Sandstorm Gold Ltd.

SAND

recently announced that it has entered into a $60 million financing package with Bear Creek Mining, which will help the latter acquire the Mercedes gold-silver mine in Mexico. The said financing package includes a $37.5 million gold purchase agreement from the mine and a $22.5 million convertible debenture. Sandstorm will receive 25,200 ounces of gold over 3.5 years, followed by 4.4% of the gold production from Mercedes for the balance life the mine. The company has increased its production guidance to between 65,000 and 70,000 gold equivalent ounces for 2022.

The Mercedes gold-silver mine, located in the state of Sonora in northern Mexico, is currently owned by

Equinox Gold Corp

EQX

. Since commercial production commenced in 2011, the mine has produced more than 800,000 ounces of gold. Its proven and probable reserves as of Dec 31, 2020, totaled 2.6 million tons, containing 325,000 ounces of gold and 2.45 million ounces of silver.

Equinox Gold became the owner of the Mercedes following its takeover of Premier Gold Mines in April. Recently, the company announced that it has entered into a definitive agreement with Bear Creek to sell the mine for $100 million in cash. The transaction is anticipated to close by Mar 31, 2021. Per the agreement between Bear Creek and Sandstorm, gold deliveries to the latter will commence immediately following the acquisition.

Sandstorm will receive 25,200 ounces of gold over the initial 3.5 years and a 4.4% gold stream thereafter. This is expected to increase its attributable gold equivalent ounces by 8% in 2022 and 11% in 2023/2024. The company anticipates the Mercedes Stream to be 13% accretive to average cash flow per share over the 2022 to 2024 period.

The $22.5 million convertible debenture bears an interest rate of 6% per year and has a term of three years.

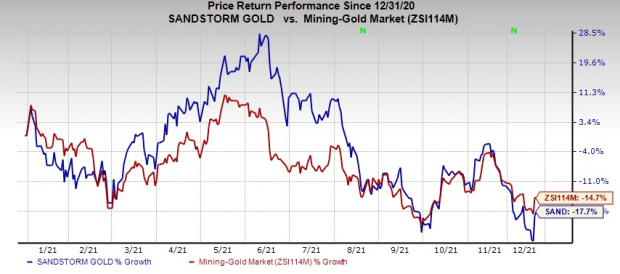

Price Performance

Image Source: Zacks Investment Research

Shares of Sandstorm have lost 17.7% so far this year compared with the

industry

’s decline of 14.7%.

Zacks Rank & Stocks to Consider

Sandstorm currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space include

Olin Corporation

OLN

and

Bunge Limited

BG

. Both OLN and BG flaunt a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Olin’s third-quarter 2021 adjusted earnings beat the Zacks Consensus Estimate but revenues missed the same. It has an expected earnings growth rate of around 740% for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has been revised upward by 20.5% in the past 60 days.

Olin’s shares have soared 122% year-to-date. The company has a long-term earnings growth of 56%.

Bunge’s third-quarter 2021 earnings and sales beat the respective Zacks Consensus Estimate. It has a trailing four-quarter earnings surprise of 105.7%, on average. The company has an estimated earnings growth rate of around 45% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 36%.

Bunge’s shares have appreciated 34% so far this year. It has a long-term earnings growth of 6.7%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report