Fortuna Silver Mines Inc.

FSM

reported a 93% surge in gold production to 66,800 ounces in the first quarter of 2022. Total gold output benefited from contributions of 30,068 ounces from the Lindero mine and 28,235 ounces from the Yaramoko mine (acquired in July 2021).

Silver production was 1,670,128 ounces in the quarter, reflecting a 13% drop from the prior-year quarter. This was mainly due to a decrease in head grade at the San Jose mine, which was in line with the Mineral Reserve average grade.

Gold-equivalent production was 103,098 ounces in the quarter under review. By-product base metal production was 9.1 million pounds of lead and 10.8 million pounds of zinc.

The company stated that all of its mines remain on track to achieve the full-year guidance.

Mine Performances

At the Lindero mine in Argentina, first-quarter gold production was 30,068 ounces, up 35% year over year. The mine’s performance has topped the 30,000-ounces mark for the second consecutive quarter. According to the company, the Lindero mine remains on track to meet the annual guidance.

The San Jose mine in Mexico produced 1,358,189 ounces of silver and 8,239 ounces of gold, down 18% and 20% year over year, respectively.

The Caylloma mine in Peru produced 311,939 ounces of silver, which was 17% higher than the prior-year quarter, driven by a 15% increase in average head grade from the contribution of newly scheduled higher-grade production stopes located in level 16 of the Animas vein.

For both San Jose and Caylloma mines, Fortuna Silver expects silver production for the year to be at the upper end of the guidance.

The Yaramoko mine in Burkina Faso produced 28,235 ounces of gold in the first quarter of 2022. Gold production is on target to meet the upper end of the annual guidance range.

Fortuna Silver maintained its annual silver production guidance at 6.2-6.9 million ounces. Gold production is expected to be between 244,000 and 280,000 ounces. Gold-equivalent production for the year is projected between 369,000 and 420,000 ounces, including lead and zinc by-products.

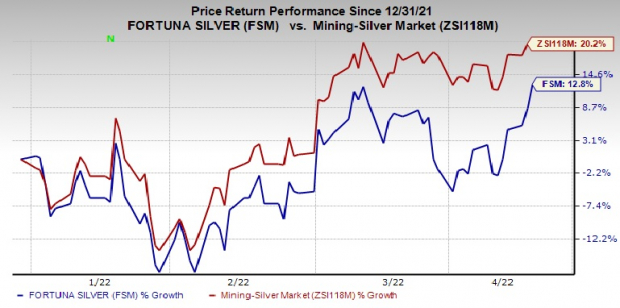

Price Performance

Image Source: Zacks Investment Research

Shares of the company have gained 12.8% so far this year compared with the

industry

’s growth of 20.2%.

How Did FSM’s Peers Fare in Q1?

Endeavour Silver Corporation

EXK

announced that it produced 2 million silver-equivalent ounces in the first quarter of 2022, which was 4% higher year over year. Consolidated silver production was 1,314,955 ounces in the quarter, up 25% year over year.

The improvement was mainly driven by a 23% increase in silver production at the Guanacevi mine and a 70% rise in silver production at the Bolanitos mine. Endeavour Silver sold 1,717,768 ounces of silver and 8,381 ounces of gold in the quarter.

Hecla Mining

HL

reported silver production of 3.3 million ounces in the first quarter of 2022, up 3% on a sequential basis, courtesy of improved performance at the Greens Creek mine. Compared with the first quarter of 2021, production was down 7%.

Gold production was down 13% to 41,642 ounces in the quarter compared with the fourth quarter of 2021. Hecla Mining’s silver-equivalent production for the quarter was 9.7 million ounces, while gold-equivalent production was 123,537 ounces.

Zacks Rank & Stock to Consider

Fortuna Silver currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the basic materials space is

Nutrien Ltd.

NTR

, which flaunts a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Nutrien has an expected earnings growth rate of 108.7% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 37.4% upward over the last 60 days.

Nutrien has a trailing four-quarter earnings surprise of 60.3%, on average. NTR has rallied around 45% year to date.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report