First Majestic Silver Corp.

AG

recently announced that total production in first-quarter 2022 reached 7.2 million silver equivalent ounces comprising 2.6 million ounces of silver and 58,892 ounces of gold. On a year-over-year basis, silver production was down 10%, while gold production soared 147%. Overall silver equivalent ounces improved 59% from the last-year quarter, primarily driven by the acquisition of Jerritt Canyon.

Compared to the record fourth-quarter 2021 performance, output in the first quarter of 2022 was down 16%. This was due to high COVID-19-related absenteeism in January and February, which resulted in lower processed tons across all Mexican operating units.

In the first quarter of 2022, the La Encantada mine produced 644,009 ounces of silver. San Dimas produced 3,080,940 silver equivalent ounces, consisting of 1,632,117 ounces of silver and 18,528 ounces of gold. Santa Elena produced 1,868,787 silver equivalent ounces. The figure consisted of 337,201 ounces of silver and 19,556 ounces of gold during the quarter. Jerritt Canyon produced 20,707 ounces of gold in the quarter.

Other Updates

During the first quarter, First Majestic began the construction of the Liquid Natural Gas (“LNG”) powerplant expansion and powerline at Santa Elena that will provide low-cost, clean energy to the Ermitaño mine. AG is planning to install four additional LNG generators to increase its power generation capacity to approximately 24 MW from the current 14 MW. Construction of the new powerline to connect the LNG plant to Ermitaño started during the quarter.

As of Mar 31, 2022, 29 exploration drill rigs were active across the company’s mines and projects comprising 11 rigs at San Dimas, 11 at Jerritt Canyon, five at Santa Elena, and two at La Encantada.

The company is slated to release its first-quarter 2022 financial results on May 12, 2021. Higher equivalent production and silver prices through the quarter are expected to get reflected in the to-be-reported quarter’s results. The Zacks Consensus Estimate for the company’s earnings for the quarter is pegged at 8 cents per share, indicating a 167% surge from the first quarter of 2021.

How Did AG’s Peers Fare in Q1?

Endeavour Silver Corporation

EXK

announced that it produced 2 million silver-equivalent ounces in the first quarter of 2022, which was 4% higher year over year. Consolidated silver production was 1,314,955 ounces in the quarter, up 25% year over year.

The improvement was primarily driven by a 23% increase in silver production at the Guanacevi mine and a 70% rise in silver production at the Bolanitos mine. Endeavour Silver sold 1,717,768 ounces of silver and 8,381 ounces of gold in the quarter.

Hecla Mining

HL

reported silver production of 3.3 million ounces in the first quarter of 2022, up 3% on a sequential basis, courtesy of improved performance at the Greens Creek mine. Compared with the first quarter of 2021, production was down 7%.

Gold production was down 13% to 41,642 ounces in the quarter compared with the fourth quarter of 2021. Hecla Mining’s silver-equivalent production for the quarter was 9.7 million ounces, while gold-equivalent production was 123,537 ounces.

Fortuna Silver Mines Inc.

FSM

reported a 93% surge in gold production to 66,800 ounces in the first quarter of 2022. Total gold output benefited from contributions of 30,068 ounces from the Lindero mine and 28,235 ounces from the Yaramoko mine (acquired in July 2021).

Silver production was 1,670,128 ounces in the quarter, reflecting a 13% drop from the prior-year quarter. This was mainly due to a decrease in head grade at the San Jose mine, which was in line with the Mineral Reserve average grade. Fortuna Silver’s gold-equivalent production was 103,098 ounces. The company stated that all of its mines remain on track to achieve the full-year guidance.

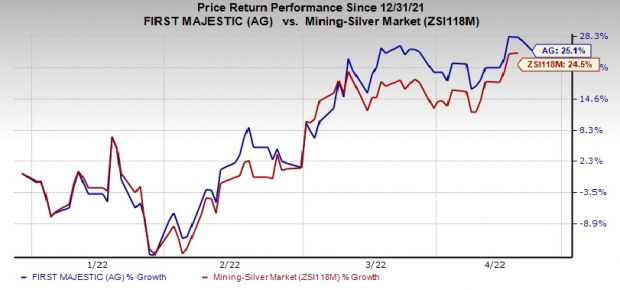

Share Price Performance

Image Source: Zacks Investment Research

So far this year, First Majestic’s shares have gained 25.1% compared with the

industry

‘s rally of 24.5%.

Zacks Rank

First Majestic carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report