Newmont Corporation

NEM

announced the pricing of its offering of $1 billion total principal amount of 2.6% sustainability-linked notes due 2023. The public offering is expected to be completed on Dec 20, 2021, subject to customary conditions.

The offering is being made pursuant to Newmont’s shelf-registration statement filed with the Securities and Exchange Commission. The notes will be senior unsecured obligations of the company and will rank equally with its current and future unsecured senior debt and senior to its future subordinated debt.

The notes will be guaranteed on a senior unsecured basis by the company’s subsidiary Newmont USA Limited. Newmont will be the first company among its mining industry peers to issue a sustainability-linked bond. This reflects a further step in aligning its financial strategy with environmental, social and governance commitments.

The coupon of these notes will be linked to the company’s performance against 2030 emissions reduction goal and the representation of women in senior leadership position goal. The interest rate payable will be raised if the company cannot achieve the stated targets by 2030.

Newmont projects net proceeds of roughly $992 million from the offering after deducting discounts and before expenses. The company plans to utilize the proceeds to buy back its outstanding 3.7% notes due 2023 and its outstanding 3.700% Notes due 2023 issued by the company’s fully-owned subsidiary, Goldcorp Inc., for up to certain aggregate maximum principal tender amounts. It also issued a notice of redemption for its outstanding 3.5% notes due 2022.

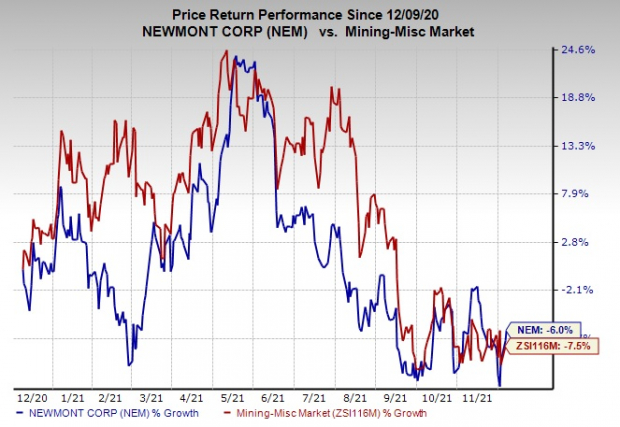

Shares of Newmont have dropped 6% in the past year compared with a 7.5% decline of the

industry

.

Image Source: Zacks Investment Research

In its last earnings call, Newmont stated that it expects attributable gold production of 6 million ounces for 2021, down from 6.5 million ounces expected earlier. The company also expects gold CAS to be $790 per ounce and all-in sustaining costs (AISC) to be $1,050 per ounce, up from the earlier view of $750 and $970 per ounce, respectively.

Newmont stated that Boddington faced issues from severe weather and Nevada Gold Mines is also witnessing headwinds. The revised upside in the cost outlook includes the impact of lower production volumes as well as elevated royalties and production taxes at higher gold prices.

It recently announced its outlook for 2022 with attributable gold production guidance of 6.2 million ounces and AISC of $1,050 per ounce, assuming a gold price of $1,800 per ounce. Total gold production combined with other metals is projected to be 7.5 million gold equivalent ounces in 2022.

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Celanese Corporation

CE

,

The Chemours Company

CC

and

Nucor Corporation

NUE

.

Celanese has an expected earnings growth rate of 139.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 8.7% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 12.7%, on average. The stock has surged around 22.4% in a year. CE currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. CC has increased around 19.6% in a year. CC currently sports a Zacks Rank #1.

Nucor has a projected earnings growth rate of 583.2% for the current year. The consensus estimate for the current year has been revised 7.2% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters. NUE has a trailing four-quarter earnings surprise of 2.7%, on average. The company’s shares have gained around 102.1% in a year. It currently carries a Zacks Rank #2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report