A boom in electric vehicles is expected to drive a phenomenal amount of demand for lithium, but that’s just the beginning.

We’ve set out to solve global climate change, and that means electrifying absolutely everything.

It means a potential boom in electric vehicles, with BloombergNEF expecting global sales of sales to hit

5.6 million units

by the end of this year.

It means a boom in energy storage solutions.

But we may not have enough metal to build it all. As a result, the hunt for battery metals has reached fever pitch, and lithium could be a big beneficiary.

We think a strong portfolio to play lithium should cover this segment from several angles, including rallying the biggest EV players, disruptive mining technology in the lithium space, and the world’s largest lithium miner.

These three stocks could be a strong combination as a global energy transition causes tight supply for one of the world’s most important energy metals:

#1 Tesla (NASDAQ:TSLA)

Tesla could easily steal half of the

$5-trillion EV market

in the coming years, leaving the other half to be divided up among the rest of the players in this field, according to Wedbush Securities.

Tesla hasn’t just managed to successfully challenge conventional car makers in North America and Europe … it’s also cornering the Chinese market—the largest EV market in the world. As of the third quarter of this year, Tesla’s China sales—an impressive

$3.11 billion

for Q3 alone–had nearly hit half of U.S. sales volumes, and it’s growing by the day.

That’s why Wedbush’s bull case price target is $1,800, while its cautious price target has just been raised

from $1,100 to $1,400 per share

.

Tesla is an expensive stock, and many might think the recent rally is the end of this game, but Wedbush’s $1,800 bull case price target suggests there could still be a lot of room to grow here.

And now, Tesla is gearing up to release another model for China in mid-2022—the

Model S Plaid

.

There are other catalysts, too, not the least of which is profit margin projections.

Tesla only posted its first annual profit in January 2020. But this year, it’s seen an increase in profit margin every single quarter, with lower costs and higher sales boosting the figures. For 2022, most analysts expect a continuation of this scenario. Increasing EV demand should make that clear enough.

New gigafactories slated to come online in

Texas

and Berlin mean even more—and faster—growth for Tesla.

The EV explosion is coming, but no one comes close to Tesla, not now, and not in the medium-term.

#2 Medaro Mining (

CSE:MEDA

;

OTC:MEDAF

)

Medaro Mining is a Canadian junior lithium explorer that’s making what we think are two major moves at once: It’s scooping up prospective lithium exploration territory and it’s also part of a joint venture developing what could become a lithium mining breakthrough.

While EVs and lithium miners are two critical ways to play an energy transition boom, a strong portfolio could be rounded out by taking a very close look at the lithium-technology space.

The hunt for lithium isn’t just about making new discoveries …

It’s about developing new technology that makes it possible for us to mine more lithium for cheaper and in a more environmentally friendly way. And while the Western world has a

weakness

in the lithium-ion supply chain, that weakness could be resolved by a combination of things, including: new discoveries, and new extraction technologies.

If developed and commercialized, the Medaro Mining JV’s technology could reduce hard-rock lithium mining costs by 30-50%. That could be great news for the $5-trillion EV industry, for starters. And Medaro’s goal is ambitious. It aims to use this technology to outperform all other lithium mining projects and license it globally.

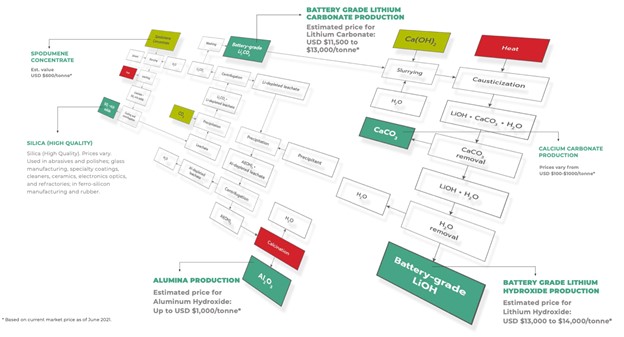

Medaro Mining now jointly owns the rights to commercialize a novel, ESG-focused processing technology designed to simplify and accelerate lithium recovery in hard-rock mining, which could lower production costs and improve production quality and efficiency.

Lithium is extracted either from subsurface brines or through hard-rock mining from spodumene-bearing pegmatite deposits. Until now, lithium from the brine has been easier to extract, but the process is environmentally questionable, and our lithium supply needs go well beyond North America’s brine potential.

The Medaro JV’s new extraction technology aims to make it easier, cheaper, and cleaner to get at hard-rock lithium. It’s also intended to significantly reduce transport costs by a plan to set up processing facilities on site. Medaro JV-licensed processing facilities might be set up right next to mines, even in the most remote locations, which could enable miners to ship battery-grade lithium directly to markets. And it could all be scalable up to a potential 50-100 tonnes per day.

These could be important pilot tests for the lithium technology space right now, and not just because of the efficiency and cost savings …

This could also be a great ESG play, and that’s where we think a lot of smart money is going now.

Medaro reports the technology can be powered completely by clean energy, including hydroelectric, solar, or wind power, with very little cleanup costs. That’s likely to be a huge deal with lithium miners who are coming under intense pressure over environmentally unfriendly processes.

Medaro says its closed-loop process doesn’t use any hydrocarbons. It only requires three feedstock materials: Spodumene concentrate; high-purity Carbon Dioxide (CO

2

), which is consumed in forming Lithium Carbonate; and high-purity water (H

2

O), which is consumed in forming Lithium Hydroxide.

If it’s proven and commercialized, this technology could unlock significant value in lithium reserves that have until now been considered uneconomical, but for investors, we think the big news is the potential global licensing opportunity for long-term revenue generation. This could be a big move for Medaro Mining (

CSE:MEDA

;

OTC:MEDAF

)

, a company with zero debt and that is well capitalized.

#3 Albemarle (NYSE:ALB)

To round out your portfolio with a straight-up lithium miner, Albemarle’s is one of the top stocks in this space.

Albemarle is focused on lithium, bromines, and catalysts, but it’s the world’s largest lithium producer, and this battery metal steals the show here, accounting for over half of the company’s EBITDA.

The company is producing lithium in Chile, the U.S (Nevada), and Australia, and it’s still hot on the acquisition trail, most recently agreeing to scoop up Guangxi Tianyuan New Energy Materials, which would give it a lithium conversion plan in China along with plans to build two new lithium hydroxide conversion plants. Keeping in mind that China is the biggest EV market in the world, Albemarle’s strategy suggests major growth prospects.

Q3 results were also pretty impressive, beating estimates overall and seeing lithium sales increase 35% from a year earlier.

With lithium prices expected to continue on their upward trajectory, and demand expected to explode, leading to a tight supply situation, Albemarle seems best-positioned from a mining standpoint.

Other companies to keep a close eye on:

Teck Resources (NYSE:TECK, TSX:TECK)

could be one of the best-diversified miners out there, with a broad portfolio of Copper, Zinc, Energy, Gold, Silver and Molybdenum assets. It’s even involved in the oil scene! With its free cash flow and a lower volatility outlook for base metals in combination with a growing push for copper and zinc to create batteries, Teck could emerge as one of the year’s most exciting miners.

Teck has had a great year, climbing from just $18 in January, to today’s price of $26.78. In addition to its positive trajectory, the company has seen a fair amount of insider buying, which tells shareholders that the management team is serious about continuing to add shareholder value. In addition to insider buying, Teck has been added to a number of hedge fund portfolios as well, suggesting that not only do insiders believe in the company, but also the smart money that’s really driving the markets.

Celestica (NYSE:CLS, TSX:CLS)

is a key company in the lithium boom due to is role as one of the top manufacturers of electronics in the Americas. Celestica’s wide range of products includes but is not limited to communications solutions, enterprise and cloud services, aerospace and defense products, renewable energy and enough health technology.

Thanks to its exposure to the renewable energy market, Celestica’s future is tied hand-in-hand with the green energy boom that’s sweeping the world at the moment. It helps build smart and efficient products that integrate the latest in power generation, conversion and management technology to deliver smarter, more efficient grid and off-grid applications for the world’s leading energy equipment manufacturers and developers.

Even old-school fossil fuel producers are getting in on this race.

Suncor (NYSE:SU, TSX:SU)

might be known mostly for its oil production. But it’s one of the few majors really pushing the boundaries. In fact, it has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

But that’s just one part of its business, however. Suncor is also a world leader in renewable energy innovations. Recently, the company invested $300 million in a wind farm located in Alberta. Additionally, as Canada moves away from oil, Suncor is well positioned to take advantage of another one of the country’s resource reserves; Lithium. The best part? It doesn’t even have to move very far. In fact, Alberta’s oil sands are a major hotspot for lithium production.

Lithium Americas Corp. (NYSE:LAC, TSX:LAC)

is one of North America’s most important and successful pure-play lithium companies. With two world-class lithium projects in Argentina and Nevada, Lithium Americas is well-positioned to ride the wave of growing lithium demand in the years to come. It’s already raised nearly a billion dollars in equity and debt, showing that investors have a ton of interest in the company’s ambitious plans, and it will likely continue its promising growth and expansion for years to come.

It’s not ignoring the growing demand from investors for responsible and sustainable mining, either. In fact, one of its primary goals is to create a positive impact on society and the environment through its projects. This includes cleaner mining tech, strong workplace safety practices, a range of opportunities for employees, and strong relationships with local governments to ensure that not only are its employees being taken care of, but locals as well.

Lithium Americas’ efforts have paid off in the market, as well. While many companies across multiple industries struggled last year, Lithium Americas’ stock soared. Since the beginning of the year, Lithium Americas has seen its share price climb by nearly 100%, and its showing no signs of slowing, especially as lithium demand continues to soar.

Westport Fuel Systems (TSX:WRPT)

isn’t a lithium play, but it is an important company to watch in the global energy transition. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. Because it is a manufacturing play at heart, it is a unique way to get in on the boom in the alternative fuel auto industry.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since February 2020, the company has seen its stock price rise by 348%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

By. Michael Kern

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include the Medaro Mining Corp. (the “Company”) joint venture (JV) with Global Lithium Extraction Technologies Inc. to develop a proprietary method of lithium extraction; that the Company will succeed in the development and commercialization of the proprietary technology to extract lithium which is highly cost effective, efficient and clean; that the Company will be able to earn its option to acquire ownership in its lithium projects; that the Company’s lithium projects will have commercial amounts of lithium which may be extracted and developed using its proposed technology or otherwise; that the market for lithium will continue to grow to billions of dollars; that the Company will be able to produce sufficient quantities of lithium to supply major contracts worldwide or be otherwise able to commercialize its business; that the Company’s JV will be able to develop, commercialize and license the technology on a global scale; that the technology will be able reduce extraction costs by up to 50%; that the technology will be implemented in remote areas close to productive mines; that the Company will design processing facilities for lithium extraction using the technology developed by the JV; that the technology will be able to extract commercial amounts of lithium; that the Company will be able to earn its option to acquire ownership in its uranium project; that the Company’s uranium project will have commercial amounts of uranium which may be developed; . Forward-looking statements are subject to a number of risks and uncertainties, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. Risks that could change or prevent these statements from coming to fruition include that the Company’s JV may be unable to successfully develop a proprietary method of lithium extraction; that the Company may be unsuccessful in the development of its proposed technology, or even if developed, that the Company may be unable to commercialize the technology or otherwise be able to extract lithium by a method which is cost effective, efficient or clean; that the Company may fail to be able to develop lithium extraction facilities or to license its technology; that the Company may fail to fulfill its obligations under its option agreements in respect of its lithium and uranium projects and be unable to acquire ownership in the properties; that the Company’s lithium and uranium projects may be fail to have any or sufficient commercially viable amounts of lithium or uranium which may be extracted and/or developed; that the market for lithium may not grow as quickly or as much as anticipated; that the Company may not be able to finance its intended development of technology and/or the maintenance/development of its lithium and uranium properties; competitors may offer cheaper or better products; markets don’t develop for the products as expected; intellectual property rights may not protect the Company’s processes and the Company’s technology may infringe on the intellectual property of others; and the Company may not be able to carry out its business plans as expected. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is for entertainment purposes only. Never invest purely based on our communication. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “Oilprice.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:MEDA. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.