AG

announced that it has entered into an agreement to sell its fully-owned past-producing La Parrilla Silver Mine in Durango, Mexico to Golden Tag Resources Ltd. for $33.5 million. The silver, gold, lead and zinc operation had been placed under care and maintenance by AG in September 2019.

First Majestic will receive 143,673,684 shares in Golden Tag shares for a total value of $20 million. This represents approximately 40% of the outstanding shares in Golden Tag. Per the deal, AG will also receive up to $13.5 million as three milestone payments in either cash or shares in Golden Tag.

The first payment of $2.7 million in cash will be paid either 18 months following the closure of the transaction or, on the receipt of certain approvals in Mexico – whichever is earlier. The first deferred payment of $5.75 million in cash or shares will be payable upon receipt of a written resource estimate prepared by a qualified person, of 5 million ounces or more of silver equivalent reserves in La Parrilla, or 22 million ounces of silver equivalent measured and indicated resources on La Parrilla. The second deferred payment of $5.05 million in cash or shares will be paid on receipt of a written resource estimate prepared by a qualified person, of 12.5 million ounces of silver equivalent measured and indicated resources in a new zone on La Parrilla, in respect of which no mineral reserves or resources have been identified

The transaction will be closed after Golden Tag obtains the approval of the TSX Venture Exchange and other customary closing conditions are fulfilled.

First Majestic currently owns four producing mines. Among these, three are in Mexico – the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver Mine. The Jerritt Canyon Gold Mine is located in Nevada. Four of its mines are currently in care and maintenance. These include the San Martin Silver Mine, the Del Toro Silver Mine, the La Parrilla Silver Mine and the La Guitarra Mine. In May 2022, AG announced that it has entered into an agreement to sell the La Guitarra Silver Mine in Mexico to Sierra Madre Gold & Silver Ltd. in an all-share deal worth $35 million.

In the third quarter of 2022, First Majestic reported a loss of 9 cents per share, missing the consensus mark of a loss of 3 cents due to lower metal prices. AG reported a loss per share of 7 cents for the third quarter of 2021. Revenues for the quarter were $160 million, up 28% from the prior-year comparable quarter’s level. Higher production at San Dimas and Santa Elena, partially offset by a decrease in the average price per silver equivalent ounce sold, drove revenues. Earnings declined year over year due to higher costs of sales and lower metal prices.

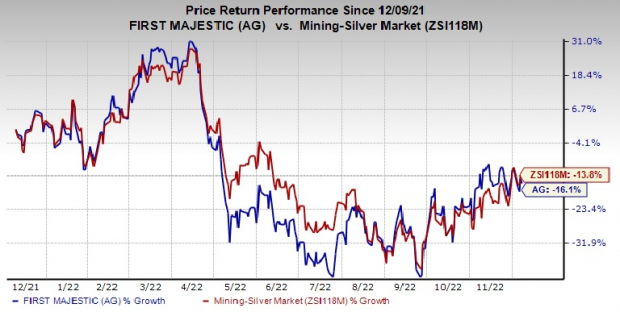

Price Performance

Image Source: Zacks Investment Research

Shares of the company have fallen 16.1% in the past year compared with the

industry

‘s decline of 13.8%.

Zacks Rank & Stocks to Consider

First Majestic currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space include

Olympic Steel, Inc.

ZEUS

,

Commercial Metals Company

CMC

and

Steel Dynamics, Inc.

STLD

.

Olympic Steel currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ZEUS’s current-year earnings has been revised 4.8% upward in the past 60 days. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 53% in a year.

Commercial Metals currently carries a Zacks Rank of 1. The consensus estimate for CMC’s current-year earnings has been revised 13.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 49% in a year.

Steel Dynamics has a projected earnings growth rate of 36.1% for the current year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 7.3% upward in the past 60 days.

Steel Dynamics has a trailing four-quarter earnings surprise of roughly 6.2%. STLD has rallied roughly 76% in a year. The company currently carries a Zacks Rank #2 (Buy).

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report