DTE Energy Company

DTE

recently announced that its combined-cycle natural gas-fired power plant in Michigan — Blue Water Energy Center — has finally commenced its operations. The 1,150-megawatt (MW) plant, which has been built to provide cleaner and affordable power for 850,000 customer homes in southeast Michigan, boasts an investment worth $1 billion.

With this recent development, the company takes a step forward in providing cleaner and reasonable energy for its Michigan customers while also assisting the state in pursuing its clean energy goals of achieving carbon neutrality by 2050.

DTE Energy’sClean Energy Goals

With the entire Utility sector transitioning to a clean energy environment, DTE Energy remains committed to reducing the carbon emission of its electric utility operations by 32% by 2023, 50% by 2030 and 80% by 2040 from the 2005 carbon emission levels. The company expanded this commitment by announcing a net-zero carbon emission goal for DTE Electric and DTE Gas by 2050.

To meet carbon reduction goals in the near term, DTE Electric plans to put in service another natural gas-fueled combined-cycle generation facility in 2022.

Apart from the aforementioned measure to mitigate climate crisis effects, DTE plans to expand in renewables through 4,000 MW of renewable energy from Michigan wind and solar farms while meeting its energy goals through investments in technologies like hydrogen and battery storage systems, thus ensuring the 24×7 provision of electricity for its customers and lower energy bills.

To this end, it is worth mentioning that DTE Energy currently intends to invest $40 billion over the next 10 years to support reliability, the addition of renewable resources and the increased pace of electric vehicle adoption. Such strategies should boost the company’s renewable energy portfolio in the coming days.

Other Utility Moves

To reap the benefits of the growing renewable market in the United States, utilities other than DTE Energy that are investing in combined-cycle natural gas-fired power plants include

Duke Energy

DUK

,

Dominion Energy

D

and

CMS Energy

CMS

.

Duke Energy invested $817 million to build the Asheville combined-cycle station. Its other combined-cycle stations include the Citrus combined-cycle station and a 750 MW combined-cycle natural gas plant at the W.S. Lee

Duke Energy boasts a long-term earnings growth rate of 6.1%. DUK shares have returned 10.5% in the past year.

Dominion Energy has significantly invested in the natural gas combined-cycle plant to boost its attainment of clean energy goals. Dominion Energy’s natural gas combined-cycle plants include the 540 MW Columbia Energy Center, the 875 MW Jasper Generating Plant, the 250 MW McMeekin Station and the 650 MW Urquhart Station.

Dominion Energy’s long-term earnings growth rate is pegged at 6.3%. D shares have returned 9.2% in the past year.

CMS Energy’s subsidiary, Consumer Energy, has two natural gas combined-cycle plants — one in Zeeland and one in Jackson — with a total generating capability of 1117 MW. The Zeeland facility employs two natural gas simple-cycle units providing an additional 360MW of generating capability. Together, The Zeeland and Jackson Generating Stations are capable of contributing more than 1,470 MW of clean energy to the grid.

CMS Energy boasts a long-term earnings growth rate of 8.4%. CMS shares have returned 18% in the past year.

Price Movement

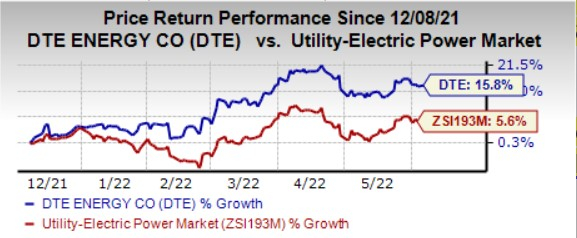

In the past six months, DTE Energy’s shares have rallied 15.8% compared with the

industry

’s growth of 5.6%.

Image Source: Zacks Investment Research

Zacks Rank

DTE Energy currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report