Univar Solutions Inc.

UNVR

is slated to release

first-quarter 2022

results after market close on May 9. The company is expected to have gained from cost-cutting and productivity actions, strong demand, market share gains and operational execution in the quarter.

The chemical company beat the Zacks Consensus Estimate for earnings in all the last four quarters. It has a trailing four-quarter negative earnings surprise of around 31.5%, on average.

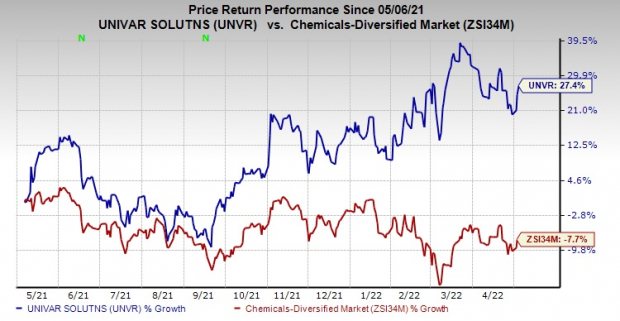

Shares of the company have increased 27.4% in the past year against a 7.7% fall of the

industry

.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What do the Estimates Say?

The Zacks Consensus Estimate for Univar’s first-quarter revenues is currently pegged at $2,602 million, suggesting a rise of 20.7% year over year.

Some Factors at Play

Univar’s operational execution, market share gains, expenses management and productivity actions are expected to get reflected in the company’s performance in the to-be-reported quarter. The company’s cost-cutting and productivity actions are likely to have helped it boost margins in the first quarter.

Strong demand and higher pricing are also expected to have supported the top line. The favorable impact of chemical price inflation is likely to have continued in the March quarter.Univar is also expected to have witnessed demand strength in personal care and food ingredients. Strong demand is also likely to have continued in several markets in the general industrial portfolio.

However, it is likely to have been impacted by continued supply-chain challenges in the first quarter.

Zacks Model

Our proven model does not conclusively predict an earnings beat for Univar this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP:

Earnings ESP for Univar is 0.00%. The Zacks Consensus Estimate for earnings for the first quarter is currently pegged at 84 cents. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

Univar currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider, as our model shows these have the right combination of elements to post an earnings beat this quarter:

MAG Silver

MAG

, expected to release earnings on May 16, has an Earnings ESP of +57.9% and carries a Zacks Rank #3. You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MAG Silver’s first-quarter earnings has been revised 42.9% upward in the past 60 days. The consensus estimate for MAG’s earnings for the quarter is currently pegged at 10 cents.

Sociedad Quimica y Minera de Chile S.A.

SQM

, slated to release earnings on May 18, has an Earnings ESP of 29.73% and flaunts a Zacks Rank #1.

The consensus estimate for Sociedad Quimica’s first-quarter earnings has been revised 55.7% upward in the past 60 days. The Zacks Consensus Estimate for SQM’s earnings for the quarter is pegged at $1.23.

Endeavour Silver Corp.

EXK

, scheduled to release earnings on May 11, has an Earnings ESP of 4.35% and carries a Zacks Rank #3.

The consensus estimate for Endeavour Silver’s first-quarter earnings has been revised 20% upward in the past 60 days. The Zacks Consensus Estimate for EXK’s earnings for the quarter is pegged at 6 cents.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report