Duke Energy Corporation

’s

DUK

systematic capital expenditure to expand the existing electric transmission and distribution infrastructure, expanding renewable generation as well as increasing demand for customers make it a solid investment option in the utility space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Growth Projections

The Zacks Consensus Estimate for 2021 and 2022 earnings per share has moved up 0.2% and 0.2%, respectively, in the past 60 days.

The Zacks Consensus Estimate for revenues for 2021 and 2022 indicates a year-over-year increase of 4.9% and 3.7%, respectively.

Surprise History and Earnings Growth

Duke Energy delivered an average earnings surprise of 2.3% in the last four quarters.

Duke Energy’s long-term (three to five years) earnings growth is projected at 5.3%.

Regular Investments & Emission Reduction

Duke Energy plans to invest in the range of $60-$65 billion in the 2022-2026 time period to strengthen its existing infrastructure. A major portion of the same will be invested in zero-carbon generation. Duke Energy is executing its infrastructure plans and intends to invest $30 billion in the transmission and distribution modernization plan during the 2022-2026 period.

Duke Energy has taken initiatives to expand the renewable asset base and aims to reach the target of net-zero carbon emissions from electric generation by 2050. DUK has already lowered its carbon emissions in 2020 by more than 40% since 2005.

Dividend History & Dividend Yield

Duke Energy’s dividend payment history indicates that the company has been performing steadily and generating enough cash flow to distribute dividends to shareholders. DUK has been paying dividends to shareholders for the past 95 consecutive years and increasing the same annually over the past 14 years.

Lower risk-regulated investment will help Duke Energy to generate enough cash flow over the long term that will encourage management to continue with shareholder-friendly initiatives. Currently, Duke Energy has a

dividend yield

of 3.89% compared with the Zacks S&P 500 composite’s 1.36%.

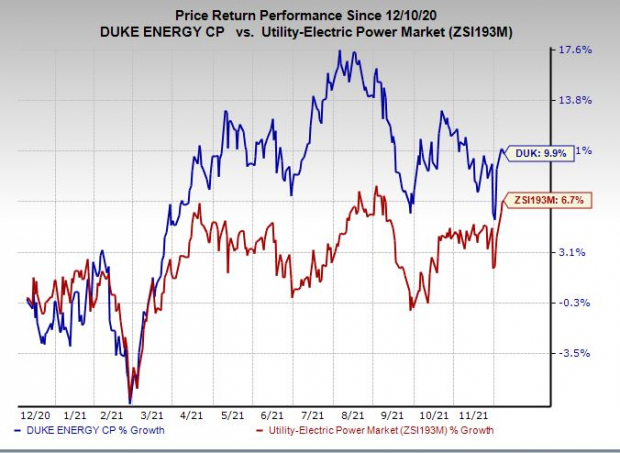

Price Performance

In the past 12 months, Duke Energy’s shares have returned 9.9% compared with the

industry

’s 6.7% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include

Otter Tail Corporation

OTTR

,

California Water Service Group

CWT

and

Dominion Energy

D

, each holding a Zacks Rank #2.

Otter Tail, California Water Service, and Dominion Energy delivered an average earnings surprise of 27.9%, 10.8%, and 2.4%, respectively, in the last four quarters.

The Zacks Consensus Estimate for 2021 earnings per share of Otter Tail, California Water Service, and Dominion Energy has moved up 0.8%, 7.6%, and 0.5%, respectively, in the past 60 days.

In the past year, shares of Otter Tail, California Water Service, and Dominion Energy have returned 57.6%, 31.3%, and 1.1%, respectively, compared with the Zacks Utility Sector’s 4.8% growth.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report