Yamana Gold Inc.

AUY

produced a record 281,388 gold equivalent ounces (“GEO”) in the fourth quarter of 2021, ahead of the guidance of 270,000 GEOs with Canadian Malartic, Jacobina, Cerro Moro and El Peñón posting standout quarters. This brought the year’s total production to 1.01 million GEOs, which surpassed the guidance of 1.00 million GEOs. The company also stated fourth-quarter all-in sustaining costs (“AISC”) are expected to be lowest for the year, at roughly $970 per GEO — approximately 8% below the AISC reported for the prior three quarters.

Yamana Gold’s fourth-quarter production of 281,388 GEOs comprised 240,718 ounces of gold and 3.14 million ounces of silver. Jacobina delivered a record quarterly production of 48,228 ounces of gold driven by all-time highs of tons mined. El Peñón produced 67,901 GEOs while Canadian Malartic produced 88,933 ounces of gold (50% basis) during the quarter. Canadian Malartic benefited from higher grades and recoveries from ore in the Malartic pit as the operation continues to transition to the Barnat pit. Minera Florida produced 18,247 ounces of gold. Cerro Moro had its strongest quarter of the year, producing 58,078 GEOs. Production continued to gain from access to additional mining faces, which supported the increase in mill feed coming from higher-grade underground ore and stable throughput.

The full-year production figure of 1.01 million GEO, consisted of 884,793 ounces of gold and 9.17 million ounces of silver. Jacobina had a record year with a production of 186,206 ounces. Production increased for the eighth consecutive year. It is expected to continue in the coming years as a result of the phased expansion strategy and the exploration programs aimed at generating significant value from the remarkable geological upside of the property. El Peñón produced 226,330 GEOs, while Canadian Malartic’s production was 357,392 ounces of gold (50% basis). Minera Florida produced 84,768 ounces of gold for the year. Meanwhile, Cerro Moro produced 156,484 GEO.

Thanks to strong cash flows during the quarter, Yamana Gold ended 2021 with a cash balance in excess of $305 million. With its strong financial position and robust cash flows, the company is well-poised to drive growth from its pipeline of low-capital organic growth projects while rewarding shareholders through its increasing dividends and share repurchases.

During the fourth quarter, the company completed foundational work on its Climate Action Strategy and established GHG abatement pathways for Scope 1 and 2 emissions. The company is on track to produce approximately 85% of its GEO utilizing renewable energy by the end of 2022.

Through 2021, the company’s exploration activities were focused on replacing mining depletion at the operations and on further defining new discoveries at Canadian Malartic, Jacobina, El Peñón and on the Wasamac development project. Preliminary results are encouraging and suggest a replacement of mineral reserves and mineral resources at the wholly-owned operations. The company will report the year-end 2021 mineral reserves and mineral resources on Feb 17, 2022. Yamana Gold is scheduled to release its three-year production and 2022 cost guidance on the same date along with its full-year 2021 operating and financial results.

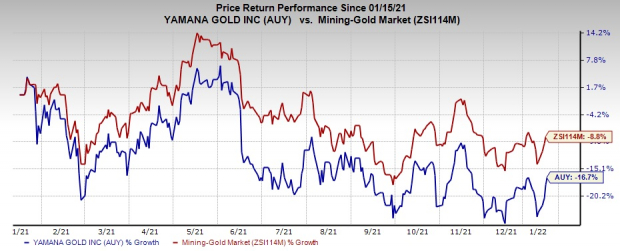

Price Performance

Image Source: Zacks Investment Research

Shares of Yamana Gold have fallen 16.7% over the past year compared with the

industry

’s decline of 8.8%.

Zacks Rank & Key Picks

Yamana Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space include

Commercial Metals Company

CMC

,

Albemarle Corporation

ALB

and

AdvanSix Inc.

ASIX

.

Commercial Metals has a projected earnings growth rate of 10.5% for the current fiscal year. The Zacks Consensus Estimate for CMC’s current fiscal year earnings has been revised upward by 6.6% over the past 60 days. CMC sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 7.4%. CMC has rallied around 78% in a year.

Albemarle, sporting a Zacks Rank #1, has an expected earnings growth rate of 49.8% for the current year. ALB’s consensus estimate for the current year has been revised upward by 4% over the past 60 days.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 22.1%. ALB shares have appreciated 31% in a year.

AdvanSix, carrying a Zacks Rank #2 (Buy), has an expected earnings growth rate of 3.9% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised upward by 1.6% in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 46.9%. ASIX has soared 108% in a year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report