Barrick Gold Corporation

GOLD

announced the per share amount of the third and final $250-million tranche of a return of capital distribution totalling $750 million. The per share amount to be paid on Dec 15, 2021 will be roughly 14 cents, based on the number of issued and outstanding shares as of the Nov 30, 2021 record date.

This follows the approval of the total $750-million return of capital distribution by shareholders at the company’s Annual and Special Meeting on May 4, 2021. The first distribution of $250 million was made in June 2021 and the second distribution of $250 million was made in September 2021.

The company will also pay an earlier-announced dividend of 9 cents per share for the third quarter to shareholders of record at the close of business as of Nov 30, 2021.

This $750-million return of capital, in addition to quarterly dividends, will lead to total cash return to shareholders of roughly $1.4 billion during the year, which reflects the highest annual cash payout to shareholders in Barrick’s history. Even after making the distributions, the company’s balance sheet remains strong due to the robust operational and financial performance, leaving it in a position to maintain its commitment to provide shareholders with meaningful returns and continuing to invest in future growth and development, the company noted.

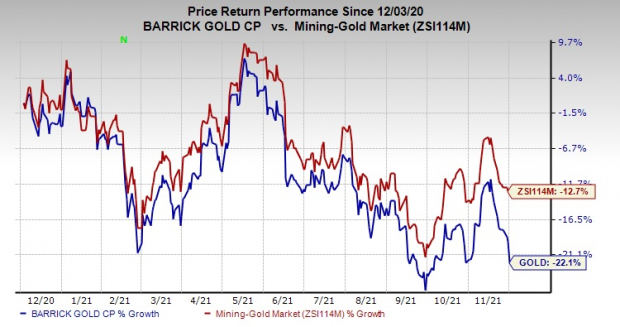

Shares of Barrick have declined 22.1% in the past year compared with a 12.7% fall of the

industry

.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it anticipates attributable gold production in the range of 4.4-4.7 million ounces. AISC is expected in the range of $970-$1,020 per ounce and cost of sales is projected in the band of $1,020-$1,070 per ounce.

The company also expects copper production in the range of 410-460 million pounds at AISC of $2.00-$2.20 per pound and cost of sales of $1.90-$2.10 per pound.

Capital expenditures are projected between $1,800 million and $2,100 million.

Zacks Rank & Key Picks

Barrick currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

The Chemours Company

CC

and

Celanese Corporation

CE

.

Nucor has an expected earnings growth rate of 583.2% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 7.7% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. The stock has surged around 91% in a year. NUE currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. CC has increased around 15.6% over a year. CC currently sports a Zacks Rank #1.

Celanese has a projected earnings growth rate of 139.5% for the current year. The consensus estimate for the current year has been revised 8.8% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. CE has a trailing four-quarter earnings surprise of 12.7%, on average. The company’s shares have gained around 14.8% in a year. It currently carries a Zacks Rank #2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report